Looking To Add The Best Tech Stocks To Your January Watchlist? 3 Names To Know

Looking back at 2020, it is undeniable that tech stocks dominated the stock market. Even with the coronavirus pandemic halting the world, those in the tech industry pressed on with innovations galore. In fact, you could say that the pandemic accelerated the tech industry with all the problems that came with it. As a result, top tech stocks like Amazon (AMZN Stock Report) and AMD (AMD Stock Report) saw new all-time highs. Moving forward, investors likely have one burning question in mind. Can the tech industry do this again in 2021?

To answer that, we would have to consider how long it would take to vaccinate the world. You can’t deny that the top tech companies reaped the benefits with many stuck at home. Current projections of the complete distribution and inoculation of vaccines suggest that it could take months to vaccinate the entire U.S. population. In light of this, I could see the current tech tailwinds persisting for the better part of 2021. If that is the case, countless segments of tech could continue to grow. These include but are not limited to cloud computing, video streaming, and cybersecurity to name a few. If anything, this shows the resilience of the tech industry which can adapt to shifting demands.

New and old investors alike know this, and it would not surprise me if they are waiting for the next big tech news. For one thing, the term ‘tech’ encompasses a plethora of industries in the stock market. Because of this, even the most seasoned investors can find themselves lost amongst the sea of tech stocks. In some cases, discerning which stocks to watch can be a challenge. To remedy that, here is a list of the top tech stocks to watch this week.

Top Tech Stocks To Watch Right Now

- Taiwan Semiconductor Manufacturing Company (TSM Stock Report)

- Atomera Inc (ATOM Stock Report)

- Quantum Corp (QMCO Stock Report)

Read More

- FUBO Stock: Time To Buy Or Sell After Preliminary Revenue Tops Consensus?

- Looking For The Best Health Care Stocks To Buy Right Now? 3 Names To Know

Best Tech Stocks To Watch This Month #1: Taiwan Semiconductor Manufacturing Company

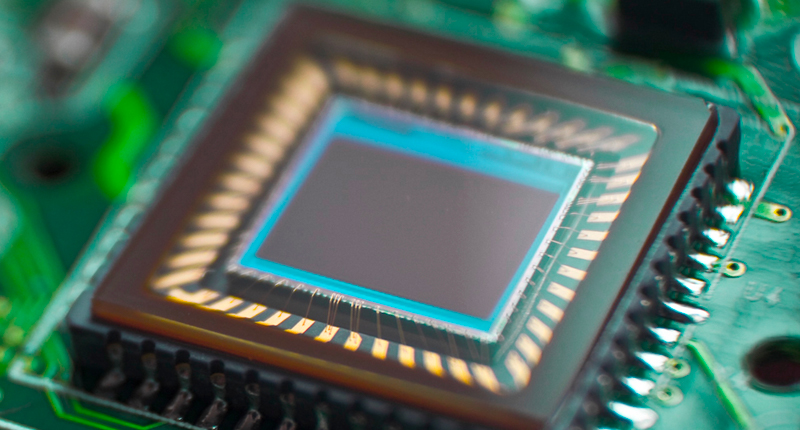

Right off the bat, we will be looking at Taiwan Semiconductor (NYSE: TSM). This semiconductor titan is among the most valuable companies in the sector. Veteran tech investors would be very familiar with the company. In fact, TSM stock has seen steady growth with gains of over 80% in the past six months. However, a recent announcement in Japan’s semiconductor industry yesterday could have given investors a reason to be excited.

To elaborate, the company will be building an advanced packaging facility in Tokyo. Taiwan Semiconductor’s latest move sent shockwaves throughout stocks involved in the same market. Crucially, this is because of the involvement of Japan’s Trade Ministry in the deal. A memorandum of understanding will be signed together with the formation of a 50-50 joint venture for the project. This is an excellent play by TSM as Japan is the world-leader in chip-making equipment and materials. The company will be playing a vital role in bolstering the country’s manufacturing capabilities in the field. This looks to be the beginning of a powerful alliance between TSM and the Japanese government.

In its recent quarter fiscal posted in October, TSM reportedly made $12.6 billion in total revenue which marked a respectable 21% year-over-year rise. Furthermore, it also saw a 33% rise in cash on hand in the same period. In other words, the company ended the quarter with over $21.5 billion to work with. With pockets this deep, I would have such towering aspirations as well. All things considered, will you be adding TSM stock to your 2021 watchlist?

[Read More] Top Renewable Energy Stocks To Watch In January? 1 Up 1000%+ In The Past Year

Best Tech Stocks To Watch This Month #2: Atomera Inc

Second, we have Atomera (NASDAQ: ATOM). In brief, Atomera focuses on deploying its proprietary technology into bolstering the growing semiconductor industry. The technology in question is Mears Silicon Technology (MST). Important to note, MST functions to increase performance and power efficiency in semiconductor transistors. Considering the enabling role Atomera’s technology serves, it is no wonder it has grown together with the semiconductor industry. We can see this reflected in ATOM stock which is up by over 550% in the past year. Additionally, the company’s shares skyrocketed by over 37% during yesterday’s trading session.

On January 5, news broke of Atomera entering a Joint Development Agreement (JDA) with a “leading semiconductor provider”. The JDA entails the integration of Atomera’s MST into the unnamed company’s silicon fabrication process. CEO Scott Bibaud said, “This agreement aligns well with our long-standing mission to collaborate with leaders in the industry to extend the life of existing manufacturing processes and accelerate the adoption of new technologies, through the development of our cutting-edge materials.” One thing to consider, JDAs are an agreement format generally suited towards larger customers. Accordingly, it seems to me that Atomera is gunning for customers with the means to showcase its work. In the long run, this could translate to deeper customer penetration, faster integration, and quicker adoption across product lines. To sum it up, this could be the beginning of interesting times for the company.

With such a well thought out play, I can understand the hype around ATOM stock. The company is backed by a client of the suggested magnitude does bolster its financial position as well. Should the company play its cards right, do you think ATOM stock has more room to grow in the long-term?

[Read More] Looking For Best Stocks To Buy For 2021? 3 Names To Watch

Best Tech Stocks To Watch This Month #3: Quantum Corp

Last but not least, Quantum (NASDAQ: QMCO) specializes in services related to unstructured data. In general, customers rely on the company to store and deploy digital content. To point out, QMCO stock has been on a tear since the trading week started with gains of over 9%. Understandably, the company has been busy bolstering its executive team this week.

Last Monday, Quantum announced that it had brought Rick Valentine on as Senior VP and Chief Customer Officer. Valentine will likely be tasked with making sure Quantum’s customer service is top-notch as it continues to transition towards an as-a-service model. CEO Jamie Lerner said, “As we advance on our goal to be a leader in video and unstructured data solutions, Rick’s deep expertise in SaaS transformation and customer experience will ensure that the Quantum customer experience remains second to none.” This is a great play by the company as it adapts its business to the emerging software-as-a-service industry. At the very least, investors appear to think so concerning QMCO stock.

In its second-quarter fiscal posted in October, Quantum saw $85.82 million in total revenue. On top of that, it also reported a 108% rise in cash on hand to the tune of $12.52 million. Lerner said, “Our results in the second fiscal quarter exceeded our forecasted outlook, benefitting from the strength of our Federal government business, and solid sales execution. We are seeing a gradual and steady recovery across most of our vertical markets and key geographies, and simultaneously maintaining discipline with our expenses while increasing our investment in research and development to support the introduction of new software products.” Do you think this bodes well for QMCO stock moving forward?