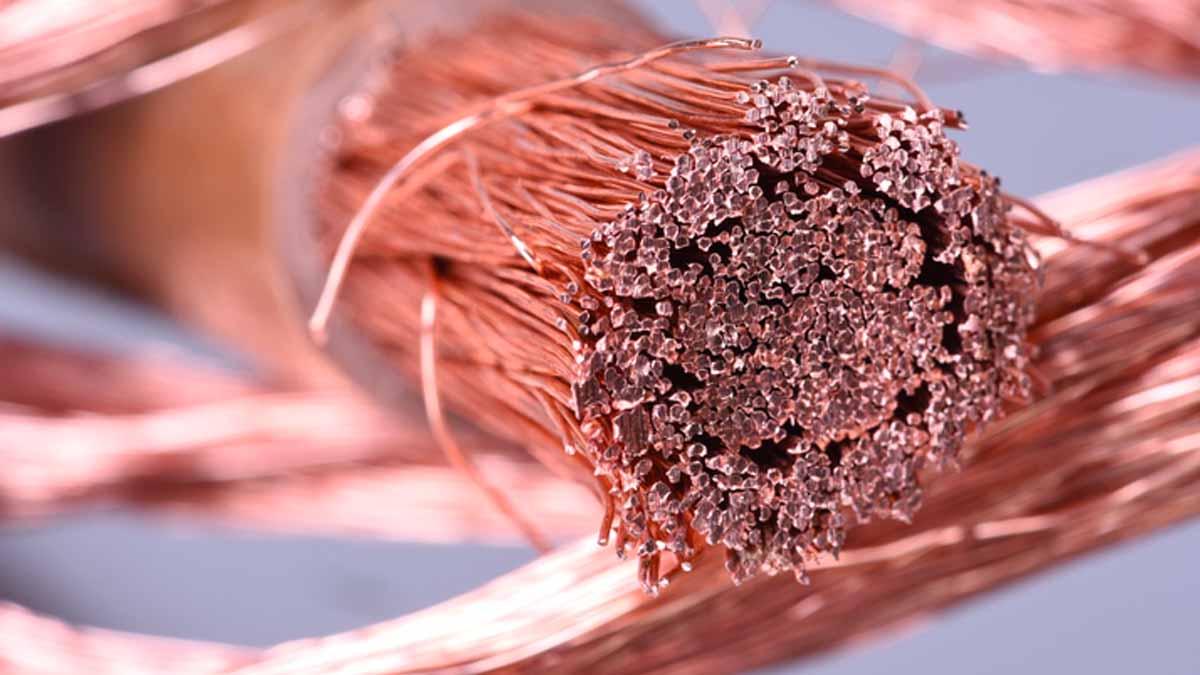

Copper stocks represent the ownership of copper mines or companies involved in Copper production. Copper is an essential industrial metal used in numerous applications such as electrical wiring, plumbing, and construction. It is also used in many consumer products such as jewelry, cookware, and coins. Due to its abundance, copper is one of the most widely traded metals in the world. Today, some of the more widely known copper companies among stock market investors are names like Teck Resources Ltd (NYSE: TECK), Southern Copper Corporation (NYSE: SCCO), and Glencore Plc (OTCMKTS: GLNCY).

As a result, copper stocks are often seen as a way to hedge against inflation because the price of copper tends to increase when inflation levels are rising. Considering the Federal Reserve recently announced another 75 basis point interest rate hike, this could have investors keeping close tabs on copper stocks in the stock market today.

Additionally, copper stocks are also considered to be a good choice for growth-oriented investors since the demand for copper is expected to rise in the future due to continued global economic growth and urbanization. If reading this has you interested in researching copper stocks to buy [or sell] now, here are two companies for your September 2022 watch list.

Copper Stocks To Buy [Or Avoid] Now

1. BHP Group (BHP Stock)

To start this off, we’re going to look at BHP Group Limited (BHP). For the uninitiated, BHP Group Limited is a diversified natural resources company. The company is among the world’s largest producers of major commodities, including steel-making coal, copper, zinc, iron ore, and nickel. Currently, the company offers its shareholders an annual dividend yield of 12.90%

BHP Recent Stock News

Last month, BHP Group Limited announced its 2022 full-year fiscal results. In the report, the company announced a 34% jump in profit from business operations for the year ending June 2022. The company said this is mainly because of the increasing commodity prices. What’s more, profit from operations increased to $34.1 billion from $25.5 billion during the same period, in 2021. Additionally, BHP reported revenue for the full-year 2022 of $65 billion.

BHP Group Chief Executive Officer, Mike Henry said this about the quarter, “BHP delivered strong operational performance and disciplined cost control to realise record underlying earnings of US$40.6 billion and record free cash flow of US$24.3 billion. We have reduced debt and announced a final dividend of US$1.75 per share, bringing total cash dividends announced for the full year to a record US$3.25 per share.“

BHP Stock Chart

On Thursday, shares of BHP stock closed the trading day up over 2% at $51.21 a share. Meanwhile, BHP stock has outperformed the broader markets so far in 2022. Given this information, will you be adding BHP Group stock to your list of copper stocks to buy right now?

[Read More] 4 High Yield Dividend Stocks To Watch Amid The FOMC Meeting

2. Freeport-McMoRan Inc. (FCX Stock)

After that, let’s check out Freeport-McMoRan (FCX). Freeport-McMoRan Inc. is a global mining company with headquarters in the United States. The company operates mines and smelters in North and South America, Asia, and Africa. Freeport-McMoRan is one of the world’s largest producers of copper and gold, and it also has significant operations in oil and gas. For a sense of scale, Freeport-McMoRan reported a total of 1.1 billion pounds of copper as of the end of its most recent second quarter of this year.

FCX Recent Stock News

On Wednesday, Freeport-McMoRan announced its Board of Directors declared cash dividends of $0.15 per share on FCX’s common stock payable on November 1, 2022, In addition to that, in August, FCX reported its second quarter 2022 financial results.

Getting right to it, Freeport-McMoRan’s 2nd quarter 2022 results came in under analysts’ expectations. Specifically, FCX reported earnings of $0.58 per share, along with revenue of $5.4 billion. Compared with the second quarter 2022 consensus earnings estimate of $0.76 per share, with revenue of $6.5 billion. Moreover, FCX announced a 5.8% decline in revenue during the same period, in 2021.

Furthermore, FCX’s Chairman and CEO Richard C. Adkerson, had this to say about the quarter, “FCX is in a position of strength as we navigate the current global market uncertainties. The actions we have taken in recent years to build a strong balance sheet, successfully expand low-cost operations, and maintain flexible growth options will allow us to manage the current market situation in an effective manner while preserving substantial future asset values. Despite near-term uncertainties, the long-term market fundamentals and value opportunities for our stakeholders remain extraordinarily favorable.”

FCX Stock Chart

On Thursday, Freeport-McMoRan finished the trading day at $28.35 per share. Meanwhile, with shares of FCX stock still down 45.47% from its 52-week high, could now be a good time to keep Freeport-McMoRan on watch?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!