Why Are Technology Stocks Worth The Attention?

As China recovers from the coronavirus pandemic, leading Chinese tech stocks have come to the fore. This came as many tech stocks report strong first-quarter earnings, which demonstrated the effect of stay-at-home orders for online businesses. As the stock market has seen massive sell-offs amid the current pandemic, there has been a demand surge for companies that cater to the new normal. Since mid March, Chinese tech stocks have rallied after the fastest decline in the equities market in modern history. This led investors to look for the best tech stocks to buy now.

Technology companies that grew their online business and developed their own competitive advantage thrives especially during these times. For example, if you have invested in Grubhub (GRUB Stock Report) or Meituan Dianping (MPNGF Stock Report) recently, you would understand what I’m talking about.

Why Now Is The Time To Focus On Asian Tech Stocks?

In this article, I will be focusing on tech stocks to buy in Asia. Don’t get me wrong. This doesn’t mean that U.S. tech stocks are not worth the attention. But we believe Asian firms are beginning to play an increasing role in the space. China’s growing economy and especially huge government support for technology investments is a huge plus to the tech industry. Meaning, there will be opportunities to find the next Amazon in Asia if you look closely. One of the fun parts about investing is the search for companies that haven’t yet met their full potential but are poised for dramatic growth.

If you are not convinced, just look at TikTok. Netizens of all ages throughout the world are entertaining and being entertained on the app. People just can’t get enough of it. It is easy to forget that TikTok is made by a Chinese company named Bytedance. Unfortunately it is still a privately-held company. While we wait for Bytedance to go for IPO this year or next. Let us look at the existing Asian tech stocks to buy.

Read More

- Teladoc Health (TDOC): Is It Too Late For Virtual Health Care Stocks?

- Why JD.com (JD) May Be A Better Buy Than Alibaba (BABA)?

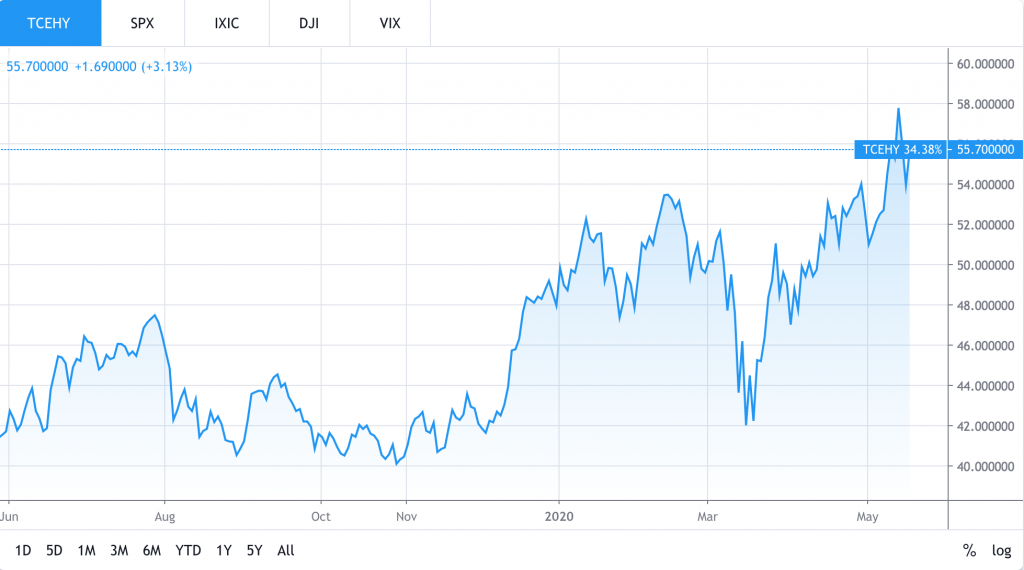

Tech Stocks To Buy Now #1 Tencent (TCEHY)

Chinese internet giant Tencent (TCEHY Stock Report) needs no introduction. The company has beaten earnings expectations, with sales growing 26% in the first quarter. This came as many people in China were stuck at home with most of their time spent playing games and other online entertainment options. Tencent is the world’s largest video game publisher. It also owns China’s top mobile messaging platform Wechat. To those who are not familiar with this super-app in China, the mobile messaging platform contains entire suites of features within Wechat. This locks in users into its sprawling ecosystem of Mini Programs which allow users to access various services like ride-hailing services, online games, e-commerce, payments and many more without actually leaving the app. Given the network effect, we think Tencent has got a real moat here.

Despite the lockdown, Tencent’s main business showed resilient results. This proves that the company’s stock remains one of the safer bets in the stock market right now.

Online Gaming and Social Media Advertising Power TCEHY Stock

The engines fueling Tencent’s growth rate were its online gaming empire and its dominant WeChat platform. This shows that during the global pandemic, it is still possible to find a silver lining in the chaotic market. From the company’s report, the gaming revenue grew 31% during the coronavirus-stricken March quarter compared to the prior quarter which saw a 25% growth.

Social media advertising grew a whopping 47%, surpassing the 37% growth in the last quarter. This is particularly impressive when advertisers were mostly looking to pull back their ad spending amid the economic contraction in China. This once again proves that the social media platform offers the best return on investment for advertisers.

With that in mind, a surge in social media gaming traffic definitely helps offset shrinking traditional online marketing budgets. On the flip side, many analysts find it challenging for Tencent to sustain the current first quarter’s growth to the next as the pandemic retreats in China and people start returning to their offices.

Tech Stocks To Buy Now #2 Sea Ltd (SE)

Sea Limited (SE Stock Report) is a leading regional consumer internet company founded in Singapore. While it doesn’t have the global presence of Tencent or Alibaba, it is definitely one of the stocks under the radar in the market. According to economists, we are likely to see Southeast Asian countries occupying a larger piece of the global economic pie in the coming decade. As such, Sea might be a good proxy to take advantage of this growth in the region.

Leading Gaming & E-Commerce Platform In Southeast Asia

Sea’s gaming segment, Garena, engages in gaming and esports which is a huge deal for the company. The gaming segment contributed more than half of the group’s total revenue. The company has definitely benefited from having Tencent as one of its major shareholders, allowing Garena to publish Tencent games in Southeast Asian markets. Tencent understands there’s great potential in the Southeast Asian market with almost 9% of the world’s population in the region. The region also has a younger population compared to Tencent’s home market China. One of the best known games launched by Tencent, League of Legends, is available in Southeast Asia through Garena. The presence of Tencent games on Garena attracts more users to the platform. In turn, having more users on the platform attracts other game development companies to publish games on Garena.

Another notable platform owned by Sea is the e-commerce site, Shopee. The e-commerce segment contributed around 30-40% of the company’s total revenue. Shopee has undergone exponential growth in the last few years, and it is currently the largest e-commerce platform in the region. Even though there are a number of competitors in this region, e-commerce is a fast growing area in Southeast Asia and Shopee has demonstrated its ability in securing the largest market share. With the current Covid-19 outbreak, Shopee could benefit from the rising demand for online shopping, especially where many countries in Southeast Asia are still under some forms of lockdown.

What’s Next?

Sea Ltd is publishing its quarterly report on 18 May. Perhaps we will have a better idea of the stock’s potential after the results are published. But if the results of Tencent are any guide, we believe Sea Ltd will not disappoint. If anything, remember that lockdown in Southeast Asia started weeks after China. So, Sea Ltd’s second quarter results might be even better than the first quarter.