5 Electric Vehicle Stocks To Watch This Week

Electric vehicle stocks may not be the hottest investment theme in the stock market right now. But the bullish thesis surrounding the industry remains intact. With companies like Tesla (NASDAQ: TSLA) making cars that can outperform many gas-powered vehicles in one way or another, things could be looking up for the broader EV segment. Not to forget that governments across the world are pushing for a cleaner and more sustainable future.

Before we get into details, let’s also take some time to appreciate that the great divide between traditional automakers and EV startups is narrowing. And that has created opportunities for investors looking for top electric vehicle stocks to buy. While a lot of the government’s focus will be on clean energy, the latest EVs on the road are seemingly capturing most of the attention. If anything, the EV sector is certainly an exciting avenue for investors looking to tap on some growth names.

If you believe that the majority of new vehicles sold will soon be electric, finding the best EV stocks to buy could benefit your portfolio. With all of this in mind, let’s take a look at some of the top EV stocks to watch in the stock market today.

Top EV Stocks To Watch Right Now

- Nio Inc. (NYSE: NIO)

- Churchill Capital Corp IV (NYSE: CCIV)

- Fisker Inc. (NYSE: FSR)

- Ford Motor Co. (NYSE: F)

- EHang Holdings Ltd. (NASDAQ: EH)

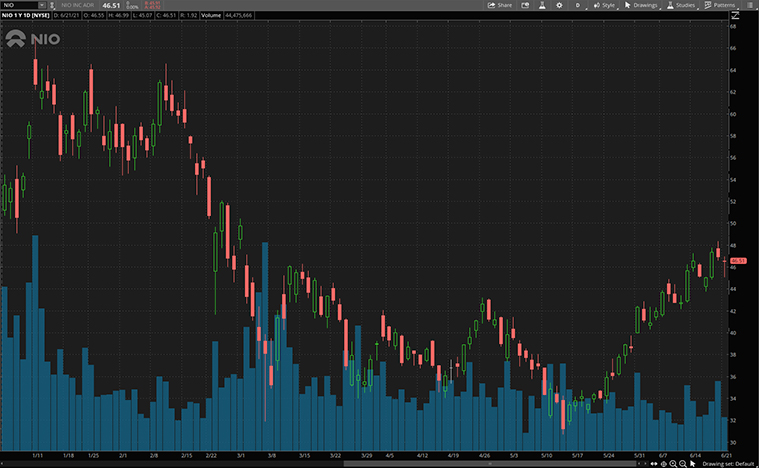

Nio

Nio is an electric vehicle maker that has seen huge success both in China and the stock market. The company is arguably one of the most successful EV companies in terms of growth today. Often dubbed as the ‘Tesla of China’, NIO stock has seen some momentum picking up recently. This shouldn’t come as a surprise with a few catalysts supercharging what may be the best EV stock in China. The first catalyst many investors have their eyes on with Nio is its ongoing expansion into European markets.

If you have been following the company’s news, you would know that Nio announced its entry into the Norwegian market in late April. And that’s not all, the company also announced it will enter the German market by 2022 earlier last week. Although Norway has a higher penetration rate in terms of EV adoption, Germany is widely considered to be one of the most important markets to break into in Europe. More importantly, Nio’s battery-as-a-service business model could put NIO stock in a strong position to compete with other top EV stocks in the stock market.

Read More

Lucid Motors

We’ve been discussing the merger between Lucid Motors and Churchill Capital for a while now. If you are looking for a strong contender to compete against Tesla, Lucid Motors might just be what you are looking for. As the company has amassed an impressive engineering and design team to create a new class of premium EVs, it may be worth giving CCIV stock a shot. Some believe the company could create a more luxurious EV in comparison to what Tesla has to offer. Not to mention, Lucid Motors also boasts a top-tier self-driving suite and bidirectional fast charging.

That’s not to say Tesla stock is not worth the investment. What I’m trying to say is, it’s also worth having a closer look at companies that could potentially eat away Tesla’s market share. While CCIV stock has been trading sideways in recent months, its valuation and technology make it worth a closer study. With disruptive technological innovation in EVs, would you say that CCIV stock is trading at a steep discount relative to its potential?

[Read More] 3 Growth Stocks That Could Be Better Investments Than AMC Stock Right Now

Fisker

Coming up next, we have the EV startup Fisker. To put it simply, it is a company that designs and manufactures electric vehicles. Its flagship Fisker Ocean is set for mass production in 2022. The company recently inked a long-term manufacturing deal with Magna International (NYSE: MGA). If anything, this shows that Fisker’s asset-lite model is one step closer to reality. From this partnership, Fisker could be looking at enhanced production efficiency and cost innovation.

The company also recently signed a letter of intent with the Mekonomen Group. With a network of more than 3,000 affiliated workshops across Scandinavia, the Mekonomen Group will provide a range of after-sales services to Fisker. Furthermore, Fisker also announced the nomination of Sharp Corporation to develop technologies to support its next-generation in-vehicle screens and interfaces. The agreement covers the Fisker Ocean SUV, Project PEAR (Personal Electric Automotive Revolution), and potentially two additional Fisker vehicles. Considering all these, would an investment in FSR stock now be worth the risk?

Ford Motor

It may come as a surprise to know that Ford is one of the biggest winners this year in this list of top EV stocks to watch. The legendary automaker’s shares surged more than 70% year-to-date. And that’s because the company is pursuing leadership positions in electrification and mobility solutions. Recently, the company announced that its’ luxury automotive brand, the Lincoln Motor Company, will also be accelerating its brand transformation. As Lincoln approaches its 100th anniversary next year, the brand plans to electrify its entire portfolio of vehicles by 2030.

With Ford stock generally seems to be moving on an upswing, shareholders who held on since last year are being handsomely rewarded. CEO Jim Farley said that EVs represent the biggest growth opportunity for the company since the Model T. With the $30 billion push to electrification by 2025, there could be much to look forward to. With that in mind, do you think F stock is a top EV stock to watch right now?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

EHang Holdings

Last on the list, EHang Holdings had been trending in the stock market lately. Unlike the rest of the companies on this list, EHang isn’t exactly an EV company. In fact, as its vehicles are straight up in the air. The company touts itself as the world’s leading autonomous aerial vehicle company. In plain English, EHang makes flying cars. You may have heard about it this year. But the truth is, the company is already making a name for itself.

Recently, the company announced that it has successfully performed the first trial flight of its flagship AAV EHang 216 passenger-grade vehicle in Japan. And if you think that the company is still in prototype mode, you’d need to think again. In fact, sales in China have already begun, with 22 units sold in the last quarter. Considering all these, it appears that the future of flying cars is much closer than we previously thought. While EH stock isn’t cheap at any price metrics, you could say that it’s certainly putting a lot of work to grow into its current valuation. With the excitement surrounding the company, is EH stock a buy or sell right now?