Should We Invest In Biotech Stocks In June 2020?

By now, you should know that biotech stocks are pretty hot this year. Be it bull or bear markets, biotech stocks represent the ultimate risk-reward plays. Of course, these investments are inherently volatile in nature.

Some biotechnology companies have just one or two (potential) products that could deliver revenue. Any positive feedback from the clinical trials would result in bigger price swings for these stocks. Some of them have been gaining attraction since the coronavirus pandemic. If you have been in this space long enough, you would see that there are plenty of “pre-revenue” biotech companies. Meaning companies with no approved products. These companies are usually small-cap biotech stocks, which are riskier in nature. This is because they are racing against time to develop a successful product before they run out of money for research and trials.

Read More

- Square Versus PayPal: Which Fintech Stock Is A Better Buy

- What Are The Best Tech Stocks Today? 2 Names To Know

How To Find The Best Biotech Stocks To Buy?

There are expensive and cheap biotech stocks. Often, you get what you pay for. The more established biotech companies that are currently profitable and have a strong pipeline of drugs are the ones that are expensive. Long term investors would love these biotech stocks.

On the other hand, cheap or small cap biotech stocks are usually the ones without revenue. But don’t get me wrong. Small-cap biotech stocks could also be overpriced and have similar price tags as the more established peers. These are the classic high risk high return stocks which risk-seeking traders would flip. Be it expensive or cheap biotech stocks, let’s take a look at two of the more intriguing biotech stocks this week to help determine if they are worthy of consideration for your portfolio.

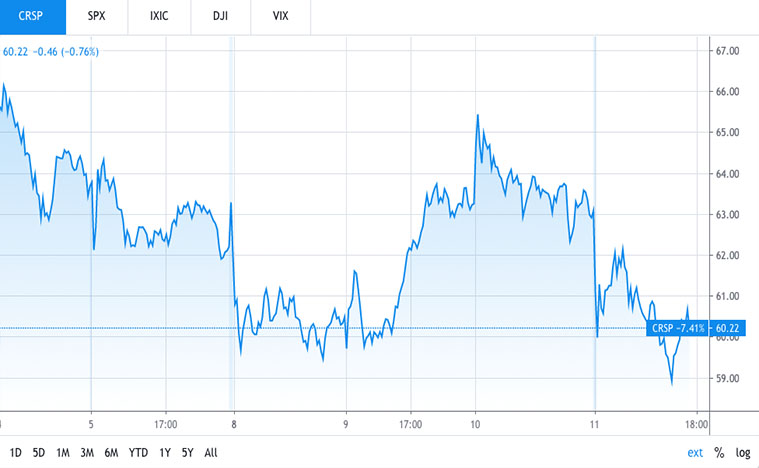

Best Biotech Stocks To Buy: CRISPR Therapeutics

First, up the list, CRISPR Therapeutics (CRSP Stock Report) offers promising gene-editing tools that could alter some medical treatments. The company has a total of 9 therapeutic programs, with four promising studies in the clinical testing phase. CRISPR’s advanced programs target beta-thalassemia and sickle cell disease (SCD), two hemoglobinopathies that have a high unmet medical need. The company’s most promising lead gene-editing candidate, CTX001, a product developed in collaboration with Vertex Pharmaceuticals (VRTX Stock Report), shows lots of promise. The product has already received several regulatory designations to expedite drug development from both the Food & Drug Administration (FDA) and the European Medicines Agency (EMA).

Shares of CRSP have been climbing steadily since the March sell-off. From the lows in March, CRSP stock has climbed more than 80% and last traded at $63.03. So why is CRSP stock worth investors’ attention now? Many analysts are very hopeful as patients with SCD treated with CTX001 did not experience any vaso occlusive crises (a side-effect of SCD that causes acute pain). The results were of course encouraging, but investors should note that there’s still a long way to go before the biotech company can successfully launch CTX001 on the market.

[Read More] Tesla Stock Surges Past $1,000; What’s Next?

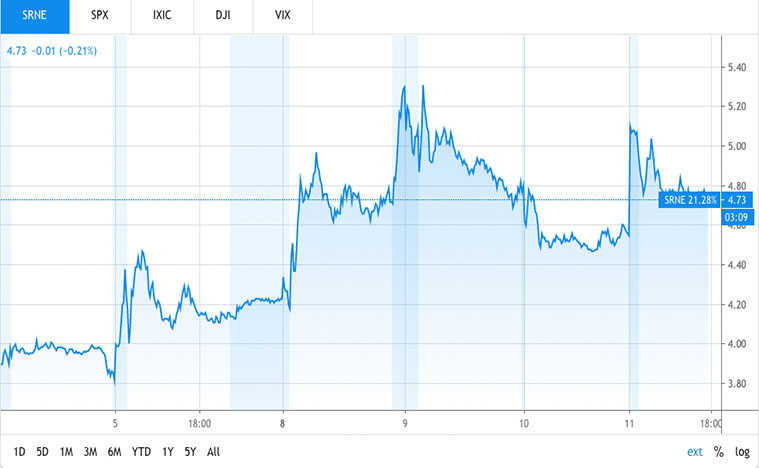

Best Biotech Stocks To Buy: Sorrento Therapeutics

Sorrento Therapeutics (SRNE Stock Report) has been finding ways to develop an antibody for the treatment and prevention of Covid-19. After the mass screening of potential candidates, Sorrento believes an antibody it developed, the STI-1499, could be the answer to the novel coronavirus. During the pre-clinical experiment, it is observed that STI-1499 can neutralize the viruses in animal testing. While this is highly positive news to the company, no one can guarantee its effectiveness when tested on humans.

Shares of Sorrento Therapeutics made a huge jump on May 15. This came after the company announced some exciting news regarding its treatment for Covid-19. The SRNE stock rose by more than 100% on the news. Although it has since fallen from the peak, the stock is still up 35.93% year to date. The company currently has one approved product for pain treatment that is associated with shingles. While the company has several products in its pipeline, none of them are close to launching in the market. While the Covid-19 candidate seemed promising in preclinical trials, betting on SRNE stock to successfully find the treatment for the novel coronavirus is still quite speculative.