Are These The Top Consumer Discretionary Stocks To Invest In Now?

While investors are flocking from tech stocks to reopening plays, consumer discretionary stocks remain an area of interest now. Why? Well, you could say that this group of stocks sits in a cozy middle ground between the two aforementioned industries. On one hand, some of the home entertainment stocks like Roku (NASDAQ: ROKU) rely on streaming tech to operate. On the other hand, travel companies such as Carnival Corporation (NYSE: CCL) continue to soar on incoming tourism boom hopes. Both companies operate in very different industries, but both rely heavily on consumer discretionary dollars, nonetheless. Not to mention, both companies’ shares have more than tripled since early April last year.

Right now, you might be wondering if the top consumer discretionary stocks in 2020 can still perform this year. After all, these are companies that catered to homebound consumers amidst the pandemic. Well, considering the recent round of stimulus checks, these companies could see continued growth albeit at less breakneck speeds. When the pandemic comes to an end, consumers will likely still rely on the e-commerce services and streaming services they’ve come to love throughout this pandemic. In this case, you could say that consumer discretionary stocks still have room to grow moving forward. Given all of this, here are four making moves now.

Top Consumer Discretionary Stocks To Watch

- Amazon.com Inc. (NASDAQ: AMZN)

- FuboTV Inc. (NYSE: FUBO)

- Ozon Holdings (NASDAQ: OZON)

- Parts Id Inc. (NYSE: ID)

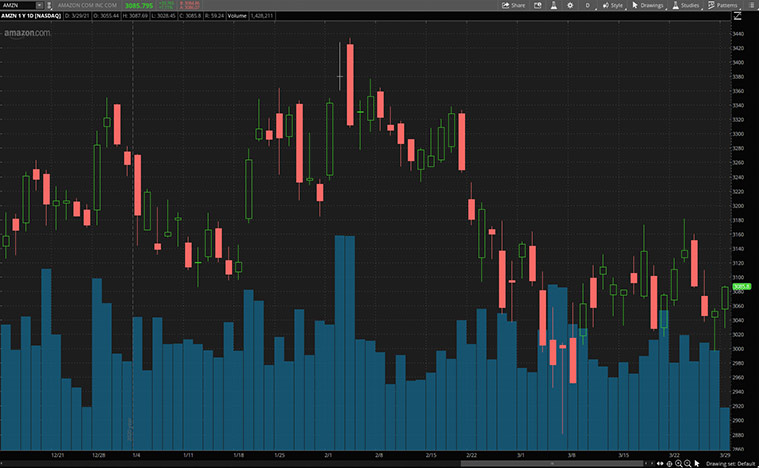

Amazon.com Inc.

Starting us off is e-commerce juggernaut, Amazon. Over the past year, the company has made massive strides across the board. From a global leading computing division to its streaming services, Amazon’s portfolio is diverse, to say the least. Moreover, the company has also been making moves in the health care business with its Amazon Care division. Just last Friday, the company received FDA authorization for its self-made COVID-19 test kit for testing employees regularly. Regardless, there are no shortages of headlines when it comes to Amazon refining its business operations. But what has Amazon been doing to improve its e-commerce services post-pandemic?

Now, despite its current leading position in e-commerce, Amazon has not been sitting idly by. Take its $131 million investment into air cargo contractor Air Transport Services Group earlier this month for example. If anything, the company has been focusing on bolstering its air fleet to meet rising international sales.

Accordingly, Amazon Air launched its second air gateway in Fairbanks, Alaska, its most northern air gate in the world. No doubt, consumers across the globe will continue to rely on the company’s best-in-class delivery services. This goes to show that Amazon is set on maintaining its current position in the e-commerce industry. Would this make AMZN stock a buy for you now?

[Read More] Qualcomm (QCOM) Vs NVIDIA Corp (NVDA): Which Of These Semiconductor Stocks Is A Better Buy?

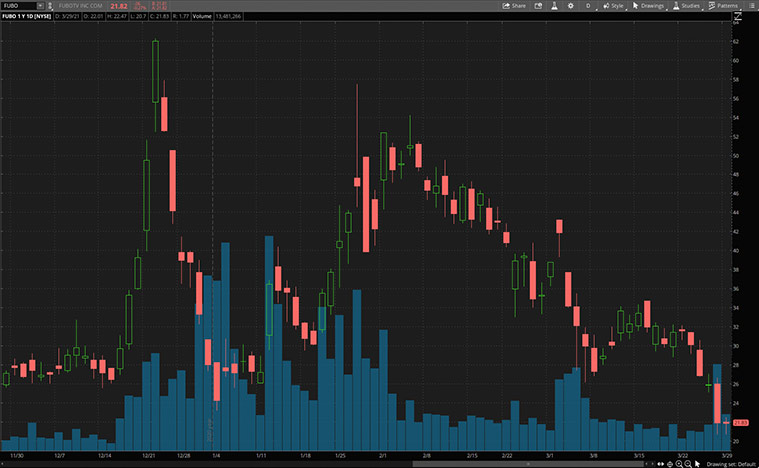

FuboTV Inc.

Another top consumer discretionary stock in focus now would be Fubo. For the uninitiated, the company mainly offers streaming television services. In particular, the company’s streaming platform focuses primarily on live competitive sports channels and events. This includes but is not limited to football, basketball, and hockey championships as well as related news channels. For the most part, Fubo continues to reap the benefits from accelerated cord-cutting trends courtesy of the pandemic. Specifically, it caters to sports fans who are looking to stream top-quality live sporting events. With the company revealing its upcoming earnings report date, could now be the time to watch FUBO stock?

Well, despite there not being any other major announcements from Fubo, the company could be riding sports streaming tailwinds in the long term. To begin with, Amazon streaming service, Prime Video, is now in an exclusive partnership with the National Football League (NFL). Through this deal, the NFL’s highly anticipated Thursday Night Football program will appear exclusively on Prime Video starting in 2023.

However, this deal only accounts for seasonal NFL games that come round once a year. By extension, Fubo could benefit from the overall phasing out of cable TV as sports fans turn to streaming platforms for their entertainment needs. When the time comes, Fubo would be a go-to given its rich sports streaming portfolio. In the meantime, would you consider buying FUBO stock?

Read More

- Top 5 Things To Watch In The Stock Market This Week

- Best Stocks To Buy In April 2021? 4 Biotech Stocks To Watch This Week

Ozon Holdings

Next, we have Russia’s leading e-commerce platform, Ozon. Ozon empowers small and medium-sized businesses by connecting them with consumers via its platform. As with most e-commerce players, Ozon benefitted from the surge in online shopping throughout 2020. So much so that the company saw its gross merchandise value skyrocket by 140% in 2020. Aside from its booming e-commerce business, Ozon also operates Russia’s leading online travel agency, Ozon Travel. In theory, Ozon would stand to benefit from general tailwinds in both the e-commerce and travel industry. More importantly, Ozon is slated to release its fiscal 2020 financials before tomorrow’s opening bell. Naturally, it would not surprise me if OZON stock is on investors’ radars now.

Nevertheless, Ozon has not been resting on its laurels even after a stellar year. Just this month, the company made three major improvements to its core platform. For starters, Ozon now operates via a digital storefront model, allowing sellers to deliver orders via their own delivery services. This caters to sellers in more remote locations, niche product sellers, or larger brands.

Additionally, Ozon users now have access to bulk buying services which entitle them to discounts starting from 20%. If that wasn’t enough, the company introduced third-party services to its platform last week. With Ozon firing on all cylinders now, will you be adding OZON stock to your portfolio?

[Read More] 4 Top Cybersecurity Stocks To Watch In The Stock Market Today

Parts Id Inc.

Topping off our list is Parts Id Inc. In brief, it is a leading automotive digital commerce company. Particularly, Parts Id offers a one-stop-shop for the automotive parts and accessories markets. Given its e-commerce operations, consumers would turn to Parts Id for their automotive needs throughout the current pandemic.

At the same time, automobile enthusiasts would be able to shop from the comfort of their homes via Parts Id as well. ID stock appears to be in the limelight now with gains of over 20% at today’s opening bell. This could be a delayed investor reaction to analyst coverage of the stock and the company’s latest announcement.

Last week, investment firm D.A. Davidson analyst Michael Baker initiated coverage on ID stock. Baker gave the stock a Buy rating with a price target of $12 a share. This marks a 47% premium over its current price of $8.16 as of 11:14 a.m. ET. Rosy analyst coverage aside, Parts Id is also in the process of expanding its tire installation network in the U.S. In detail, the company is looking to increase its installation locations sixfold by the end of the year. As Parts Id seems to be kicking into high gear, could ID stock follow suit? You tell me.