Are These Trending Retail Stocks A Good Buy Right Now?

Safe to say, it has been an interesting year for the retail industry. If anything, the pandemic has shown that not all retail stocks are made equal. After all, the e-commerce sector of the industry exploded onto the scene when coronavirus first hit. This was no doubt because most consumers being homebound amidst lockdowns. We saw this trend continue well throughout the past year culminating in a massive spike in retail sales during the holiday season. Fast forward to this week where even conventional retail stocks are in the limelight as the rollout of the third round of stimulus aid is ongoing. Could the retail industry be looking at a major rebound this quarter?

Well, on one hand, the U.S. Commerce Department did reveal that retail sales dropped by a seasonally adjusted 3% last month. However, this was likely due to excessively cold weather hitting most of the country throughout February. On the other hand, stimulus checks paired with accelerating nationwide vaccination efforts would see more retail shoppers out and about.

All in all, it would not surprise me to see the retail industry pick up steam moving forward. Evidently, conventional retailer L Brands (NYSE: LB) is currently looking at gains of over 500% in the past year. You could also argue that consumers would continue to rely on e-commerce giants like Amazon (NASDAQ: AMZN) out of convenience. To this end, could one of these retail stocks be the best bang for your buck?

Top Retail Stocks To Buy [Or Avoid] Right Now

- Five Below Inc. (NASDAQ: FIVE)

- Pinduoduo Inc. (NASDAQ: PDD)

- Williams-Sonoma Inc. (NYSE: WSM)

- Dollar General Corporation (NYSE: DG)

Five Below Inc.

First up is Five Below. The Pennsylvania-based company operates a chain of specialty discount stores across the U.S. As its name suggests, the company sells products that cost $5 or less. Accordingly, Five Below identifies as a “high-growth value retailer for tweens, teens, and beyond” which offers high-quality products at an extreme value. Besides appealing to younger audiences with limited funds, investors could be watching Five Below now as well. Namely, FIVE stock is likely on investors’ radars now as the company just posted its recent earnings after yesterday’s closing bell.

Diving right into it, Five Below reported better-than-expected figures in its fourth-quarter fiscal yesterday. The company posted an earnings per share of $2.20 on revenue of 858.5 million. To highlight, this exceeded Wall Streets’ estimates of $2.11 per share on revenue of $838 million.

In short, Five Below saw green across the board. Nevertheless, the company does not seem to be slowing down in 2021. CEO Joel Anderson mentioned that Five Below is looking to open over 170 new stores while expanding its distribution capabilities. At the same time, it will also be making entries into Utah and New Mexico this year. With Five Below firing on all cylinders, could FIVE stock be worth investing in now?

[Read More] Best Stocks To Buy Now? 4 Tech Stocks to Watch

Pinduoduo Inc.

Following that, we have Chinese e-commerce giant Pinduoduo. For some context, it is the largest agriculture-focused e-commerce platform in the country. With its platform, Pinduoduo connects farmers of fresh produce with consumers. Indeed, demand for Pinduoduo’s services would likely surge over the past year with the pandemic limiting movement in the region. Similarly, PDD stock has also surged in value, gaining by over 350% over the past year. With the figures in its recent-quarter fiscal, investors could be watching PDD stock yet again.

In detail, the company posted stellar figures across its key metrics. For starters, Pinduoduo saw its gross merchandise value jump by over 66% year-over-year to a whopping $255.6 billion. Adding to that, the company saw its total revenue for the quarter skyrocket by 146% over the same period. No doubt, these figures are impressive for a company that operates solely on mobile phones.

But, the real story here is that Pinduoduo surpassed Alibaba (NYSE: BABA) in terms of annual active users (AAUs). In terms of numbers, Pinduoduo clocked in a record 788 million AAUs compared to Alibaba’s 779 million. According to Pinduoduo VP of Strategy David Liu, the company still has plans to optimize its operations moving forward. With Pinduoduo’s current momentum, would you consider PDD stock a buy?

Read More

- Should Investors Buy These Top Entertainment Stocks?

- Top Stocks To Invest In Right Now? 4 Tech Stocks To Watch

Williams-Sonoma Inc.

Williams-Sonoma (WSM) is a consumer retail company that sells kitchen-wares and home furnishings. According to WSM’s estimates, it is the world’s largest digital-first home retailer. Also, WSM is the parent company behind the Pottery Barn, Mark and Graham, and Rejuvenation brands. Above all, the company’s brands are all integrated on its Key Rewards free-to-join loyalty program, offering members exclusive benefits. In terms of scale, WSM operates in the U.S., Puerto Rico, Canada, Australia, and the U.K. For homebound consumers, WSM’s home furniture offerings could be a go-to. Based on WSM’s latest quarter fiscal, this does seem to be the case.

In it, the company posted strong fourth-quarter figures, beating consensus earnings and revenue estimates. WSM posted earnings per share (EPS) of $3.95 on revenue of $2.29 billion. To investors’ delight, this marks a year-over-year surge of 85% in EPS. Not to mention, the company achieved these results despite shipping constraints and generally low retail traffic.

CEO Laura Alber cited the 47.9% boost in e-commerce year-over-year as a key growth driver for the quarter. Aside from that, WSM also saw same-store sales increase by 25.7% across the board as well. Given all of this, do you think WSM stock still has room to grow this year?

[Read More] CrowdStrike Holdings (CRWD) Vs Cloudflare (NET): Which Is A Better Cybersecurity Stock To Buy?

Dollar General Corporation

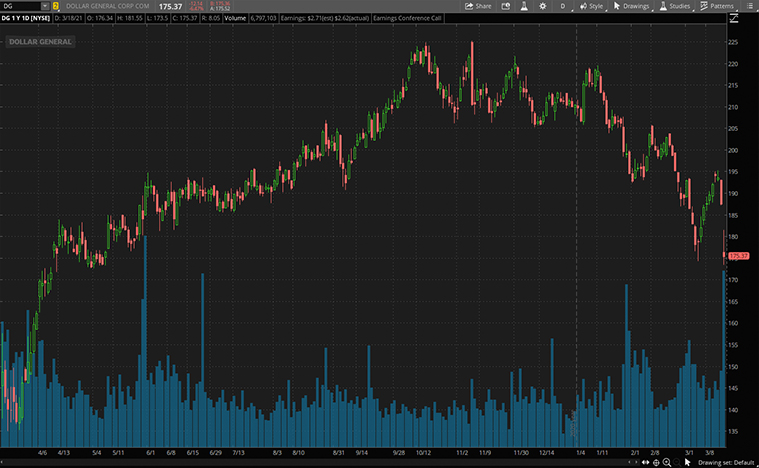

Next, we will be looking at variety store company Dollar General. For the uninitiated, the massive retail chain operator offers daily necessities in stores across the U.S. at everyday low prices. Dollar General operates over 17,100 stores in the U.S. Notably, this far exceeds Target’s (NYSE: TGT) and Walmart’s (NYSE: WMT) combined total U.S. stores. More importantly, DG stock is making waves now as the company released its fourth-quarter results earlier today.

For the quarter, Dollar General reported an earnings per share of $2.62 on total sales of $8.41 billion. CEO Todd Vasos mentions that the company had a strong finish to fiscal 2020. Given that its brick-and-mortar operations continue to be impacted by the pandemic, Dollar General remains resilient. On that note, the company issued a somewhat conservative outlook for the fiscal year 2021 citing a flat net sales movement.

However, Dollar General also bumped its quarterly dividend up by 17% while establishing a $2 billion stock buyback program. It seems that the company is confident of its long-term growth prospects but remains wary of pandemic-related uncertainties. Investors were quick to trim their DG stock at today’s opening bell because of its conservative 2021 outlook. Would it be wise to buy on the dip? Your guess is as good as mine.