Are These Manufacturing Stocks On Your Watchlist?

If there’s one thing that we are familiar with a pandemic, that is to see the demand for personal protective equipment (PPE) skyrocket. Major headlines covering big developments like potential candidates or treatments have definitely helped boost shares of pharmaceutical and biotech stocks. But we know to develop successful vaccines or treatments are going to take a long time. This is regardless of how much optimism lingers around the biotech space. Now that we are seeing a resurgence in cases across the states, it’s time to adjust our approach towards the novel coronavirus. “Prevention is better than cure” has never been more true.

More states are starting to mandate the wearing of masks in public. There couldn’t be any better time to pay attention to manufacturers of PPE. They make items including medical face masks, face shields, and infection control suits. In fact, the PPE business has become one of the most lucrative. It involves far less R&D compared to vaccines and treatments. Essentially, manufacturers just need to put a few raw materials and the right machinery in one place to kick start production. The next thing you know, you see a line of buyers queuing up for these products. Once the production facility is up and running and the customers secured, this is a business that can generate stable recurring cash flows.

Now, Californians are required to cover their faces in ‘most settings outside the home’. This includes when shopping, taking public transport, or while in crowded areas. In a nutshell, it looks like face masks could be in high demand with more states enacting mandates to wear them. As such, should we allocate some of our investments to medical stocks?

Read More

- 3 Stay-at-Home Stocks To Watch In 2020

- 2 Consumer Staples Stocks To Watch Amid The COVID-19 Pandemic

- Shopify Stock Jumps On Walmart Deal; Time To Buy?

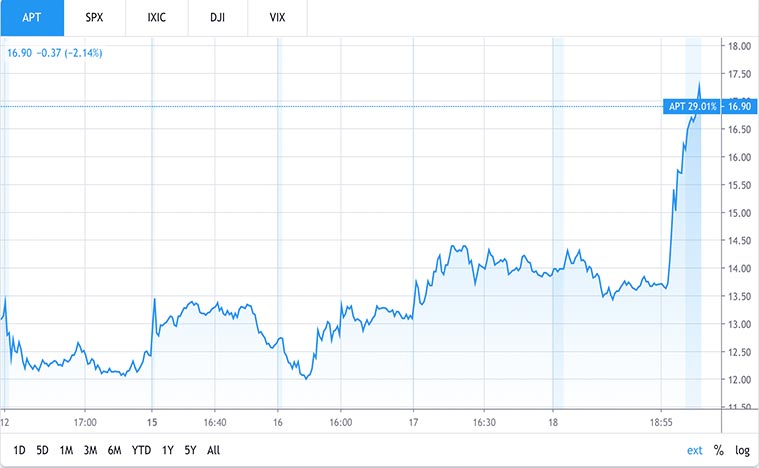

Top Manufacturing Stocks To Watch: Alpha Pro Tech

Shares of Alpha Pro Tech (APT Stock Report) popped on Thursday as California Governor Gavin Newsom signed an order requiring his state’s citizens to wear face masks in public. Alpha is a small-cap global manufacturer of PPE. From the company’s latest fiscal quarter results reported on May 6, its revenues grew by 47.5% to $18.2 million years over year. This is driven by the surging demand for PPE due to the outbreak. The APT stock has been hovering around $12-$13 for the past two months amid the flattening of the curve. The resurgence of Covid-19 now is creating a spike in demand for PPE once again. If you are into momentum trading, now might be a good time to ride along with other investors.

But here’s the thing. During the first wave of the novel coronavirus, the majority of the face masks came from China. That was because face mask manufacturers in many other countries halted their production. Now that these manufacturers are back online again, the demand for Alpha Pro Tech’s products may be not as strong as before. Don’t get me wrong, I’m not saying that their face masks are inferior to the imported ones. Just that there are more choices of face masks in the market now than there were a few months ago. Now that shares of APT have gone up by 15% in one trading session, can we expect APT stock to close higher today?

[Read More] Are These 2 Retail Stocks Set To Rebound In 2020?

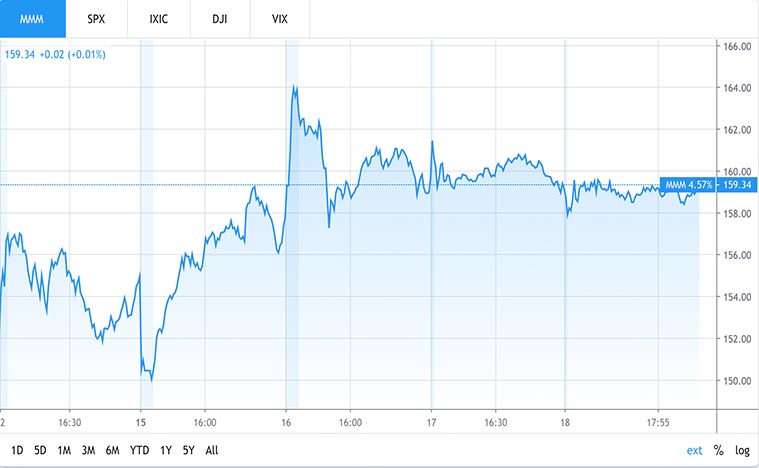

Top Manufacturing Stocks To Watch: 3M

Industrial conglomerate 3M (MMM Stock Report) reported May monthly sales results on 15 June 2020. It cited a drop in overall sales by 20% compared to the same period last year. Despite the strong demand for its N95 respirators, the negative effects brought by Covid-19 on the safety and industrial segment weighed down the overall profitability of the company.

The company has been adding production capacity for N95 respirators since the beginning of the year. This was simply due to surging global demand from the coronavirus pandemic. Its output has doubled to 1.1 billion per year. And the company expects that to almost double again to an annual rate of 2 billion within 12 months. If the pandemic is here to stay for another year or two, can we expect 3M’s overall business to be lifted by masks only?

Bottom Line

Both Alpha Pro Tech and 3M are examples of manufacturers that saw soaring demand for their PPE products. Now, they have at least rebounded to their average trading price. All in all, these manufacturing stocks require two different sets of strategies. That’s because Alpha Pro Tech is mostly focused on PPE. On the other hand, 3M’s respirator product is only one of its segments in the conglomerate. When the pandemic is over, we could see a substantial drop in Alpha Pro Tech’s sales like what the company experienced during the H1N1 pandemic. Hence, investors may witness the same pattern yet again when Covid-19 subsides.

As for 3M, when we see the curves flattening, the other segments of the company could more than compensate for the fall in face masks sales. The diversified nature of 3M’s business allows MMM stock to avoid wild swings. If you prefer stocks with a slow and steady growth, this may be an option to consider.