4 Top Quantum Computing Stocks To Watch In The Stock Market Now

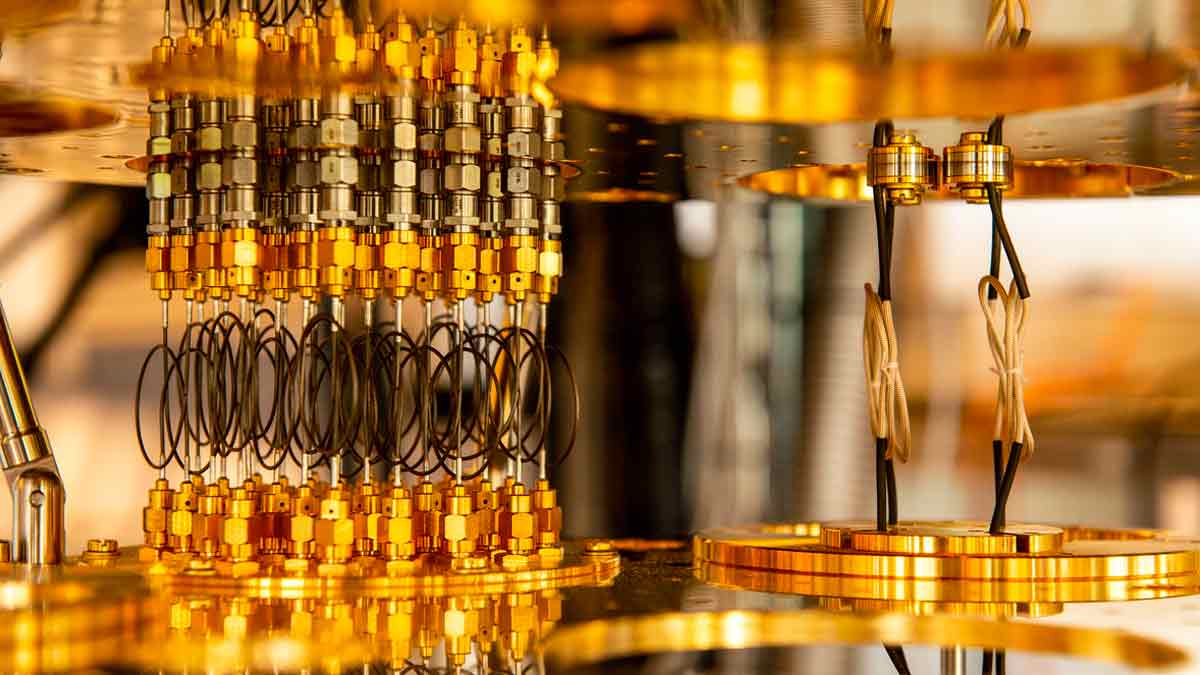

With investors digesting the latest update from the Federal Reserve, tech stocks could present an interesting opportunity now. Accordingly, quantum computing stocks could be worth watching in the stock market now. What is quantum computing might you ask? As the name suggests, this area of tech primarily consists of computers that employ quantum theory. Without going too deep into the details, quantum computers operate on the same tech that enables physicists to predict the movement of subatomic particles. In short, this means of estimation translates to quantum computers being able to outperform the cutting-edge supercomputers of today. For these reasons, investors looking to bet on the next phase of computing would be eyeing the sector now.

If anything, there is no shortage of exciting news in the sector for investors now. Earlier this week, IBM (NYSE: IBM) unveiled Europe’s first quantum computer in Germany. Through a collaboration with the Fraunhofer Institute, the company successfully created the Q System One. According to IBM, it is now “Europe’s most powerful quantum computer in the industrial context.” The company also believes that this is a vital step towards the quantum industry which could “be worth more than $65 billion by 2030.” Elsewhere, other tech giants are also making their plays in the quantum computing world now. Namely, Amazon (NASDAQ: AMZN) is currently offering users the chance to experiment with this area of tech via its Amazon Braket division. Having read all of this, you might be keen to add some quantum computing stocks to your portfolio. In that case, here are four making waves in the stock market today.

Quantum Computing Stocks To Watch Now

- Alphabet Inc. (NASDAQ: GOOGL)

- NVIDIA Corporation (NASDAQ: NVDA)

- Applied Materials Inc. (NASDAQ: AMAT)

- Advanced Micro Devices Inc. (NASDAQ: AMD)

Alphabet Inc.

Alphabet or more commonly known as Google is a multinational tech company. Through its Google Quantum AI, the company is advancing the state-of-the-art of quantum computing and developing tools for researchers to operate beyond classical capabilities. GOOGL stock closed Friday’s trading session at $2,402.22 and is up by over 35% year-to-date. In April, the company announced its first-quarter 2021 financial results.

In it, the company posted total revenue of $55.31 billion for the quarter, a 34% increase year-over-year. Operating income for the quarter was a cool $16.43 billion, representing a 30% increase compared to a year ago. Also, Google reported a net income of $17.93 billion for the quarter or diluted earnings per share of $26.29.

This impressive quarter reflected elevated consumer activity online and broad-based growth in its advertiser revenue. The company also continues to see momentum for its Google Cloud segment. Given the exciting quarter, will you consider buying GOOGL stock for these reasons?

Nvidia Corporation

Nvidia is a quantum computing stock that has taken the world by storm. The company has essentially redefined modern computer graphics through its pioneering work in the graphics processing unit (GPU) that is used by millions worldwide. Its products are used in growing markets like the gaming, professional visualization, data center, and automotive industries. NVDA stock currently trades at $745.55 as of the closing bell on Friday and has more than doubled in valuation in the last year.

In late May, the company reported record financials for its first-quarter fiscal 2022. Diving in, Nvidia reported revenue of $5.66 billion for the quarter, an 84% increase year-over-year. Its gaming and data center segments also reported record revenue at $2.76 billion and $2.05 billion respectively. Net income for the quarter was $1.91 billion or diluted earnings per share of $3.03. This represented an increase of 106% compared to a year ago.

Its gaming revenue doubled year-over-year due to its new generation of RTX 30 series GPUs. Notably, on June 1, 2021, the company announced its latest gaming flagship, the RTX 3080 Ti GPUs. Nvidia says that it is 1.5x faster than the previous generation and offers an incredible leap in performance and fidelity. “With RTX such a huge success, gamers, and creators will be thrilled with the performance and features the GeForce RTX 3080 Ti offers,” said Jeff Fisher, senior vice president of the GeForce business unit at NVIDIA. For these reasons, is NVDA stock worth buying?

[Read More] Best Stocks For Inflation In 2021? 4 Real Estate Stocks To Watch

Applied Materials Inc.

Applied Materials is a leader in materials engineering solutions. Its products are used to produce virtually every new chip and advanced display in the world. Also, its expertise in modifying materials at the atomic level and on an industrial scale is unrivaled. In essence, it manufactures chips for electronics, flat panel displays, and solar products. AMAT stock currently trades at $131.23 as of 4:00 p.m. ET. and has more than doubled in the last year.

On Wednesday, the company announced a breakthrough in chip wiring. In doing so, Applied Materials has found a new way to engineer the wiring of advanced logic chips that will enable scaling to the 3nm node and beyond. The new solution is called Endura Copper Barrier Seed IMS. It combines seven different process technologies in one system under high vacuum.

Integrating these multiple process technologies in a vacuum allows the company to reengineer materials and structures. Basically, this could help consumers have more capable devices and longer battery life. Given this piece of news, is AMAT stock a top quantum computing stock to consider buying?

[Read More] Best Stocks Moving Today? 4 Biotech Names To Watch

Advanced Micro Devices

Following that, we will be looking at Advanced Micro Devices Inc. (AMD). Similar to our earlier entry, it is a semiconductor company. In brief, the company develops computer processors and related tech. Through its offerings, AMD offers consumers and businesses alike high-performance graphics and computing power.

Logically, the company would be looking towards quantum computing to expand its current offering to the next level. As of last month, the company’s processors are currently powering the Perlmutter supercomputer at the Lawrence Berkeley National Laboratory. According to AMD, this processor facilitates research in clean energy, microelectronics, and quantum information science.

Now, AMD stock is currently trading at $84.65 as of Friday’s close. Couple this with its leading position in the semiconductor industry and investors could consider it a viable tech investment now. Regardless, AMD’s processors continue to bolster some of the biggest names in tech today. This is evident as Google Cloud is now using third-generation AMD EPYC processors for its business. Google Cloud CEO Thomas Kurian had this to say, “By collaborating with AMD, Google Cloud customers can now leverage amazing performance for scale-out applications, with great price-performance, all without compromising x86 compatibility.” As digital workloads continue to grow, so would the demand for AMD’s products. With all this in mind, would you consider AMD stock a top buy now?