Are These The Best EV Stocks To Buy Right Now?

Automotive stocks have been hit hard in 2020. With the COVID-19 disrupting virtually every industry across the globe, you can see why the stock market was not spared. The S&P 500 Automobiles (Industry) had lost more than half of its value in March. However, if you pay attention to electric vehicle (EV) stocks, you will notice a trend. EV stocks have recovered following their correction from the pandemic, and some have even made further gains. Today, the S&P 500 Automobiles (Industry) have nearly doubled since March. The index is only 13% below its value at the start of the year.

In March, you would think that the automotive industry would have collapsed after witnessing such a devastating blow. However, EV companies have essentially reinvigorated the automotive industry. The reason being that the world is moving towards renewables. More people realize the repercussions of using fossil fuel, so the shift is justified. With cheaper EV production costs and more efficient batteries available, there is more incentive to switch over to an EV.

In 2019, the global electric vehicle market was valued at $162.34 billion. It is projected to reach a staggering $802.81 billion by 2027. There is certainly a lot of potentials for EV companies to grow and we may be at the advent of a new dot com boom. Key industry players like General Motors (GM Stock Report) and Ford (F Stock Report) have already begun shifting to EV. If these automotive titans have already begun transitioning, this could ultimately be a sign to pay attention to EV stocks. With that in mind, could these 3 EV stocks be worth adding to your portfolio?

Read More

- What Are The Best Tech Stocks To Watch This Week? 3 For Your Watchlist

- Looking For Automotive Stocks To Watch Before November? 1 Up 1,446% In 5 Days

Best EV Stocks To Buy [Or Sell] Right Now: Nio

Nio (NIO Stock Report) has by far had a stellar year in the stock market. The Shanghai-based company has enjoyed gains of 653% in its stock price year-to-date and is currently at $27.97 per share. It is one of the few stocks that were seemingly unaffected by the COVID-19 pandemic. While an overwhelming number of sectors were hammered hard by the pandemic, NIO stocks were on the uptrend.

In its second-quarter fiscal posted in August 2020, the company recorded an impressive 146.5% increase in vehicle sales year-over-year at $493.4 million. Nio had also reported that its deliveries of ES8 and ES6 models had grown by 322.1% year-over-year. It also recently launched its EC6 model in July at the Chengdu Motor Show. The 5-seater premium smart electric coupe SUV is now available to order via the NIO app. This new model inherits the NIO family design with a touch of stylish and sporty coupe silhouette. With a battery pack of 100kWh, it can reach a mileage of 615 km on a single charge. This allows competing with big names like Tesla’s Model Y at a more affordable price.

The company founder and CEO William Li said that he expects Nio to manufacture 150,000 vehicles annually by the end of next year, compared to its current capacity of 60,000. In the long run, the company hopes to boost production up to 300,000 EVs a year. The company also reported cash and cash equivalents of $1.6 billion as of June 2020. Nio has also stated that it is focusing on improving operating efficiency across the company. With Nio making all the right moves, could this poise NIO stock as a top EV stock to buy?

Best EV Stocks To Buy [Or Sell] Right Now: Tesla

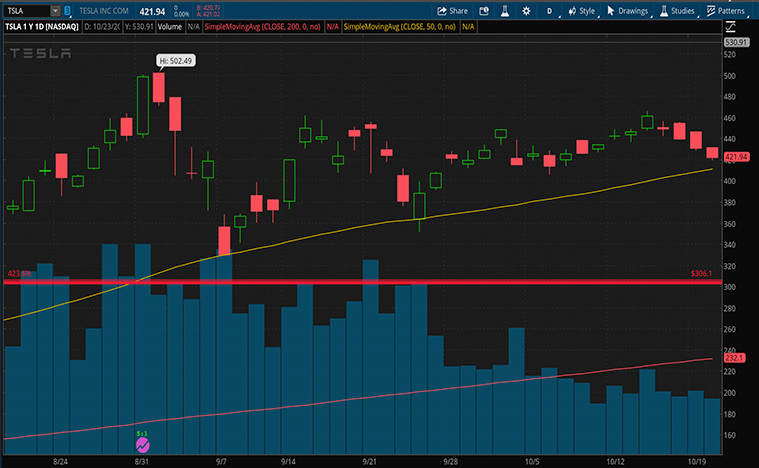

For being the poster boy of the EV industry, Tesla’s (TSLA Stock Report) success story is worth mentioning. Ahead of its third-quarter earnings this week, the company has demonstrated improved manufacturing efficiency and wider market adoption of its EVs. For that reason, analysts expect a strong performance for its third quarter. Year-to-date, TSLA stocks have enjoyed a price increase of over 400%. If this were any indication, it paints the future of the automotive industry in the color of EVs.

The company’s Model 3 has received a strong reception in China and has an installed annual capacity of 200,000 units. This makes its’ Model 3 the bestselling EV and allows it to compete with other mid-sized premium sedans, such as the BMW 3 Series. The company also reported that in Germany, one of its biggest European markets, the Gigafactory Berlin is under construction. Tesla is implementing further structural improvements based on its learnings from prior factories.

Tesla also has a stake in the energy business. Its Megapack batteries generated profit for the first time in its second-quarter fiscal for 2020. Megapack is the world’s largest energy project, operating at 1 Gigawatt hour (GWh). The company has also made home retrofit solar more affordable in the US. At $1.49 per watt, the average Tesla solar system is now one-third less expensive than the industry. The company saw its Solar Roof installations roughly tripled in Q2 compared to Q1. When all is said and done, is TSLA stock one of the best EV stocks to watch in 2020?

[Read More] Top Pharmaceutical Stocks To Capitalize On U.S. Vaccine Hopes

Best EV Stocks To Buy [Or Sell] Right Now: Workhorse Group Incorporated

Workhorse (WKHS Stock Report) has been trading for the last decade, but it has only been in limelight in 2020. Currently trading at $22.08 per share, the EV company has enjoyed a year-to-date increase of 619%. The company focuses on manufacturing electrically powered delivery and utility vehicles. Workhorse develops electric vehicles for last-mile delivery and other commercial purposes.

The company’s C650 and C1000 step vans have a modular battery pack system. There is also a proprietary telematics system to track and monitor the performance of its EVs. Workhorse estimates that its vehicles have 60% fewer maintenance expenses compared to fossil-fueled trucks. With that, you could expect over $170,000 in fuel and maintenance savings over a 20-year life span.

Workhorse currently has 400 vehicles on the road. This number could increase significantly in the coming years. This is because Workhorse is now one of the 3 remaining bidders for a contract worth $6 billion. The US Postal Service plans to upgrade its fleet of 165,000 vehicles and Workhorse stands a chance to benefit from this contract. Seeing the return on investments of Workhorse’s vehicles, the company does have a competitive edge over its competitors.