Top Quantum Computing Stocks To Watch In The Stock Market Today

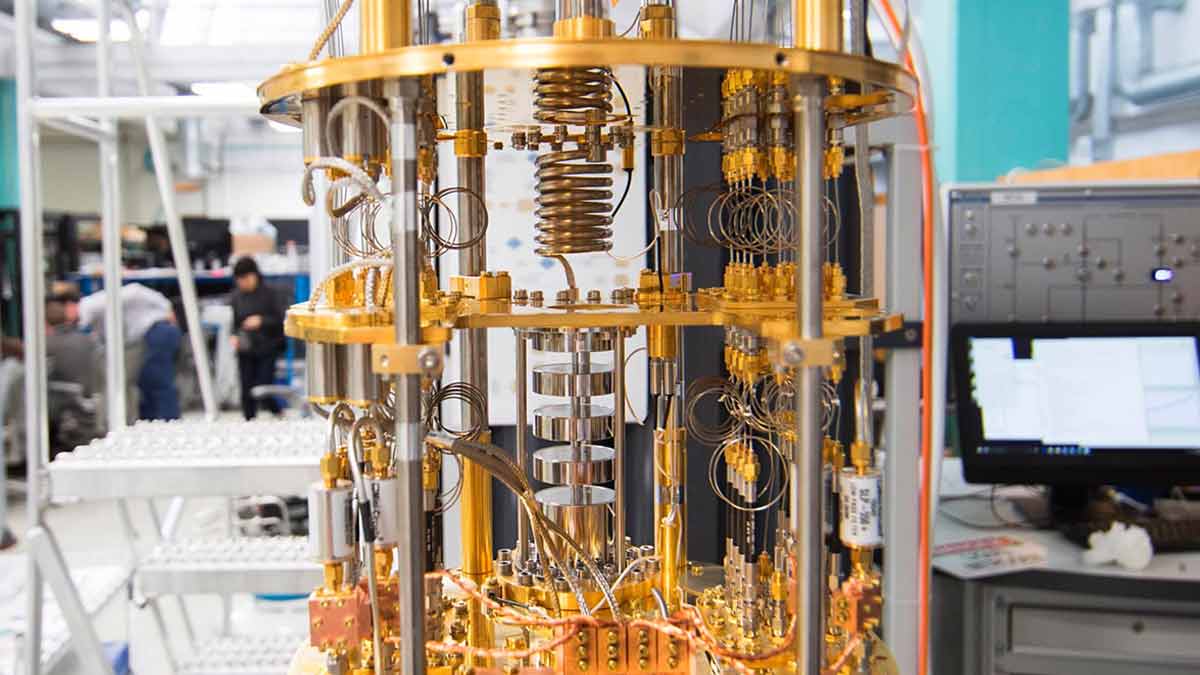

Quantum computing stocks have been one of the best performers in the stock market today. While quantum computing was more of a theory years ago, things are changing. And that translates to a fast-growing market. According to IQT Research, the quantum computing market is forecast to reach $2.2 billion by 2026. Gone were days where quantum computers are just an academic curiosity. They are now being used in big business applications.

Why are they hot? That’s because these supercomputers can solve complex problems that are beyond the capabilities of standard computers. That means the technology could potentially produce solutions to challenges that were previously unsolvable. This could incentivize companies to further dwell deeper into the technology as it has shown notable gains over the years. With all that in mind, do you have a list of top quantum computing stocks to watch during the second half of the week?

Best Quantum Computing Stocks To Watch

- NVIDIA Corporation (NASDAQ: NVDA)

- International Business Machines (NYSE: IBM)

- Advanced Micro Devices Inc. (NASDAQ: AMD)

- Amazon.com Inc. (NASDAQ: AMZN)

NVIDIA Corp.

NVIDIA is a primary graphics processing unit (GPU) maker with its products implemented in consoles, computers, the automotive market, and even cryptocurrency miners. For those unfamiliar, NVIDIA is a multinational tech company that designs graphics processing units and systems on a chip (SoCs).

More importantly, the company’s ability to satiate the demand from crypto-miners is putting the company’s stock into the limelight. If you have been looking for trending stocks to buy this week, NVDA stock stood out among top semiconductor stocks. If you have been following NVDA stock price movement, you would know that it has risen by over 20% over the past month.

From its most recent quarterly report, the company posted a record quarterly and full-year revenue. Quarterly revenue came in 61% higher year-over-year to $5 billion. Its full-year revenue was an impressive $16.68 billion, a 53% increase from the year earlier. The year certainly reflected a breakout year for Nvidia’s computing platforms. Its pioneering work in accelerated computing has led to gaming becoming the world’s most popular form of entertainment. Demand for the company’s latest RTX 30 series GPUs has also been off the charts as it has started a major upgrade cycle. Its data center segment also saw a jump of 97% in revenue, at $1.9 billion. For these reasons, will you consider buying NVDA stock?

[Read More] Top Lithium Battery Stocks To Buy Now? 4 Trending This Week

International Business Machines

Coming up next, we have International Business Machines, more commonly known as IBM. The company has long been at the forefront of quantum computing. As you may know, IBM is one of the pioneers in the computing industry. And it is not resting on its laurels. One of its divisions, IBM Quantum, helps clients gain quantum computing skills. Some notable corporations, including Daimler, are already lining up to work with IBM in the area of quantum computing.

Apart from quantum computing, the company has also made significant investments in its blockchain and hybrid cloud platforms. IBM will also be spinning off its infrastructure services business under the name NewCo. The company may be a little late to the game, but it is becoming more focused. IBM is certainly transforming, whether via acquisitions or organic growth. Apart from being one of the top quantum computing stocks to watch, it is also an excellent dividend stock to have among its industry peers. With all these in mind, do you have IBM stock on your watchlist?

Read More

- 4 Top Epicenter Stocks To Watch In April

- Okta (OKTA) vs CrowdStrike (CRWD): Which Cybersecurity Stock Is A Better Buy?

Advanced Micro Devices, Inc

Following that, we have semiconductor stock, Advanced Micro Devices. The company makes the world’s most powerful processors and power devices of all shapes and sizes. These power devices from supercomputers to game consoles, from always-on cloud infrastructures to your child’s laptop. AMD has a deep understanding of the processing power that the future demands due to long-term relationships with multiple industry-leading partners. Therefore, many investors believe that the company could innovate and help propel the computing industry forward.

On April 7, shareholders of both companies approved the acquisition of Xilinx. The acquisition would be an all-stock transaction through which AMD shareholders would own 74% of the combined company and Xilinx shareholders would own 26%. This deal is huge for the company because it is expected to give AMD more leverage with Taiwan Semiconductor Manufacturing Co. Ltd (NYSE: TSM) by making it an even bigger part of the foundry’s business.

It is no secret that AMD had a fantastic year in 2020. You can see that in its financials for the fiscal year ended December 26, 2020. Revenue for the year increased by 45% to $9.76 billion. Meanwhile, net income was $2.49 billion, a staggering increase of over 750% year-over-year. So with so much buzz around the company, would you invest in AMD stock?

[Read More] Best Growth Stocks For 2021? 4 Names To Know

Amazon.com Inc

Last on the list, we have e-commerce juggernaut, Amazon. The company is not just another e-commerce company where you make purchases online. With the current market value of $1.6 trillion, it is not surprising that Amazon is one of the most valuable companies on earth. Despite having such high value, Amazon continues to thrive and beat all odds. For the previous fiscal year ended December 31, the company saw revenues rise by 38%. Meanwhile, net income increased by 84%. Chances are, it would not be wise to bet against its growth in the near future. And if you look closely, you would know that Amazon delivers more than just packages.

You see, it is not one of the biggest companies without reasons. Amazon also offers quantum computing on Amazon Web Services through Amazon Bracket. While the quantum computing arm is still relatively new within the company, don’t be surprised if it’s going to be one of the leaders in this niche. If you look closely, you may be impressed by how stunningly profitable AWS is. More than half of 2020’s operational profits came from its cloud computing arms. If you believe Amazon has a role to play in advancing quantum computing, do you think AMZN stock has more room to run?