Is Pacific Biosciences The Best Biotech Stock To Buy In The Stock Market Today?

In the biotech world of genome sequencing, Illumina (NASDAQ: ILMN) may be the undisputed market leader. But when it comes to shareholder returns in the past year, Pacific Biosciences of California Inc. (NASDAQ: PACB) was one of the top performers, rewarding investors lavishly. For the uninitiated, Pacific Biosciences (or PacBio) is a biotechnology company that develops gene sequencing systems.

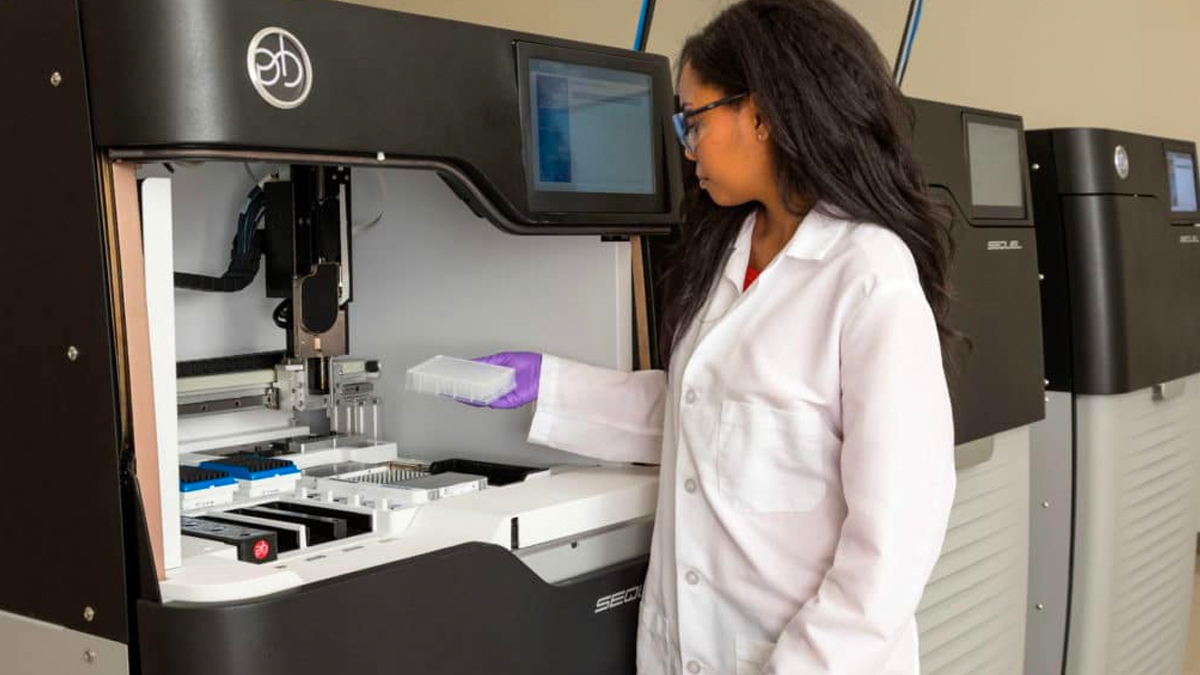

PacBio’s key product is its Sequel system, a nucleic acid sequencing platform based on Single Molecule, Real-Time Sequencing (SMRT) technology. The company has been growing its installed base. At the end of 2020, it has sold a total of 203 systems. Of these 203, 35 were installed in the fourth quarter of 2020. As the company sells more systems, it can generate more recurring revenues going forward from sale of consumables.

From $3 dollar per share in March 2020, the company had witnessed its stock price shoot through the roof. That brings its one-year return to over 1,700%. And the stock is still holding up. The outperformance of PACB stock can be attributed to its sequencing for the coronavirus genome. Despite a monstrous run in its stock price, many analysts believe that the good times should keep rolling for PacBio. If you are interested in PACB stock, read on.

Read More

- Best Stocks To Buy Tomorrow? 4 Reporting Earnings This Week

- Looking For Biotech Stocks To Buy Now? 4 Names To Know

Quarterly Results That Beat Expectations

Many would have expected the pandemic to have a serious impact on the company’s performance. And these are not without reasons. When so many of PacBio’s clients shut down their operations due to the novel coronavirus, it sure is a valid reason to be concerned. However, CEO Christian Henry said that the pandemic did not have a significant impact on its fourth-quarter earnings.

The revenue may have fell 3% year-over-year to $27.1 million, but it still topped the consensus analyst estimate of $25.4 million. Looking at the top line alone may not exactly be rosy. But the whole picture looked better with the company’s bottom line. Considering that the company managed to rake in a net income of $74.9 million compared to the net loss of $91,000 in the same period last year, this paints a rather positive outlook for the company. On top of that, PacBio also ended the quarter with $318.8 million cash and equivalents on its balance sheet. This marks another 50% increase from its previous quarter of $208.6 million as of September 30, 2020.

With the company’s monstrous rally in 2020, investors are expecting solid numbers on its financial report. While the stock market is forward-looking, PACB stock appears to have gotten ahead of results. Having said that, PacBio could be on the cusp of living up to high expectations. Or it could be poised to disappoint investors in the coming quarter. Of course, whether the company could live up to its expectations would need to depend on the performance of the management and how fast the salesforce could grow under the new leadership.

[Read More] 4 Ad Tech Stocks To Watch Right Now

SoftBank’s $900 Million Investment

Another reason for the recent rally of PACB stock could simply be because PacBio received a strategic investment from SoftBank Group (OTCMKTS: SFTBF). The investment will be made through SoftBank’s recently established asset management arm, SB Northstar.

The DNA sequencing company said the cash will help it broaden its product portfolio and fast-track its commercialization plans. “This strategic investment by SoftBank validates our leadership position in the long-read DNA sequencing market and enables us to further accelerate our growth strategies,” PacBio CEO Christian Henry said in a press release.

With Pacific’s transformative technology, it can provide highly accurate and uniform results in genetic sequencing. Also, PacBio is a leader in high-fidelity (HiFi) DNA-sequencing platforms, which can produce accurate and complete data that researchers can use to study genetic diseases. The aim of this technology is to give doctors a more comprehensive understanding of how genes contribute to human health. That way, it could allow them to develop more effective treatments for a wide range of genetic disorders moving forward.

“We believe that PacBio’s HiFi sequencing will be the de facto standard tool for population genomics fundamentally altering the practice of healthcare,” SB Management CEO Akshay Naheta.

[Read More] Making A List Of The Best Marijuana Stocks To Buy Right Now? 4 To Watch

New Partnership & New Products Could Be The Catalysts For PACB Stock

Last month, PacBio announced a multi-year partnership with Invitae (NYSE: NVTA) to expand its genome testing capabilities using PacBio’s HiFi sequencing system. Invitae CEO Sean George said that this deal will enable his company “to develop a new generation of innovative whole genome-based offerings.” George expects the collaboration will help make whole-genome sequencing for diagnosing diseases and guiding healthcare decisions “affordable and accessible to all patients who can benefit from in-depth, full genome information.“

In recent months, Pacific Biosciences has also launched its advanced version of Sequel for higher accuracy. This is something that will likely contribute to an increase in its installed base going forward. As the pandemic is relatively under control right now, investors should be able to gauge how eager the customers are for the new Sequel IIe gene-sequencing system.

[Read More] Should Investors Be Watching These Top Coronavirus Stocks Right Now?

Bottom Line On PACB Stock

By and large, genome sequencing is a highly potent area to be in the biotechnology sector. However, the real question here is, should investors initiate a position in PACB stock now? Before we dive in, it’s also worth noting that the company has come a long way to reach where it is today. Since the merger attempt with Illumina fell off, things haven’t looked pretty well for the company until a change of leadership and its recently launched product.

With all that in mind, the company’s long-term prospects are improving. From the company’s multiyear deal with Invitae to its new Sequel IIe gene-sequencing system, PacBio could be riding on these few products that could potentially deliver excellent revenue for this company. Furthermore, SoftBank’s recent investment would solidify PacBio’s initiatives for fueling its future growth. Where would PACB stock be a decade from now? Your guess is as good as mine.