Stock Market Today Mid-Morning Updates

On Monday, the Dow Jones Industrial Average rose 200 points on the first trading session of the year. It follows a strong 2021 for all of the major indices. This is despite fears of inflation, business disruption, tighter monetary policy, and new coronavirus variants. On the bright side, investors are focusing on increased consumer spending, hiring ramp-ups, and solid corporate earnings growth.

This is unsurprising as U.S. equities posted another year of solid gains in 2021, rising by 27% and delivering a rare third consecutive double-digit annual percentage increase. Goldman Sachs analyst David Kostin says that the five largest components of the S&P 500 returned 37% last year and now constitute about 23% of the entire index.

Among the Dow Jones leaders, shares of Apple (NASDAQ: AAPL) are up by 1.48% on Monday while Microsoft (NASDAQ: MSFT) is also up by 0.29%. Home Depot (NYSE: HD) is trading on the upswing at 0.11% while Nike (NYSE: NKE) is down 0.14%.

EV Stocks: Nio, XPeng, Li Auto Report Strong Deliveries

Shares of Electric vehicle (EV) leader Tesla (NASDAQ: TSLA) are up by 9.47% on Monday. Rival EV companies like Rivian (NASDAQ: RIVN) are up as well. Lucid Group (NASDAQ: LCID) is also up 2.84%% today. Also, Chinese EV leaders like Li Auto (NASDAQ: LI) and Xpeng Motors (NYSE: XPEV) are up after releasing their delivery reports over the weekend. Could the positive deliveries be good news for the EV industry as a whole?

Nio (NYSE: NIO) for instance, delivered over 10,000 vehicles in December, up by nearly 50% year-over-year. Cumulative deliveries of Nio’s ES8, ES6, and EC6 as of December 31, 2021, reached 167,070 EVs. Nio is currently up 2.05% on today’s opening bell. XPeng exceeded estimates by delivering 16,000 vehicles last month, increasing by a whopping 181% from a year earlier. Last but not least, Li Auto also delivered an impressive month, with 14,087 EVs delivered in December. This is a gain of 130% year-over-year.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Dow Jones Today: Are Investors Braving Through Fears Of New Variants?

Following the stock market opening on Monday, the S&P 500, Dow, and Nasdaq are all trading higher at 0.51%, 0.40%, and 0.59% respectively. Among exchange-traded funds, the Nasdaq 100 tracker Invesco QQQ Trust (NASDAQ: QQQ) ticked upwards at 0.42% Monday, while the SPDR S&P 500 ETF (NYSEARCA: SPY) rose 0.25%.

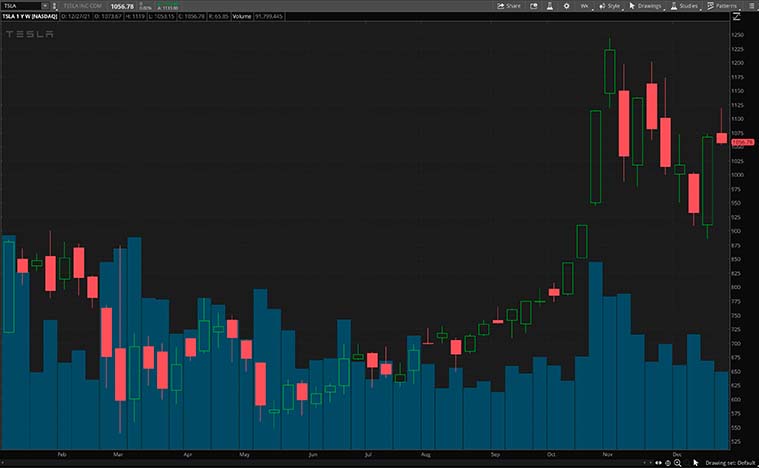

Tesla Shares Soar On Record Quarterly Delivery Figures

Tesla continues to turn heads in the stock market now. This is evident as TSLA stock continues to shake off its losses from CEO Elon Musk’s recent share sales. Namely, the main reason for the current momentum in the company’s shares would be its latest quarterly vehicle delivery report. In detail, Tesla’s monthly deliveries for Q4 2021 are now at 308,600 vehicles, a record high. Safe to say, this figure smashed consensus estimates of 263,026; suggesting that Tesla is not sitting idly by going into the new year.

As a result of all this, TSLA stock is currently up by over 9% as of today’s opening bell. To put things into perspective, the company’s latest December sales figures mark a massive 70% year-over-year increase. Given the current industry-leading scale of Tesla’s operations, this is, arguably, some impressive growth. So much so that Deutsche Bank (NYSE: DB) analysts raised their price target on TSLA stock to $1,200. Additionally, the investment banking firm also reiterated its Buy rating on the company’s shares.

Not to mention, the analysts also cite the company’s leading position in the battery segment of the industry as a growth driver as well. They said, “Tesla’s trajectory for its battery technology, capacity and especially cost could help accelerate the world’s shift to electric vehicles and extend Tesla’s EV lead considerably.” Whether or not TSLA stock can continue to ride the company’s current hot streak remains to be seen.

[Read More] Best Stocks To Invest In 2022? 4 Tech Stocks For Your Watchlist

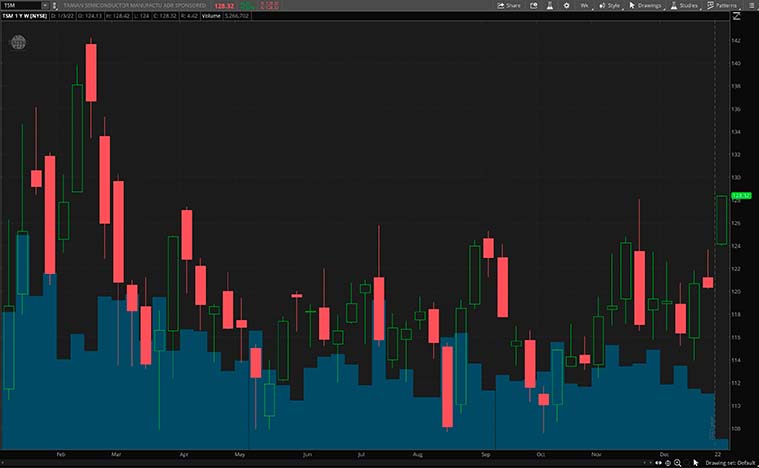

TSMC Alongside Semiconductor Chipmakers Soar On Positive 2022 Outlook For Industry And Analyst Updates

At the same time, things appear to be heating up in the world of semiconductors now. For the most part, this section of the stock market today appears to be in focus across the board. To begin with, analysts over at Goldman Sachs (NYSE: GS) revealed their “top picks” for the industry earlier today. Notably, they are Advanced Micro Devices (NASDAQ: AMD), Marvell Technology (NASDAQ: MRVL), and Micron Technology (NASDAQ: MU). All of which are currently holding on to gains of 1.92%, 0.85%, and 0.81% as of today’s opening bell.

Moreover, even the likes of Taiwan Semiconductor Manufacturing (NYSE: TSM) seem to be gaining alongside its peers. As it stands, TSM stock is holding on to solid gains of 4.22% since today’s opening bell. While not having any notable news to report today, the company is the largest semiconductor manufacturer in the world now. If anything, a report from French trade credit insurer Euler Hermes could be providing a boost for the industry now. In it, the firm notes that chip sales could increase by 9% this year, crossing the $600 billion mark.

According to the firm, there are likely three main factors driving this growth now. These are strong demand in consumer markets, rising chip prices amidst supply constraints, and higher-quality offerings. When you pair all this with the ongoing pandemic driving sales of home-use electronics, this is understandable. All in all, some would argue that semiconductor stocks could have more room to run this year.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!