Stock Market Futures Dip Following Disappointing Job Market Data

U.S stock futures are trading downwards this morning after another day of losses. In general, this is likely due to ongoing pressure from the pandemic and inflation weighing in on the economy and earnings. Take yesterday’s initial jobless claims data for example. Overall, initial filings for last week came in at a whopping 286,000, signaling the impacts of the winter Omicron surge on employment. For reference, this would be above projections of 225,000 and is the highest since October 2021.

Commenting on the current situation in stocks is Jeffrey Kleintop, chief global investment strategist at Charles Schwab. “I think there is a rotation going on towards those areas of the market that have been neglected for a long time — not just months, but years. Areas like financials and energy. Even healthcare, which is an area that had done a bit better during the pandemic, but isn’t seeing any kind of multiples like it did in the past.” He adds, “I think those areas of the market have more durability here as we look at an environment where earnings growth is slowing so valuations matter more.”

Furthermore, investors have no shortage of stock market news to go through today as well. As of 7:34 a.m. ET, the Dow futures are dropping by 0.29%. Meanwhile, the S&P 500 and Nasdaq futures are trading lower by 0.55% and 0.90% respectively.

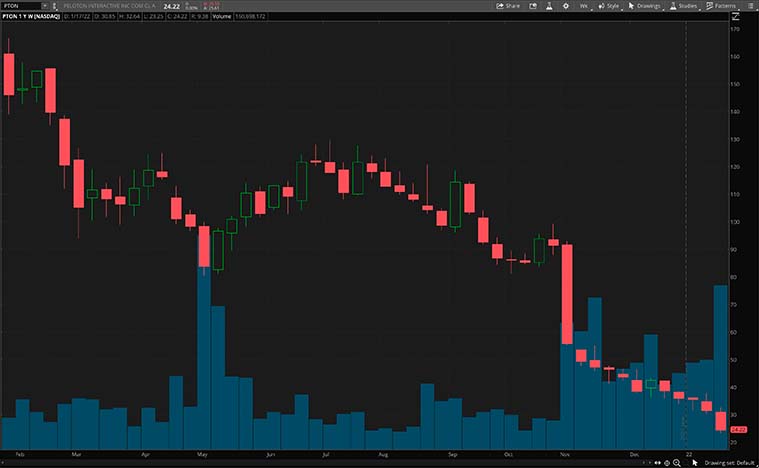

Peloton Jumps After Posting Preliminary Q2 Earnings Data

Despite growing concerns regarding the economic recovery in the U.S., investors appear to be watching Peloton Interactive (NASDAQ: PTON) closely. Namely, this is after Peloton released preliminary Q2 earnings figures yesterday evening. In essence, PTON stock is gaining by over 7% in pre-market trading today on its positive guidance for the quarter. According to the firm, it will likely see a total second-quarter revenue of $1.14 billion. This would be in line with its previous guidance range of $1.1 billion to $1.2 billion. Additionally, Peloton sees adjusted losses, before interest, taxes, depreciation, and amortization, being in the range of $270 million to $260 million. Impressively, this is a sizable improvement over its prior guidance for losses of $350 million to $325 million.

Weighing in on all this is Peloton CEO, John Foley. Foley notes, “As we discussed last quarter, we are taking significant corrective actions to improve our profitability outlook and optimize our costs across the company.” He also notes that this includes “gross margin improvements, moving to a more variable cost structure, and identifying reductions in our operating expenses.” With Peloton looking to streamline its operations now, investors could be eyeing PTON stock in the stock market today. If anything, the recent dips in the company’s shares following rumors of a production halt could present a buying opportunity for some.

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

Netflix Stock Dives As Subscriber Outlook Falls Short On Estimates

Elsewhere, content streaming giant Netflix (NASDAQ: NFLX) posted mixed results in its quarterly earnings call yesterday. For starters, the company posted an earnings per share of $1.33, crushing Wall Street’s estimates of $0.82. In terms of revenue, Netflix raked in a total of $7.71 billion, in line with forecasts. More importantly, the company saw its global paid net subscriber count grow by 8.28 million throughout the quarter. This would be above estimates of 8.19 million but down compared to the same quarter a year ago. As a result of the year-over-year decline in subscriber growth, investors appear to be trimming their position in the company.

Not to mention, Netflix is expecting to grow its subscriber base by 2.5 million in the current quarter. This would mark a notable decrease from forecasts of 6.93 million according to consensus estimates. Overall, the company notes that the main reason for the current slowdown in subscriber growth is increasing competition. After all, most of the biggest names in the entertainment space have and continue to bolster their streaming offerings. Acknowledging this, Netflix says, “While this added competition may be affecting our marginal growth some, we continue to grow in every country and region in which these new streaming alternatives have launched.” Nevertheless, I could see NFLX stock turning heads in the stock market now.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

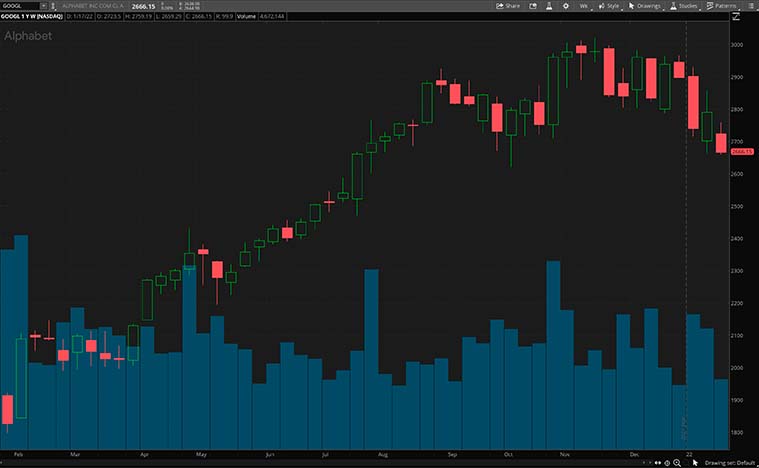

Google Reportedly Developing Augmented Reality Headset

In other news, Alphabet (NASDAQ: GOOGL) subsidiary Google is building an augmented reality (AR) headset. This news comes from The Verge, reporting information from people familiar with the project. According to the article, Google is actively working on an AR headset project that is internally codenamed, Project Iris. This would mirror a similar move among its peers towards metaverse-related tech. The report also notes that Google’s device will employ outward-facing cameras, layering computer graphics over a video feed of the real world. This will, ideally, make for more immersive, mixed reality experiences compared to traditional AR hardware on the market today.

As it stands, Google’s answer to the current metaverse hype could be out by 2024. This headset, similar to its latest Google Pixel smartphones, will depend on a custom Google processor. For one thing, this would not be new territory for the company. This is evident from its previous attempt at an AR headset back in 2012, the Google Glass. Now that such tech appears to be in demand, investors could be eager to see what Google can bring to the space. As such, GOOGL stock could be worth considering among metaverse stocks.

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Social Media Giants Meta And Twitter Making Advances In The NFT Space

Speaking of tech advancements, the likes of Meta Platforms (NASDAQ: FB) and Twitter (NYSE: TWTR) are looking towards blockchain tech. In particular, both firms appear to be keen on integrating new features relating to non-fungible tokens (NFTs) on their platforms. On one hand, we have Meta exploring ideas, allowing users to make, showcase, and sell NFTs on Facebook and Instagram. This is based on reports from The Financial Times. Should this be the case, it would mark a massive win for the NFT industry by providing significant mainstream exposure. Alongside this news also comes reports that Meta is considering launching a “marketplace for users to buy and sell NFTs.”

On the other hand, Twitter, as of yesterday, is launching an NFT verification tool on its core platform. The feature serves to verify if an account using an NFT as its profile picture actually owns said NFT or not. For now, only Twitter Blue subscribers on iOS can use this service. In practice, these users will have to connect their Twitter accounts to crypto wallets linked to their NFT holdings. After doing so, Twitter will display any verified NFT profile pictures as hexagons. Upon tapping on the pictures, users can see details about the art and ownership. All in all, we could be seeing the growing adoption of crypto trends across big tech firms. Whether or not this translates to wide-scale adoption by consumers remains to be seen.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!