Top 3 Consumer Stocks To Buy [Or Sell] Right Now

Throughout the pandemic, consumer stocks have been rather volatile. Since a lot of companies had to temporarily close manufacturing plants, one line was hurt. Then restaurants also had to close for takeout only, with many now only being open for outside seating. This outside seating has been able to improve the business for those companies. On the other hand, top consumer stocks who’s products are in supermarkets have performed well as of late.

People stockpiled food for the pandemic and still are. Reopening is becoming more common which has more people going out to buy food than ever during the pandemic. As of September, supermarkets and restaurants are starting to see sales increase once again. Delivery companies like Uber Technologies Inc. (UBER Stock Report) and GrubHub Inc. (GRUB Stock Report) have increased in stock price due to the rise of delivery as well. Let’s look at three consumer stocks that are recovering or have recovered in the market as of September 2020.

Read More

- Should Investors Buy These Cloud Stocks Ahead Of Snowflake’s IPO?

- 3 Top Entertainment Stocks To Buy Or Sell In September? 2 Making Big Moves This Week

Top Consumer Stocks To Buy [Or Avoid] Now: Tyson Foods Inc.

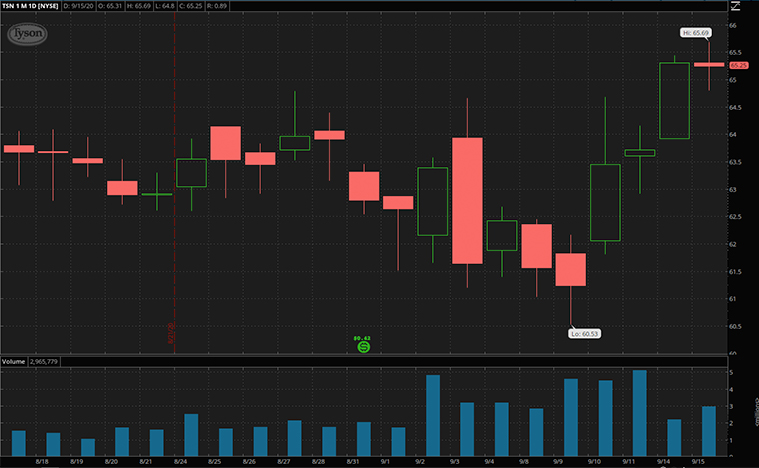

The first food stock to watch on this list is Tyson Foods Inc. (TSN Stock Report). Tyson Foods is the world’s second-leading processor of chicken, beef, and pork. It also runs one of the largest marketing operations for these products. Tyson saw a large drop in stock price due to it not taking proper coronavirus precautions early enough. This caused a total of 25 Tyson employees to pass away from the coronavirus. China stopped imports from Tyson Foods on June 22nd which caused its stock price to drop even more. This was done due to fears of spreading the virus more.

Obviously this caused TSN stock to fall back when that occurred, but it has gone up since then. In fact in the last 6 months, TSN stock price has gone up more than 44% to $65 as of September 15th. Currently there is the issue of a swine fever occurring with animals in Europe. Yet still, TSN stock was not affected by this. The company is also planning to open 7 health clinics near its facilities for employees and family. This is to boost the health and wellness of its workforce. Will TSN stock recover when the economy does? That is unsure, but that is why it is a food stock to watch.

Top Consumer Stocks To Buy [Or Avoid] Now: Wingstop Inc.

Next up on this list of consumer stocks is Wingstop Inc. (WING Stock Report). Wingstop has managed to perform extremely well in 2020. The company operates more than 1000 restaurants and sells food like wings, chicken strips, and more. It holds locations in many places around the world, operating as a chain. Wingstop has reached new record highs in the market in 2020.

At the start of 2020, WING stock was at $84 a share on average. Then, it fell sharply in March when the economy crashed. Since then, WING stock price has been on a rather well-performing rally. In August, WING stock reached new record highs of about $168 a share on average. The company’s system-wide sales increased by 37% to $509 million in its quarterly reports. This furthered the rise of the wing company. As of September 15th, WING stock is at $131 a share on average. That is why it has made this list of consumer stocks to watch.

[Read More] Top 3 Consumer Staples Stocks To Watch In September 2020

Top Consumer Stocks To Buy [Or Avoid] Now: Starbucks Corporation

The final food stock to watch on this list is Starbucks Corporation (SBUX Stock Report). This company has experienced lots of troubles caused by the pandemic. Most Starbucks locations reopened in the United States already. In its second-quarter results, same-store sales fell 10% globally. Its second-quarter income was $328.4 million which was down from $663.2 million year-over-year.

The CFO of Starbucks Corporation, Pat Grismer said, “We still have a long ways to go to get back to full recovery, but we’re optimistic based on the strength of our brand and the strategy and initiatives that we have to drive sales and improve margins.”

SBUX stock is up 50% in the last 6 months as of September 15th. SBUX stock price is at $87 a share as of the 15th as well. If Starbucks can start to increase its revenue more, it will be great for the company. That is why SBUX stock is on this list of consumer stocks to watch.