Are These Biotech Stocks Still Worth The Attention After Recent Events?

Biotech stocks have proved to be one of the most exciting areas due to their massive breakouts. No other sector comes close to the return potential of this sector. That’s not too surprising because the world is racing to find the first safe and effective vaccine against Covid-19. With both blue-chip stocks and small-cap biotech stocks exploring potential treatments, the small-cap stocks apparently seem to be leading the race. But that also comes with a ton of risks. As most of the small-cap biotech stocks are focusing on finding the vaccine only, a slight disappointment in trial data will crash investors’ investments.

The coronavirus pandemic has led many investors to look for biotech stocks that are focusing on vaccines and treatments. Many traders invested in these coronavirus stocks and made some profit. However, some investors may have a lower risk appetite. There are other biotech investment opportunities that may not have breakouts overnight but would likely bear fruit in the long term. Having said that, could these two biotech stocks be worth adding to your long term portfolio?

Read More

- 3 Coronavirus Stocks To Watch Right Now; One Up Over 500% In April

- What Are The Best Tech Stocks Today? 2 Names To Know

Best Biotech Stocks To Buy Or Avoid: Gilead Sciences

On the first day of June, Gilead Sciences (GILD Stock Report) announced results from a phase 3 clinical trial evaluating remdesivir in treating hospitalized patients with moderate cases of Covid-19. The results showed patients receiving a 5 day course of treatment with remdesivir plus the standard of care were 65% more likely to show improvement at day 11 than patients receiving the standard of care alone. This news was particularly encouraging in early intervention with remdesivir can help patients with moderate cases of Covid-19.

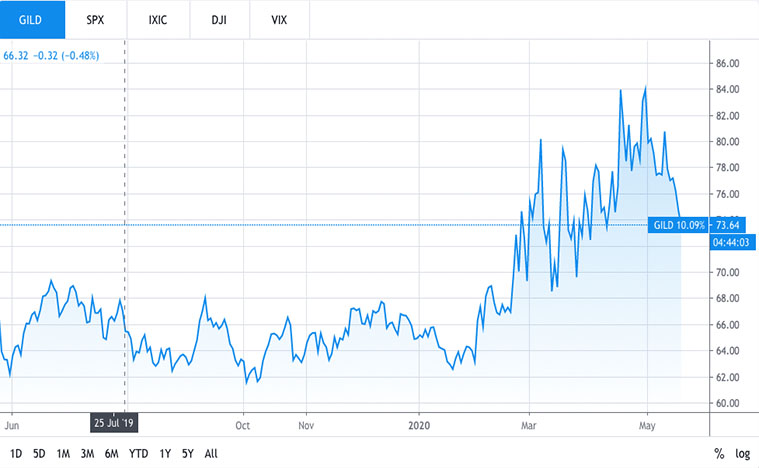

GLD stock has posted consistent growth this year as a result of its ambitious antiviral drug development program for Covid-19. However, there’s still a long way to go before GILD stock can recover to the highs it experienced in 2015. Looking back, the stock plummeted in 2015 due to its widespread public anger over the high cost of its hepatitis C therapy, Sovaldi. The company knows it this time. And I don’t think it will make the same mistake twice with the pricing of its drugs.

On the other hand, Gilead’s data also showed that patients on a 10 day course of treatment were only slightly better than those on standard of care. This could suggest the drug is not exactly a silver bullet, as some have hoped. Nevertheless, should there be potential clinical trial failures, the potential declines in share prices will likely be temporary. Even if remdesivir fails to bring in any revenue in the long run, Gilead still has a strong HIV portfolio to hold the company up. The question is, how much of the potential gains from remdesivir have investors priced in? Could Gilead still be one of the best biotech stocks to buy in the long run?

Best Biotech Stocks To Buy Or Avoid: Pfizer

Shares of Pfizer (PFE Stock Report) plummeted 7.15%. This came after its breast cancer drug, Ibrance came up shy in a phase 3 trial evaluating its use alongside adjuvant endocrine therapy in early breast cancer patients. The news came out on Friday after the closing bell. And investors rushed to cash out first thing the market opens on Monday.

Ibrance is a top-selling drug for Pfizer. In the first quarter, the cancer drug generated $1.25 billion in sales, up 11% operationally. It accounted for more than half of Pfizer’s total oncology sales. Now you understand why the less ideal results on the phase 3 trial sent the stock sliding. Pfizer’s R&D investment in Ibrance so far has been wildly successful. Since winning an FDA green light in its breast cancer treatment in 2017, its sales have skyrocketed ever since.

Despite the recent trial setback, Ibrance is likely to remain a centerpiece in its approved indication. Pfizer is one of the few big pharma stocks not caught up in the Covid-19 related rallies. This suggests that the company may be valued on a surer footing compared to some of its peers. With its existing portfolio of drugs, we could still see the company continue supporting its 4% dividend yield. That makes it one of the best biotech stocks to buy right now from the dip yesterday.