4 Consumer Stocks For Your November 2021 Watchlist

While the stock market today continues to gain, consumer stocks remain a hot topic amongst investors. After all, we are entering a crucial time of the year for the industry now. This would be the case as the year-end holiday season is fast approaching while supply chain woes among other things persist. Not to mention, there is also the current momentum in consumer stocks thanks to a strong earnings season for the sector. After considering all of these factors, I could understand if investors are watching consumer stocks closely now.

At the same time, some of the biggest names serving consumer markets now continue to up their game as well. This is evident given Coca-Cola’s (NYSE: KO) and Walmart’s (NYSE: WMT) latest moves. On one hand, Coca-Cola is acquiring sports drink retailer Bodyarmor for a whopping $5.6 billion. This would mark the company’s largest-ever brand acquisition. The likes of which will ideally bolster Coca-Cola’s standing in the increasingly popular sports drink industry.

On the other hand, Walmart seems to be taking the ongoing labor shortage and supply chain weaknesses head-on. Namely, the retail juggernaut is holding a national supply-chain hiring event this week. According to Walmart, supply chain associates will be receiving a $20.37 per hour wage on average. By and large, we could be looking at exciting times ahead for consumer-focused industries. On that note, here are four top consumer stocks to know in the stock market now.

Best Consumer Stocks To Watch This Week

- Under Armour Inc. (NYSE: UAA)

- GameStop Corporation (NYSE:GME)

- Avis Budget Group (NASDAQ:CAR)

- Clorox Company (NYSE:CLX)

Under Armour Inc.

Diving in, we have Under Armour, a consumer company that manufactures footwear, sports, and casual apparel. In fact, the company is a leading inventor and distributor of branded athletic apparel and equipment. Its products are made from the finest engineering and also use game-changing materials. For instance, its thread texturing techniques and polymer development allow for products that perform better and are generally more durable. UAA stock currently trades at $25.90 as of 10:46 a.m. ET and is up by over 10% on today’s opening bell.

Investors are likely responding to the company’s third-quarter financials. In brief, the company’s shares soared after its earnings and sales topped analysts’ estimates. Revenue for the quarter was $1.5 billion, up by 8% compared to a year earlier. This was driven by strong demand for the Under Armour brand and its ability to quickly meet the needs of its consumers and customers. Net income for the quarter was $113 million, up 191% year-over-year. Furthermore, the company says that it is on track to deliver record revenue and earnings results in 2021. With that being said, should investors consider adding UAA stock to their portfolios?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

GameStop Corporation

Following that, we have GameStop Corporation, a retailer of consumer electronics and video games. The company is one of the largest game retailers in the world. It has over 4,000 stores worldwide and an impressive e-commerce platform to boast. GameStop has been the target of retail traders that have caused the company’s stock price to skyrocket, increasing by over 900% year-to-date. GME stock is up by over 9% in the past 5 trading sessions alone and currently trades at $202.19 a piece as of 10:46 a.m. ET.

This could be due to meme momentum and also the Loopring NFT speculation. There have been reports of the company working on confidential NFT projects. The company has also been hiring software engineers to work on both NFT platforms and blockchain gaming as well as in the Web3 space. Some suggest that GameStop’s NFT marketplace will allow for the resale of digital assets, including the ability to pay royalties to the original creator on future transactions. This would be big news for the company as it could be the latest to enter the NFT market. All things considered, is GME stock worth buying right now?

[Read More] Top Reddit Stocks To Buy Right Now? 5 For Your Late 2021 Watchlist

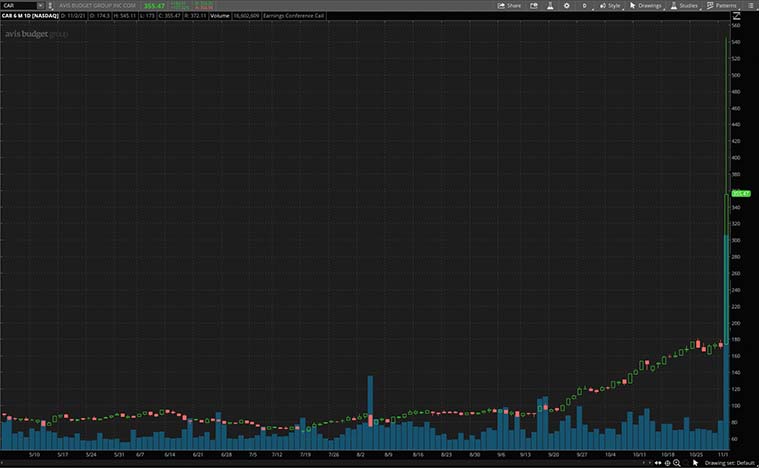

Avis Budget Group

Avis Budget Group is a consumer company that focuses on car rental services. It is a global leader in providing mobility solutions, both through its Avis and Budget brands. Impressively, it has more than 10,000 rental locations worldwide. Its Zipcar brand, which is the world’s leading car-sharing network, boasts more than one million members. CAR stock is up by over 130% on today’s opening bell and currently trades at $408.83 a piece as of 10:46 a.m. ET. This comes after the company reported its third-quarter financials on Monday.

Revenue for the quarter nearly doubled from a year earlier to $3 billion. The company says that this was driven by increased revenue per day and rental days as demand continued from the previous quarter. Also, net income was $674 million and its adjusted EBITDA was $1.05 billion, its best quarterly adjusted EBITDA in its history. Ultimately, the company says that it is seeing the benefits of its initiatives that began during the early days of the pandemic and will continue to build upon this positive momentum as the travel environment continues to normalize. For these reasons, will you consider CAR stock a buy?

Clorox Company

Last but not least we have consumer staples firm Clorox. For the uninitiated, it is a global manufacturer and marketer of consumer and professional products. Among the company’s flagship offerings are its bleach and cleaning products. Additionally, Clorox also offers home care products, pet necessities, and water-filtration products among other consumer wares. For a sense of scale, the company raked in a total revenue of $7.3 billion last year. Now, CLX stock currently trades at $166.85 a share as of 10:46 a.m. ET.

Even so, Clorox continues to turn heads in the stock market now. Notably, the company reported solid figures in its latest quarterly earnings. Clorox posted an earnings per share of $1.21, beating consensus estimates of $1.03 by a landslide. Moreover, the company also saw a total revenue of $1.81 billion for the quarter, above projections of $1.7 billion. All in all, Clorox cites stronger-than-anticipated demand across its portfolio as a strong growth driver for the quarter. Safe to say, consumers have and continue to turn to Clorox amidst the current pandemic. Should investors be doing the same with CLX stock?