3 Top Tech Stocks To Watch Before October 2021

After a volatile week of trading, the stock market appears to be under pressure going into a new week. Even so, investors could be taking a look at the top tech stocks around nevertheless. After all, some would argue that the broader tech industry has more room to run. Accordingly, this would be thanks to two key factors. Firstly, the increasingly important role of tech in our world today could provide more long-term growth opportunities in the industry. Secondly, tech companies are continuously improving their offerings.

For instance, we could take a look at the fintech industry. As the name suggests, it is the integration of financial services and tech. Today, fintech giants such as PayPal (NASDAQ: PYPL) continue to make massive plays to serve consumers more efficiently. Just last week, the company unveiled its revamped PayPal ‘super app’. In short, the app now offers users a vast array of financial tools and services. This ranges from bill paying and digital transfers to crypto and e-commerce related solutions. Additionally, PayPal is now working with Synchrony Bank. Through this partnership, the bank is powering PayPal’s new high-yield savings services, PayPal Savings.

Elsewhere, tech firms are also hard at work building their digital entertainment offerings. Namely, Nvidia (NASDAQ: NVDA) recently released new display software updates for its industry-leading graphic processing units (GPU). According to Nvidia, the newest update adds Deep Learning Super Sampling (DLSS) support to 28 of the latest games in the market. This alongside Windows 11-related integrations would further solidify the company’s position in the growing gaming industry today. Aside from these two examples, there are numerous top tech stocks for investors to watch in the stock market today. Here are three making moves now.

Top Tech Stocks To Buy [Or Sell] Today

- Zoom Video Communications Inc. (NASDAQ: ZM)

- Shopify Inc. (NYSE: SHOP)

- Alphabet Inc. (NASDAQ: GOOGL)

Zoom Video Communications

To begin with, we will be taking a look at Zoom. Like it or not, Zoom is the poster child for pandemic-related tech. Through its industry-leading communication Software-as-a-Service (SaaS) offerings, people and organizations across the globe can always stay connected. Sure, with the overall rollout of vaccines and talks of reopening, some would consider Zoom less relevant. However, the company remains hard at work bolstering and expanding its offerings regardless.

This is evident given the latest update on Zoom’s flagship application of the same name. In essence, users can now block off the video feed from other participants in a Zoom call. This would help with cases where users are operating with limited bandwidth and provide an overall improvement in experience. Additionally, Zoom is also introducing support for Rich Text Formatting (RTF) and more flexible billing options for its Pro subscription. On one hand, RTF allows the copying of different text formats between a wide variety of programs. On the other hand, paid subscribers can now make their payments via the Google Play store as well.

Not to mention, Zoom is also building the addressable market for its Zoom Phone full-featured cloud phone system service. Zoom is now offering Bring Your Own Carrier (BYOC) licenses to its reseller partners. By doing so, Zoom allows its Zoom Phone clients to retain their current carriers. According to Zoom Head of Global Business Development Laura Padilla, this allows consumers to retain their current carriers to “best meet their geographic reach and service needs”. Given all of this, is ZM stock worth adding to your portfolio now?

Read More

Shopify

Another name to consider in the tech world today would be Shopify. If anything, Shopify is one of the biggest players in the e-commerce market today. For the uninitiated, the company primarily operates as an e-commerce platform. Through its platform, Shopify facilitates over 1.7 million merchants from across the world on its website. Given the growing relevance and exposure around digital shopping over the past year, SHOP stock could be worth watching.

For one thing, the company’s shares are currently up by over 30% year-to-date. Despite its current momentum, Shopify does not seem to be slowing down anytime soon. This would be the case given the company’s recent entry into the hot NFT market and various partnerships with tech giants across the board. Speaking of the latter, Shopify is now working together with video streaming tech firm Roku (NASDAQ: ROKU).

Aside from being the first streaming app available in the Shopify App Store, Roku expands Shopify’s current offerings significantly. Through this integration, the duo is looking to provide small and medium businesses more precise ad analytics throughout the marketing process. Simply put, Shopify users can now launch digital ad campaigns more effectively thanks to Roku. With the rising popularity of Roku’s offerings, the current move makes sense. Could this make SHOP stock a top pick in the stock market now?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Alphabet

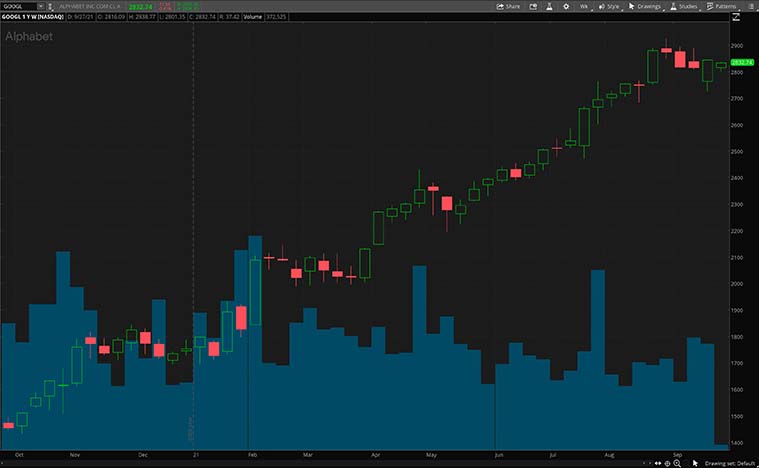

Last but not least, we have Alphabet, more precisely, we will be looking at its subsidiary Google. When it comes to the tech industry today, few can boast an ad business as impressive as Google’s. Moreover, the company also holds a major presence in the cloud computing, entertainment, and consumer tech industries across the board. More importantly, GOOGL stock continues to lead among its FAANG stock peers with year-to-date gains of over 60%. The real question now is whether or not it would be a wise time to jump on at this point.

Notably, Google appears keen on further optimizing its operations in light of the rising competition in the industry. Over the weekend, news broke of the tech giant’s latest plans regarding its cloud computing arm. For the most part, Google is planning to reduce the revenue cut it receives from its cloud marketplace. This would see Google reduce its percentage revenue share from 20% to 3%. Sure, at face value, some may consider the move a less than ideal one, given the huge cut in earnings. However, investors may want to consider the deeper, long-term plans Google has by doing so.

According to a Google spokesperson corresponding with CNBC, the company is looking to keep up with its peers. They said, “Our goal is to provide partners with the best platform and most competitive incentives in the industry.” Overall, Google seems to be aggressively intent on growing its other divisions. While time will tell if this pays off to Google’s benefit in the long run. For now, would GOOGL stock be a buy for you?