Are These Top Tech Stocks On Your Watchlist For 2021?

Tech stocks have put on a stellar performance in the stock market this year. As we come to an end in 2020, investors have come to embrace these tech stocks. The reason is simply that these top tech stocks have brought very high returns this year. Many of the winners in the industry benefited from the coronavirus pandemic. As businesses fortified and shifted to the digital space, many companies that could facilitate this shift have seen their share value spike. Take Amazon (AMZN Stock Report) and Zoom (ZM Stock Report) for instance, as they have both reported one of their best quarters in history.

The question is, can you still find great deals on some of the best tech stocks as we are less than 2 weeks into the new year? Is it too late for investors to jump onto the tech stock wagon? Even in a post-pandemic world, tech stocks will no doubt thrive. If anything, this pandemic has accelerated our dependence on tech companies and their offerings. This could be the driving force that keeps the momentum for top tech stocks to further flourish in 2021.

I mean, even the Nasdaq Composite, which is a predominantly tech-heavy index, has been up by over 80% since March. With all things considered, should investors be looking into expanding their tech portfolios? Here is a list of top tech stocks to watch in the stock market today.

Read More

- Looking For Pick-And-Shovel Plays On The EV Boom? 3 Stocks To Consider

- Could These Be The Top Software Stocks To Watch This Week? 2 Up By 100%+ Since March

Best Tech Stocks To Buy [Or Sell] Now: Marvell Technology Group

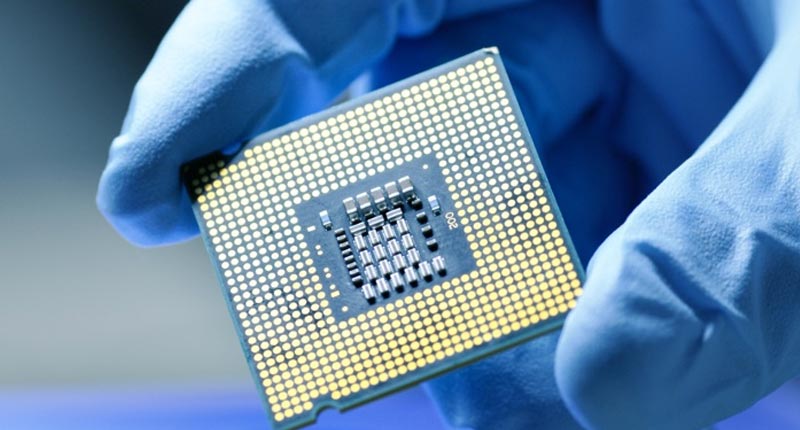

Marvell (MRVL Stock Report) is a tech company that is based in California. The company has more than 6,000 employees employed. It also boasts over 10,000 patents worldwide. The company provides semiconductor solutions to meet customers’ current needs and future ambitions. Its core business segments include a carrier, automotive, data center & cloud, and enterprise. The company’s shares are up by over 150% since the March lows.

In the company’s latest quarter posted earlier this month, Marvell reports an impressive revenue of $750 million. One of the drivers for this increase is Marvell’s networking business, which grew by 35% year-over. Also, the company noted strong growth in its 5G and Cloud products. It also posted a gross margin of 50.8% for this quarter and has $832 million in cash and short-term investments. In the company’s financial outlook for its next quarter, Marvell expects a revenue of $785 million.

The company also expects its business areas to improve in the months to come. This is driven by the deployment of 5G wireless networks into more markets. For instance, Marvell says that 5G deployments in China have increased demand for its application-specific integrated circuits. The company also currently ships its 5G processors to the likes of Samsung and Nokia. To top things off, Marvell was added to the NASDAQ-100 Index yesterday. This is further recognition of the company’s strength and future growth opportunities. With such exciting developments to come for the company, will you have MRVL stock on your watchlist?

Best Tech Stocks To Buy [Or Sell] Now: MicroVision Inc.

MicroVision (MVIS Stock Report) develops laser scanning technology for projection, 3D sensing, and image capture. The company is an innovator in ultra-miniature sensing and projection display technology. Through MicroVision’s patented PicoP scanning technology, it provides enhanced image quality from an engine that is the fraction of a business card. The company’s shares are up by over 200% in the last month alone. The company’s share also popped by over 18% as of 10:46 a.m. ET. This latest rally seems to be coming from a widely held belief that the company will make a deal with Apple (AAPL Stock Report).

With Apple moving forward with its self-driving car technology, the tech titan has made it clear that they are looking for help. More specifically, Apple is looking for a partner that has strong Light Detection and Ranging (LiDAR) technology. MicroVision happens to have one of the best LiDAR systems available today. Last month, the company announced that it had made progress with its first-generation MEMS dynamic scanning long-range LiDAR (LRL) sensor module. MicroVision believes that this will facilitate its development objective of producing hardware for demonstration and benchmarking by April 2021.

How is the company doing financially? By looking at its third-quarter results announced in October, it does seem rather earnest. It posted a revenue of $600,000 for the third quarter and has $5 million in cash and cash equivalents. Company CEO, Sumit Sharma has this to say, “MicroVision is focused on pursuing a strategic transaction at the right value for our shareholders. Our focus is to drive to an agreement at a valuation that reflects the sustainable strategic advantage, we believe, our technology offers now and into the future.” With that in mind, will you have MVIS stock in your portfolio?

[Read More] Making A List Of The Best Streaming Stocks To Buy? 3 Names To Watch

Best Tech Stocks To Buy [Or Sell] Now: Elys Game Technology Corp

Elys (ELYS Stock Report) is one of the fastest-growing and technologically advanced sports betting and iGaming full-service platform providers. It focuses on driving results for casino and leisure gaming operators. The company’s share price is up by over 50% in the last 24 hours.

In the company’s third-quarter fiscal last month, Elys posted a revenue of $9.7 million, which is a revenue increase of 44%. This reflects the strong growth from its web-based gaming turnover of more than 150%. Elys also reports that it has surpassed its goal of reaching 100,000 online gaming accounts before the end of 2020. With that, the company says that it is very well positioned for strong organic growth heading into 2021. Furthermore, the company has built an efficient and fully integrated gaming company, combining both online and land-based retail channels to facilitate the masses.

Last month, the company also announced the appointment of Matteo Monteverdi as CEO, effective on January 1, 2021. Matteo has been leading world-class B2B and B2C teams and has spent the last decade of his career at the intersection of social gaming, i-gaming, and digital betting. He will also be providing strategic oversight and execution of the company’s global business unit operations. All things said, will this be enough for you to buy ELYS stock?