4 Top Growth Stocks To Add To Your Watchlist

Today, it is a common practice for people to buy stocks with the intention of holding it for years. Growth stocks have been on investors’ radar over the past year as the stock market recovered from the crash. You know it, the music won’t go on forever. That said, now may not be a good time to buy in (yet). Why? It appears to me like we are headed toward a steep correction. If that turns out to be the case, it could be a great opportunity for investors to pick up top growth stocks on the cheap.

Some companies are better positioned than others to capitalize on this expected progress. With lending rates continuing to be at dovish levels and the Federal Reserve remaining highly accommodative, growth stocks have a huge room to run. In other words, as long as access to capital remains cheap, growth stocks can outperform. With that in mind, here are four of the best growth stocks that could deliver great returns in March 2021 and beyond.

Best Growth Stocks to Buy [Or Sell] In March

- Magnite Inc. (NASDAQ: MGNI)

- Chewy Inc. (NYSE: CHWY)

- DocuSign Inc. (NASDAQ: DOCU)

- Butterfly Network Inc. (NYSE: BFLY)

Magnite Inc. (MGNI)

Compared to other advertising stocks, Magnite Inc. is proving to be a sleeper pick with tremendous potential this year. With a recent announcement that it is acquiring SpotX for $1.17 billion from RTL Group, turning Magnite into a capital ad tech firm that has a hold on every major cable network and streaming channel. The merger also strengthens the company by creating a cost-saving synergy of $35 million annually. That in turn fortifies Magnite’s position in the ad-based streaming vertical.

The strong performance of MGNI stocks also seemed to bolster investor’s confidence, as the stock rose by more than 30% since the beginning of the year. It’s easy to forget that the stock had tripled back in 2020. Even despite the ongoing pandemic, Magnite Inc was able to report revenue of $82 million last year. That represented an increase of 69% from the previous year.

While ad-tech companies may not exactly be front end with direct relationships with users, Magnite is definitely pulling the right strings behind the scenes. So long as Magnite continues to tap into multiple different CTVs and streaming channels, it continues to grow its revenue potential. With all that said, does this make MGNI stock a prime choice for your portfolio?

Read More

- Top Electric Vehicle (EV) Stocks To Buy? 4 To Watch

- Are These The Top Consumer Stocks To Buy? 4 Names To Know

Chewy Inc. (CHWY)

Moving from a brick-and-mortar store to an online platform, Chewy Inc. has definitely found a goldmine although it’s serving a very niche pet market. According to the 2020 APPA National Pet Survey, at least 67% of American households possess an animal companion. With the closures of pet stores due to lockdowns during the pandemic, pet owners have to rely on e-commerce in obtaining essentials for their beloved pet animals. This allows Chewy Inc. to expand its foothold among pet owners who are resorting to buying pet goods online.

Some investors are worried that Chewy may lose its momentum in a post-COVID-19 world as people return to their normal routine. CHWY stock has fallen by over 16% this week, raising eyebrows and diminishing confidence among traders. That said, this is an opportunity for investors to capitalize and buy more, as there is still potential for the online pet retailer to grow.

American households with pets are also expected to increase their expenditure on pet items each passing year, even in times of recession. This is great news for Chewy Inc., as pet retailing is expected to generate at least $281 billion in revenue by 2023. With Chewy expected to deliver increased sales in the next two years, would this be enough of a factor for investors to place their faith in CHWY stock?

[Read More] Top Stocks To Invest In Now? 4 Biotech Stocks To Watch

DocuSign (DOCU)

Conducting business remotely is the new norm of 2021, as companies scrambled to adopt solutions that aid remote-only work environments. DocuSign has seen unprecedented adoption from that business transformation. That’s considering its service allows users to record signatures on documents easily and on the go. According to the company website, DocuSign serves over 800,000 companies and hundreds of millions of users worldwide.

Such influx of customers has boosted DocuSign’s profit, especially with the subscription fee imposed on users. Additionally, it has expanded to offer an Agreement Cloud suite of products. These allow clients to digitally manage end-to-end agreement processes. This new product will allow DocuSign to add another source of revenue in addition to its current revenue from e-signatures.

With DocuSign’s solid gross margin of over 70%, it is no surprise that the company continues to attract the attention of investors. Having cash and investments of over $600 million is also a testament to DocuSign’s financial stability. With all these in mind, would you consider buying DOCU stock before its earnings announcement on March 11?

[Read More] Making A List Of The Top Software Stocks To Watch Now? 4 Names To Know

Butterfly Network (BFLY)

Set to become the next big thing in medical services, Butterfly Network seeks to disrupt the medical industry. It aims to make medical imaging available universally and affordable to all people. Starting out with its handheld portable ultrasound machine dubbed the “iQ”, it shrinks the bulky ultrasound machine to a handheld device that can be viewed through a phone. With such product potential, it garnered the attention of both medical personnel and investors alike.

Although Butterfly Network is a young company, it has made moves to become a mainstay within the American medical industry. With its recent merger with Longview Acquisition Corp, Butterfly Network has over $500 million in excess cash and could be cash flow positive by 2024. The company also projects a 65% growth in revenue this year as hospitals and medical practitioners adopt their ultrasound technology. Butterfly Network also plans to include a subscription business. That could create recurring sales in an estimated $8 billion market.

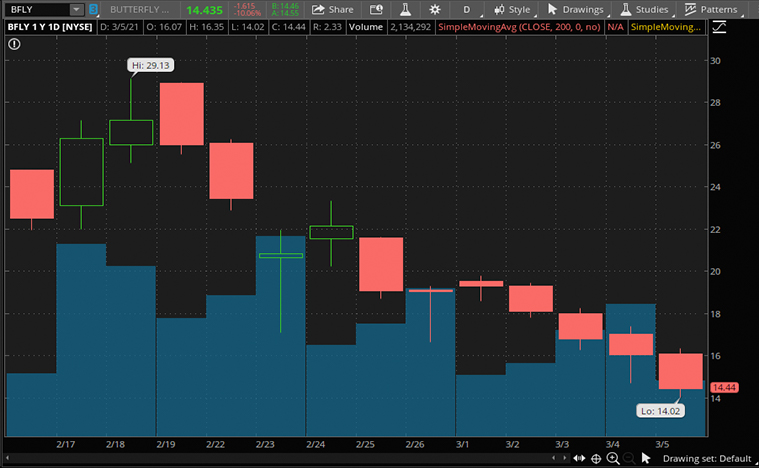

Since its highs of $29.13 in mid-February, BFLY stock has taken a breather, falling nearly 45%. Considering the long-term potential of the company, would BFLY stock be an attractive stock to buy and hold? If so, would you consider starting a position amid the broader market weakness?