Here Are Five Top Semiconductor Stocks To Watch Now

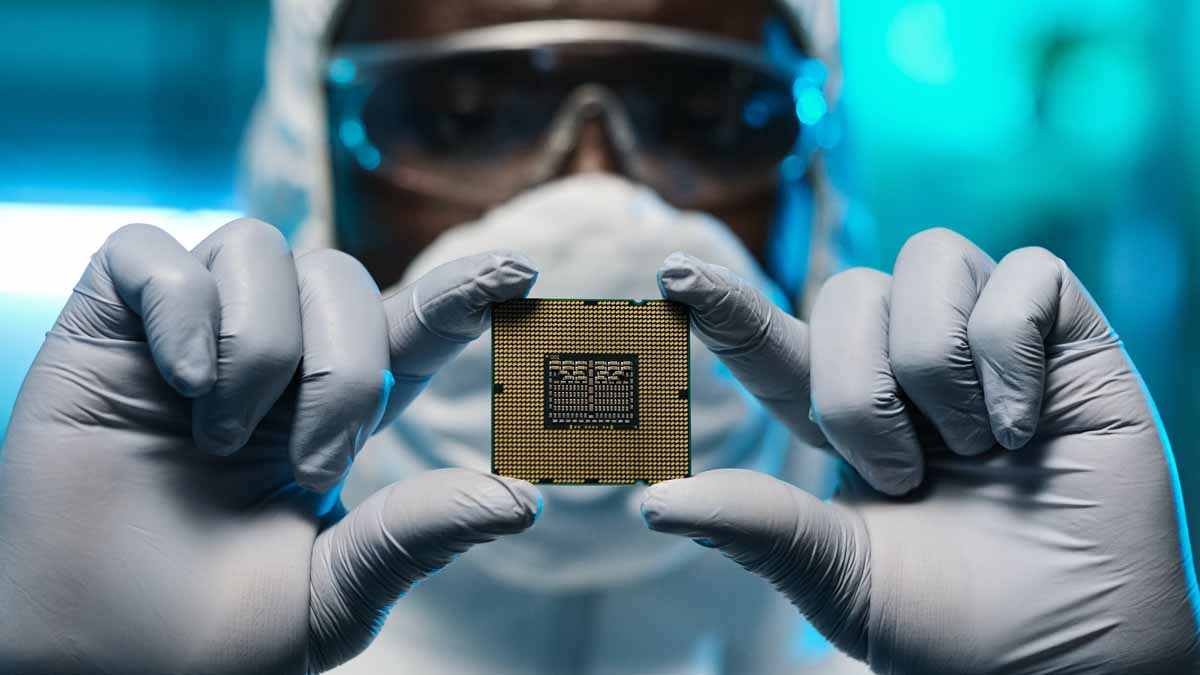

It’s not a surprise the semiconductor industry has been struggling in the stock market this year. But, don’t count these companies out just yet. After all, there are a lot of industries relying on these chips. They’re essentially the brains for most computing devices and thousands of products including cell phones or gaming consoles. As result, there is a better chance than not that the chip sector will recover one day. Thus, investors may still want to keep a close eye on top semiconductor stocks for a potential rebound.

After all, the lack of positive sentiment is not stopping semiconductor companies from making headlines. For example, the semiconductor subsidy bill is currently before Congress. The bill includes nearly $52 billion worth of subsidies for the US semiconductor industry. This caused chip stocks to rally going into Wednesday’s closing bell. With that said, there seems to still have a need to fill the gaps in demand for semiconductor chips today. Furthermore, check out five of the best semiconductor stocks to watch in the stock market now.

Best Semiconductor Stocks To Watch Right Now

- Advanced Micro Devices (NASDAQ: AMD)

- NVIDIA Corporation (NASDAQ: NVDA)

- Taiwan Semiconductor Manufacturing Co. Ltd (NYSE: TSM)

- QUALCOMM Inc. (NASDAQ: QCOM)

- Micron Technology Inc. (NASDAQ: MU)

Advanced Micro Devices

To start off our list today, we have Advanced Micro Devices or AMD. This semiconductor company continues to drive innovation in high-performance computing, graphics, and visualization technologies. Today, the company offers the industry’s broadest portfolio of leadership high-performance and adaptive processor technologies. As result, AMD stock is often regarded as one of the top semiconductor stocks in the stock market today.

Also, AMD seems to be hard at work given their news releases. In late June, AMD announced the Versal™ AI Core series has been chosen by Canon for its Free Viewpoint Video System. The Versal AI Core devices can deliver powerful machine learning-based video processing at the edge for Canon camera systems. Evidently, one could anticipate a revolution in the viewing experience for live sports broadcasting and webcasting. AMD will report its fiscal second quarter financial results on Tuesday, August 2, 2022, after market close. With that being said, would you add AMD stock to your watchlist today?

[Read More] Best Cheap Stocks To Buy Now? 3 Software Stocks For Your List

NVIDIA Corporation

Next up, we have NVIDIA, a multinational tech company that sells its graphics processing unit (GPU) and tech services. Actually, NVIDIA is a pioneer of GPUs and has essentially driven the growth of high-performance computing and artificial intelligence (AI). Additionally, the company pioneered work in accelerated computing has helped evolve trillion-dollar industries. These industries include; health care, finance, and transportation. Just this month, NVIDIA announced its hybrid quantum-classical computing platform.

Their unified computing platform helps speed up breakthroughs in quantum research. As well as development across multiple industries. This includes artificial intelligence, health, finance, and others. “Scientific breakthroughs can occur in the near term with hybrid solutions combining classical computing and quantum computing,” noted Tim Costa, director of HPC and Quantum Computing Products at NVIDIA. “QODA will revolutionize quantum computing by giving developers a powerful and productive programming model.” With such advancements, will you be adding NVDA stock to your radar right now?

Taiwan Semiconductor Manufacturing Co. Ltd

At number three is a semiconductor stock that needs little introduction, Taiwan Semiconductor Manufacturing (TSM). For the uninitiated, its primary business involves the manufacturing and sale of integrated circuits and semiconductor products. The company’s products are used in personal computers, information applications, wired and wireless communication systems, and many others. In June, TSM announced that it will start volume production of 2-nanometer chips by 2025. These groundbreaking chips will feature a new technology called “nanosheet transistor architecture”, which provides enhanced power efficiency and performance.

On July 14th, all eyes were on Taiwan Semiconductor, and the company did not disappoint. After positive quarterly guidance from Samsung, TSM reported a revenue increase of 37% year-year-over to $18.16 billion. This beat analysts’ estimates by $580 million. Also, they raised its revenue forecast for the year. The report showed a boost in results from strong markets for IoT chips & automotive. All in all, this suggests that demand for electronics is still strong, and is holding up better than initially feared. Given all of this, does TSM stock deserve a spot on your radar?

QUALCOMM Inc.

Moving along, we have Qualcomm (QCOM), a company that creates semiconductors, software, and services related to wireless technology. Notably, Qualcomm is a global leader in wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. Next, the company licenses its intellectual property portfolio which includes specific patent rights to manufacture and use certain wireless products.

This month, the company announced a quarterly cash dividend of $0.75 per common share. This is will be payable on September 22, 222 to shareholders of record at the close on September 1, 2022. They are scheduled to release its third quarter fiscal 2022 earnings on Wednesday, July 27, 2022, after the close of the market.

It’s important to mention the company’s potential partnership with Apple (NASDAQ: AAPL). This partnership entails Apple using Qualcomm’s 5G modems for its 2023 iPhones. Currently, Apple relies on its own in-house modems for its iPhones. If this goes through, Qualcomm will remain the exclusive supplier for 5G chips of this year’s new iPhones, with a supply share of 100%. Prior, Qualcomm reported that it was projecting to supply 20% of iPhone modems in 2023 as part of a bullish financial forecast. With all of this, is now the time to watch QCOM stock?

[Read More] 3 High Yield Dividend Stocks To Watch Today

Micron Technology Inc.

Lastly, let’s take a look at Micron Technology or MU. The company is an industry leader in innovative memory and storage solutions transforming how the world uses the information to enrich life for everyone. Likewise, the company has a strong portfolio of high-performance DRAM, NAND, NOR memory and storage products. Every day, the company’s innovations aim to fuel the data economy, enabling advances in artificial intelligence and 5G applications.

In June, Micron Technology announced its results for the third quarter of fiscal 2022. In it, revenue came in at $8.64 billion, an increase of $1.22 billion year-over-year. The company’s net income for the quarter was $2.63 billion. Particularly, its operating cash flow was $3.84 billion, compared to $3.56 billion for the same quarter last year. President and CEO Sanjay Mehrotra stated, “Micron delivered record revenue in the fiscal third quarter driven by our team’s excellent execution across technology, products and manufacturing.” Shortly, is MU stock a buy right now in your book?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!