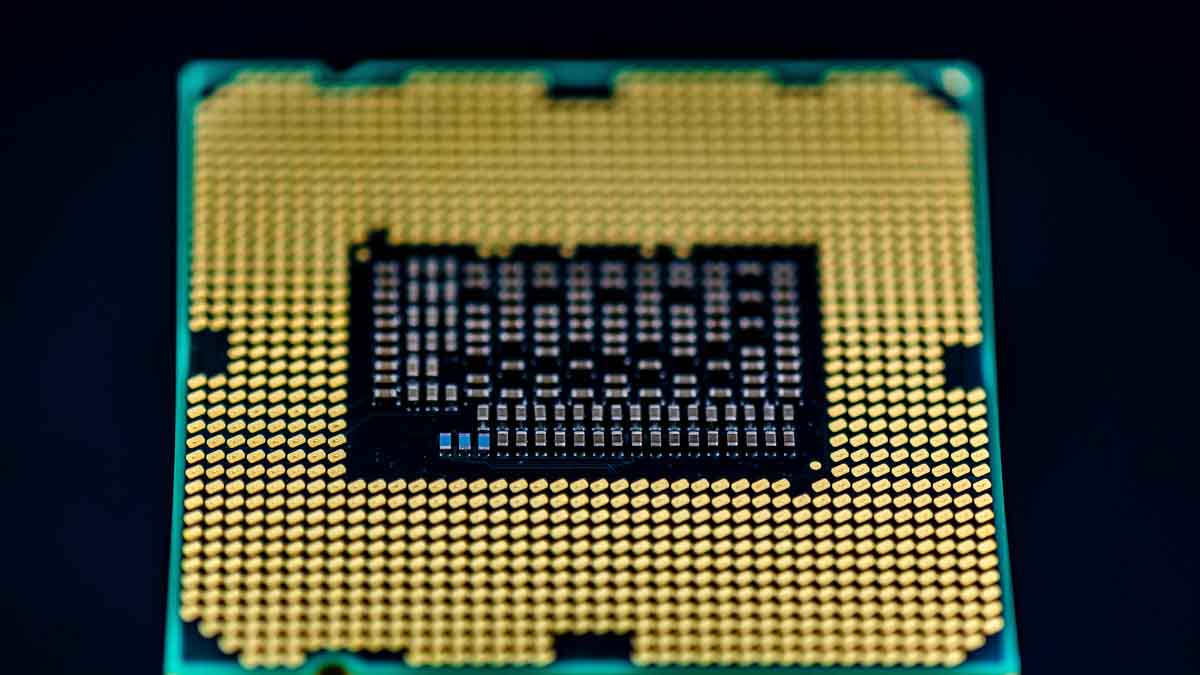

The semiconductor sector is a critical component of the global technology industry, as it is responsible for the design, manufacturing, and sale of the essential chips and integrated circuits that power electronic devices. Semiconductors are found in a wide array of products, ranging from smartphones and computers to vehicles and industrial equipment. The growing demand for advanced technology and the increasing complexity of electronic devices have driven substantial growth in the semiconductor industry, making it an attractive area for investment. However, the sector is also subject to significant cyclical fluctuations, supply chain disruptions, and competitive pressures, which can lead to volatility in semiconductor stocks.

Investing in semiconductor stocks provides exposure to the rapidly evolving technology market and its potential for growth. These stocks mainly comprise companies involved in the design and manufacturing of semiconductors, such as Intel (NASDAQ: INTC), NVIDIA (NASDAQ: NVDA), and Taiwan Semiconductor Manufacturing Company (NYSE: TSM).

When considering an investment in semiconductor stocks, investors should evaluate the financial health, technological capabilities, and growth prospects of individual companies. Factors such as market share, product pipeline, and manufacturing capacity can contribute to a company’s ability to navigate market fluctuations and maintain a competitive edge. Additionally, as the technology landscape evolves, semiconductor companies must adapt to shifting demand patterns, such as the transition towards 5G connectivity and increased adoption of artificial intelligence and machine learning. With that said, here are two semiconductor stocks to check out in the stock market in April 2023.

Semiconductor Stocks To Watch Now

- QUALCOMM Incorporated (NASDAQ: QCOM)

- Advanced Micro Devices Inc. (NASDAQ: AMD)

QUALCOMM (QCOM Stock)

First up, QUALCOMM Incorporated (QCOM) is a global leader in the development and commercialization of wireless communication technologies, providing essential components and solutions for mobile devices, networking equipment, and other consumer electronics, with a particular focus on 5G connectivity and innovation.

Last month, Qualcomm announced its most recent quarterly cash dividend. In fact, the company’s Board of Directors approved a 7% increase in Qualcomm’s quarterly cash dividend. Specifically, the dividend will jump from $0.75 to $0.80 per share on common stock. Moreover, the dividend is payable after March 23, 2023.

Since the start of 2023, shares of QCOM stock have increased by 15.53% year-to-date. While, during Monday’s afternoon trading session, QCOM stock is trading lower on the day by 2.95% at $123.82 a share.

[Read More] Best Dividend Stocks To Watch In 2023? 3 To Know

Advanced Micro Devices (AMD Stock)

Next, Advanced Micro Devices Inc. (AMD) is a multinational semiconductor company specializing in the design and production of high-performance computing, graphics, and visualization technologies, including processors, graphics cards, and related products, catering to a diverse range of markets such as gaming, data centers, and enterprise solutions.

At the end of January, Advanced Micro Devices reported a beat for its fourth quarter 2022 financial results. Diving in, the company posted Q4 2022 earnings of $0.69 per share, with revenue of $5.6 billion. This is versus consensus estimates that were earnings of $0.67 per share and revenue estimates of $5.5 billion. Meanwhile, the company also said it expects first-quarter 2023 revenue estimates in the range of $5.0 billion to $5.6 billion.

Year-to-date, shares of AMD stock have advanced by 48.44%so far. Meanwhile, during Monday afternoon’s trading session, AMD stock dropped by 3.06% on the day at $95.02 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!