Check Out These E-commerce Stocks As Online Shopping Adoption Increases

With the rise of technology over the past decade, the way of commerce is also evolving along the way. Because of this, e-commerce stocks are often on the radar of many investors of the stock market. Sure, the global pandemic has hastened the transition of commerce to online platforms. Naturally, people were afraid of going outdoors and exposing themselves to the virus during the peak of the pandemic. Hence, this has led consumers to do their shopping online. Now, don’t get me wrong, the e-commerce industry has been on the rise even before the pandemic.

For instance, we need to look no further than the company started by Jeff Bezos, Amazon.com, Inc (NASDAQ: AMZN). The company started as an online bookseller and faced many skepticisms during its early days. Look where the company is now, it is one of the largest companies in the world with arguably the largest e-commerce platform. Another example of a fast-growing company in the industry would be Chinese e-commerce giant Alibaba Group Holding Ltd (NYSE: BABA). So, if you are optimistic about the future of this space, why not look at some of the top e-commerce stocks in the stock market today?

Best E-commerce Stocks To Buy [Or Sell] Today

- Sea Ltd (NYSE: SE)

- Shopify Inc (NYSE: SHOP)

- Walmart Inc (NYSE: WMT)

- Etsy Inc (NASDAQ: ETSY)

Sea Ltd

To kick start the list, let us have a look at Sea Limited. In detail, the company is a consumer Internet company operating in the areas of digital entertainment, electronic commerce, and digital financial services. The company has its hands in the e-commerce space through its online shopping platform, Shopee. Well, SE stock has been growing steadily over the past year, seeing gains of over 110% within the period.

In fact, the Singapore-based company reported its second-quarter earnings yesterday. It was yet another strong financial quarter by the company that has gotten its investors excited. The company posted GAAP revenue of $2.3 billion, up by a whopping 158.6% year-over-year. Also, its total gross profit was $930.9 million, an increase of 363.5% year-over-year.

Furthermore, the company continues to rank first in the Shopping category by average monthly active users and total time spent in-app in Southeast Asia. The company’s attempt to penetrate the Brazilian market in late 2019 has also proven to be a huge success. For the quarter, it ranked first in the Shopping category by downloads and total time spent in-app. It also ranked second by average monthly active users. Overall, the reception of the company’s e-commerce platform in its target markets has been mostly positive. So, would you consider investing in SE stock?

Read More

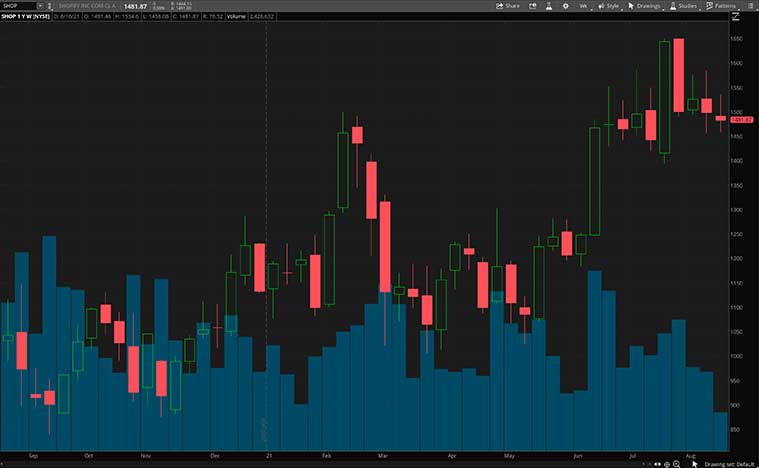

Shopify Inc

Shopify provides a cloud-based, multi-channel commerce platform designed for small and medium-sized businesses. Through its software, merchants can run their business across all of their sales channels, including Web and mobile storefronts, physical retail, and even social media marketplaces. So, merchants will have a single view of their business and customers across all their sales channels which makes the management of products and inventories an easier task.

Late in July, the company finally allowed eligible sellers to sell non-fungible tokens (NFTs) through its platform. The NBA’s Chicago Bulls launched its first-ever NFTs by launching an online store on Shopify. Now, Bulls fans can purchase digital arts directly with the team’s online store using a credit or debit card. Impressively, it appears that the NFTs were sold out in just within 90 seconds according to Shopify’s VP of merchant services. This move by Shopify opens up a whole new world for e-commerce merchants.

On top of that, the company also posted a strong second-quarter earnings report last month. Its total revenue for the quarter was $1.12 billion, up by 57% year-over-year. Meanwhile, its net income was $879.1 million compared with $36 million for the prior year’s quarter. Well, Shopify does seem to be firing on all cylinders for its second quarter. Merchants on its platform are well equipped to seize the opportunities presented in a post-pandemic retail era as consumer spending remains strong. With all these in mind, would SHOP stock be a top e-commerce stock to watch in the stock market now?

[Read more] Top Stocks To Buy Now? 5 Dividend Stocks To Watch

Walmart Inc

Following that, we have the multinational retail corporation, Walmart. Essentially, the company operates a chain of hypermarkets, department stores, and grocery stores. Walmart claims that each week, approximately 220 million customers visit its approximately 10,500 stores and clubs under 48 banners across 24 countries and its e-commerce websites.

On Tuesday, the company reported its second-quarter earnings that exceeded Wall Street expectations. Walmart gained ground in groceries and had a strong start to the back-to-school season. The company reported revenue of $141.0 billion, up by 2.4% year-over-year. Meanwhile, its operating income was $7.4 billion, representing an increase of 21.4%. The company now anticipates that its earnings per share will range from $6.20 to $6.35.

It is also noteworthy that Walmart has selected Publicis Groupe to lead media planning and buying for Walmart U.S. Despite already being one of America’s largest advertisers, it continues to strive to be a best-in-class marketing organization. So, Publicis Groupe will play a significant role in connecting customers with the brand through its omnichannel media solutions. All things considered, would WMT stock be a top buy today?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Etsy Inc

To top off the list, we will be looking at Etsy. Put simply, the e-commerce company primarily focuses on marketing handmade or vintage items as well as craft supplies. Additionally, Etsy’s digital shopping platform also offers a wide array of items spanning numerous categories. These include but are not limited to jewelry, apparel, home decorations, and furniture. ETSY stock has risen by over 45% over the past year.

Earlier this month, Etsy announced its second-quarter financial updates. Its consolidated gross merchandise sales (GMS) were $3.0 billion which represents an increase of 13.1% year-over-year. Meanwhile, its revenue was up by 23.4% to $528.9 million compared to the prior year’s quarter. Considering how dramatically the world has changed since the onset of the pandemic, the company’s financial performance has been quite impressive.

Furthermore, investors should also note that the company announced two strategic acquisitions back in July, namely Depop and Elo7. This allows Etsy to further extend its total available market opportunities in the resale market. In particular, Etsy is able to gain access to a large and growing apparel segment in Brazil’s e-commerce market via Elo7. So, given these exciting developments, would ETSY stock have a place in your portfolio?