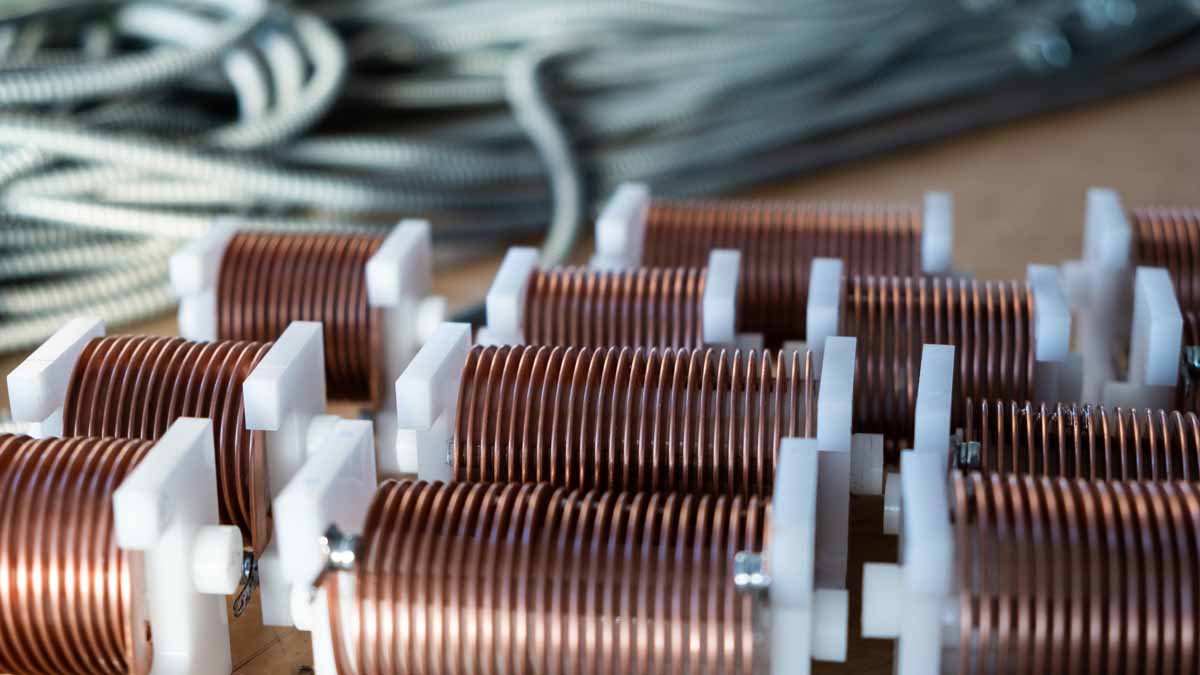

Copper is a versatile and essential metal that is widely used in a variety of industries. These include construction, electrical and electronic products, transportation, and consumer goods. Copper has unique properties such as high conductivity and durability. Which in turn makes it a critical component in the production of many products.

Investing in copper stocks is a way for investors to gain exposure to the copper market and capitalize on its demand. Copper stocks can be found in the form of mining companies that extract and produce copper, as well as companies that manufacture products using copper as a raw material. When investing in copper stocks, it’s important to consider factors such as the overall demand for copper, the cost of production, and the state of the global economy. Additionally, it’s crucial to carefully research and analyze the financial performance and growth prospects of individual copper stocks before making an investment.

Overall, investing in copper stocks can provide investors with the potential for attractive returns, but it also carries certain risks. For example, market volatility and fluctuations in the price of copper. As with any investment, it’s important to understand the underlying market dynamics and to approach investments in copper stocks with caution and a well-researched strategy. If this has you keen on investing in the copper sector, here are two copper stocks to watch in the stock market today.

Copper Stocks To Invest In [Or Avoid] Now

Rio Tinto (RIO Stock)

Starting off, Rio Tinto Plc (RIO) is a mining company based in the United Kingdom. The company specializes in the extraction and production of copper. As well as other minerals such as iron ore and aluminum. Additionally, Rio Tino has a strong presence in several key copper-producing regions, including Australia, North America, and South America.

In January, Rio Tinto announced its fourth-quarter production results. In detail, the company saw a 6% increase in mined copper production compared to the previous year. This was largely due to higher grades at two of its mines. However, the production was offset by lower grades and recoveries at another mine, as a result of planned mine sequencing. Moreover, RIO said it plans to undertake a large rebuild of its smelter and refinery in the second quarter of 2023. Which is expected to take around three months and improve the performance of these facilities.

So far in 2023, shares of RIO stock have gained by 4.24% year-to-date. While, during Tuesday’s mid-morning trading session, Rio Tinto stock is trading at $74.03 a share.

[Read More] Top Stocks To Buy Now? 2 Undervalued Stocks To Watch

Freeport-McMoRan (FCX Stock)

Next, Freeport-McMoRan Inc. (FCX) is a leading mining company based in the United States. In brief, the company focuses on the extraction and production of copper, gold, and other minerals. The company operates globally and has a significant presence in several key copper-producing regions, including North America, South America, and Indonesia.

Late last month, Freeport-McMoRan reported better-than-expected fourth-quarter 2022 financial results. Specifically, the company posted Q4 2022 earnings of $0.52 per share, along with revenue of $5.8 billion. Meanwhile, the consensus estimates for the quarter were earnings of $0.40 per share, and revenue estimates of $5.1 billion. However, compared to the same quarter in the previous year, revenue saw a decrease of 6.6%.

Year-to-date, shares of FCX stock have advanced by 10.93% so far. Additionally, on Tuesday, FCX stock is trading slightly lower on the day by 0.15% at $42.06 per share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!