Do You Have These Top Defensive Stocks On Your September 2021 Watchlist?

Defensive stocks seem to be hot in the stock market today. For the most part, I can understand why. Namely, investors are digesting the mixed bag of news on the U.S. job market this week. On one hand, private payroll figures underperformed in August, according to the ADP’s closely watched monthly report. In detail, the economy added 374,000 private payrolls versus estimates of 625,000. On the other hand, the weekly initial jobless claims metric came in at 340,000 versus estimates of 345,000. Overall, the labor market appears to still have a ways to go before making a full recovery.

Now, what does all this have to do with defensive stocks might you ask? Well, simply put, defensive stocks are, as the name suggests, for more defensive investment strategies. This is because this group of stocks is home to companies whose offerings are constantly in demand regardless of the current business cycle. For instance, we could look at consumer staples stocks like Burger King’s parent company Restaurants Brands International (NYSE: QSR). Earlier today, Burger King launched a new loyalty program in the U.S., offering customers a wide variety of rewards.

On top of that, some of the best dividend stocks are also part of this sector of the stock market now. Companies such as Bristol-Myers Squibb (NYSE: BMY) provide the general public with crucial pharmaceuticals across the globe. Whether you are looking to go the more conservative route or diversify your portfolio, defensive stocks could be a viable play now. On that note, here are four defensive names to watch in the market today.

Best Defensive Stocks To Watch Today

- Uber Technologies Inc. (NYSE: UBER)

- Five Below Inc. (NASDAQ: FIVE)

- Citigroup Inc. (NYSE: C)

- UnitedHealth Group Inc. (NYSE: UNH)

Uber Technologies Inc.

Uber is a tech company that has ride-hailing, package delivery, freight transportation, and food delivery services. The company has given over 25 billion trips and continues to build products that serve communities and has essentially changed how people, food, and things move through cities. It also boasts millions of active monthly users worldwide and has one of the largest market shares for ride-sharing in the U.S. UBER stock currently trades at $41.43 apiece as of 2:08 p.m. ET. KeyBanc recently reiterated it as overweight, saying that the company still has a big opportunity to gain market share in the grocery delivery space.

On August 4, 2021, the company announced that its Gross Bookings have reached an all-time high of $21.9 billion, up by 114% year-over-year. Impressively, the company also posted a net income of $1.1 billion. Also, its revenue grew by 104% year-over-year and 35% quarter-over-quarter. This is evident as the company says that its drivers and couriers alone in the U.S. increased by nearly 420,000 from February to July. It also ended the quarter with $5 billion in cash and cash equivalents. Given the impressive financials, will you consider adding UBER stock to your portfolio?

Read More

Five Below Inc.

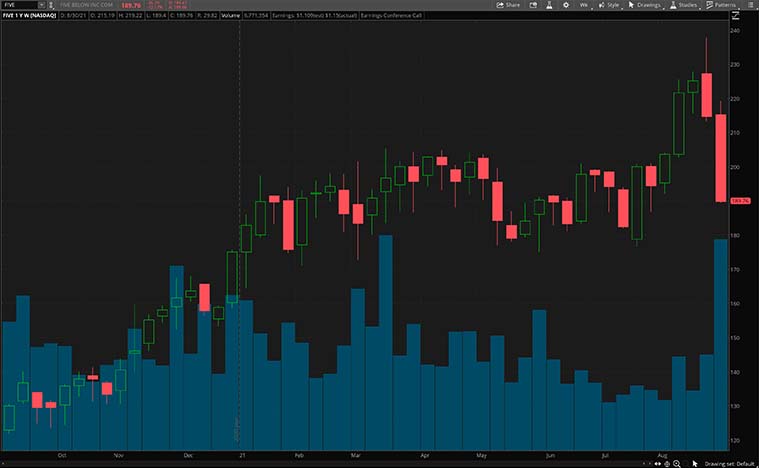

Five Below is a leading high-growth value retailer that offers high-quality and trend-right products. It has a long runway for unit growth and offers a compelling new store model that has long-term potential. The company’s business model benefits from scale and has consistently posted positive comparable sales in the past decade. FIVE stock currently trades at $189.46 as of 2:09 p.m. ET and is up by over 60% in the past year alone. On Wednesday, the company reported its second-quarter financials.

Firstly, the company posted net sales of $646.6 million, increasing by a commendable 51.7% year-over-year. Comparable sales increased by 39.2% compared to a year earlier as well. In terms of expansion, the company opened 34 new stores and ended the quarter with 1,121 stores in 39 states. This in turn represents a 14.2% increase in stores year-over-year. Secondly, net income for the quarter was $64.8 million compared to $29.6 million in the second quarter of 2020.

CEO Joel Anderson continued, “The third quarter is off to a strong start from a sales perspective. We are innovating across our three key strategic priorities: product, experience and supply chain, where the teams are working diligently to mitigate the impact of global disruptions.” For these reasons, will you consider FIVE stock as a top defensive stock to watch right now?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Citigroup Inc.

Citi is a multinational investment bank and financial services corporation with headquarters in New York City. In fact, it is one of the largest banking institutions in the U.S. and is one of the Big Four banking institutions of the U.S. It boasts over 200 million customer accounts and does business in more than 160 countries. C stock currently trades at $71.46 as of 2:09 p.m. ET and has enjoyed gains of over 35% in the past year.

On July 14, 2021, the company reported its second-quarter financials. Net income for the quarter was a whopping $6.2 billion compared to $1.1 billion a year earlier. This was driven by the lower cost of credit. Revenues for the quarter were $17.5 billion and the company had also returned $4.1 billion of capital to shareholders. The company saw growth across its businesses, most notably in its Investment Banking and Equities segments. All things considered, will you add C stock to your watchlist of defensive stocks today?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

UnitedHealth Group Inc.

Following that, we will be taking a look at UnitedHealth Group (UNH). In brief, the Minnesota-based company is a major player in the managed health care and insurance industry today. Given the company’s wide massive portfolio of health care products and insurance services, UNH stock could be a go-to now. As it stands, the company’s shares are trading at $423.28 as of 2:09 p.m. ET. This would be after gaining by over 20% year-to-date. Part of these gains would be thanks to the company’s latest operational update earlier today.

In an interview with Forbes, UNH revealed plans to grow its U.S. coverage in 2022. In short, UNH’s health insurance division is expanding into seven new U.S. states to sell coverage. According to UNH chief growth and experience officer Krista Nelson, UNH is eager to “serve more people with affordable coverage options and consumer-centric benefits”. All in all, as the company continues to bolster its U.S. operations, will you be keeping an eye on UNH stock?