4 Top Retail Stocks To Watch Ahead Of October 2021

As we head into the final trading day of September, retail stocks appear to be kicking into high gear. Because of this, retail stocks could be among the most active stocks in the stock market today. Despite concerns over global supply chain woes, retailers are hard at work expanding and refining their offerings. After all, the holiday season is fast approaching and supplies, as mentioned earlier, are on the low end now. The question now is whether or not this tailwind would be enough to get investors’ attention.

Regardless, there is no shortage of action in the retail space now. Just yesterday, retail giant Target (NYSE: TGT) announced its latest offering for this year-end. Namely, customers who make purchases between October 10 and December 24 are eligible for price adjustments. In essence, Target will match its prices to its competitors within two weeks of a particular purchase. Safe to say, this would make for an enticing offer to consumers looking to get their holiday shopping done now.

At the same time, new players continue to emerge in the industry as well. As of yesterday, online eyewear retailer Warby Parker (NYSE: WRBY) is now trading on the New York Stock Exchange. The company’s shares soared by over 30% on its public debut. Given all the focus on retail stocks, here are four to know in the stock market now.

Top Retail Stocks To Buy [Or Sell] Today

- Amazon.com Inc. (NASDAQ: AMZN)

- Dollar Tree Inc. (NASDAQ: DLTR)

- AutoNation Inc. (NYSE: AN)

- Conagra Brands Inc. (NYSE: CAG)

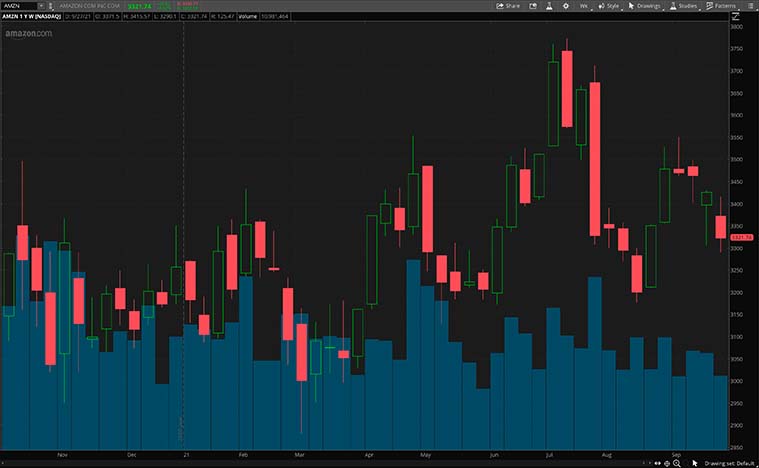

Amazon.com Inc.

Amazon is a multinational tech company that focuses on its e-commerce platform and also its cloud computing service. Its e-commerce store is one of the largest online marketplaces in the world. It is also a leading AI assistant provider and boasts a comprehensive live-streaming platform. On September 28, 2021, Microsoft (NASDAQ: MSFT) announced that it will be bringing Amazon’s storefront apps to its Microsoft Store over the next few months. AMZN stock currently trades at $3,322.44 as of 9:35 a.m. ET.

Furthermore, Amazon has also announced the launching of Astro, its AI-powered home robot. Astro will be able to sync up with Alexa and the robot can also be remote-controlled to check on pets, people, or for general home security. This would be part of Amazon’s strategy to become more integrated with its consumers’ daily lives. The company has been eyeing for a slice of the robotics market after all, boldly stating that it believes all homes will have one in five to ten years. Given this exciting piece of news, is AMZN stock worth investing in right now?

[Read More] 4 Semiconductor Stocks To Watch Right Now

Dollar Tree Inc.

Dollar Tree is a leading operator of discount variety stores that has served North America for more than 30 years. The company has headquarters in Virginia and operates 15,000 stores across 48 states and five Canadian provinces. The stores operate under the company’s Dollar Tree, Family Dollar, and Dollar Tree Canada brands. DLTR stock has surged by over 14% since Wednesday and currently trades at $99.04 as of 9:35 a.m. ET.

This latest rally seems to come after the retailer announced plans to add price points above $1 across all its Dollar Tree Plus stores and will begin testing price points above $1 in some legacy Dollar Tree stores. Michael Witynski, President and Chief Executive Officer, stated, “For decades, our customers have enjoyed the ‘thrill-of-the-hunt’ for value at one dollar – and we remain committed to that core proposition – but many are telling us that they also want a broader product assortment when they come to shop. We believe testing additional price points above $1 for Dollar Tree products will enable us over time to expand our assortments, introduce new products and meet more of our customers’ everyday needs.” With that being said, will you add DLTR stock to your portfolio?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

AutoNation Inc.

Following that, we have AutoNation, the largest and most recognized automotive retailer in the U.S. It has over 300 locations from coast to coast and has sold over 13 million vehicles. Its success is driven by a commitment to delivering a peerless experience through its customer-focused sales and service processes. AN stock currently trades at $127.14 as of 9:36 a.m. ET and has enjoyed gains of over 130% in the past year alone.

Analysts at Morgan Stanley (NYSE: MS) upgraded their rating on AN stock to the equivalent of buy and upped their price target on the stock to $116 from $70. The firm says that it is bullish on the auto retailer’s management changes. Notably, AutoNation named Mike Manley, a former Fiat Chrysler chief executive as its CEO, replacing Mike Jackson who is retiring after more than 20 years with the company. The appointment has been dubbed as a significant narrative change and Morgan Stanley’s new target reflects the potential for AutoNation to be a stronger player in the new mobility ecosystem. For these reasons, should investors consider adding AN stock to their watchlist right now?

[Read More] 3 Top Pot Stocks To Watch After The SAFE Banking Act Update

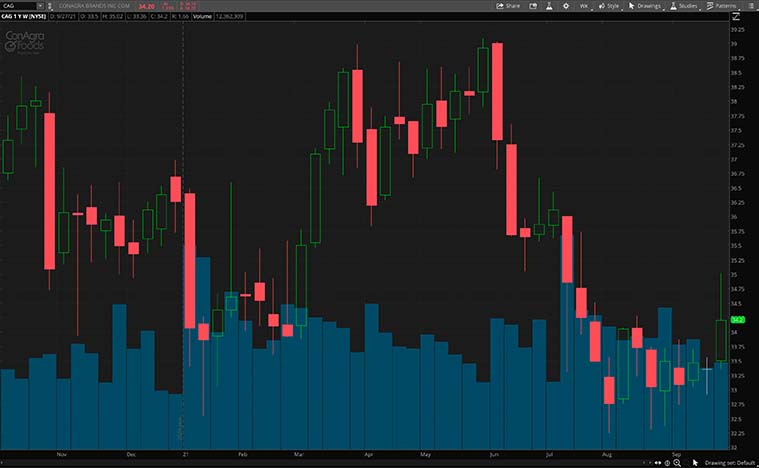

Conagra Brands Inc.

Last but not least is Conagra Brands. In brief, the Illinois-based company primarily markets edible consumer packaged goods. For the most part, it makes and sells products under a wide variety of brands. The likes of which are mostly marketed towards supermarkets and restaurants among other food service establishments. Furthermore, given its role as a consumer discretionary, the company could be a go-to for investors looking for more defensive stocks in the market now. This would be where CAG stock comes into play.

As it stands, the company’s shares currently trade at $34.51 as of 9:36 a.m. Despite all of this, Conagra continues to gain momentum. Yesterday, the company announced a quarterly dividend of $0.3125 per share. As with most players in the industry, Conagra’s dividend payout could continue to incentivize investors in the current market. All in all, would you consider CAG stock a buy now?