Here Are 4 Semiconductor Stocks To Check Out In The Stock Market Today

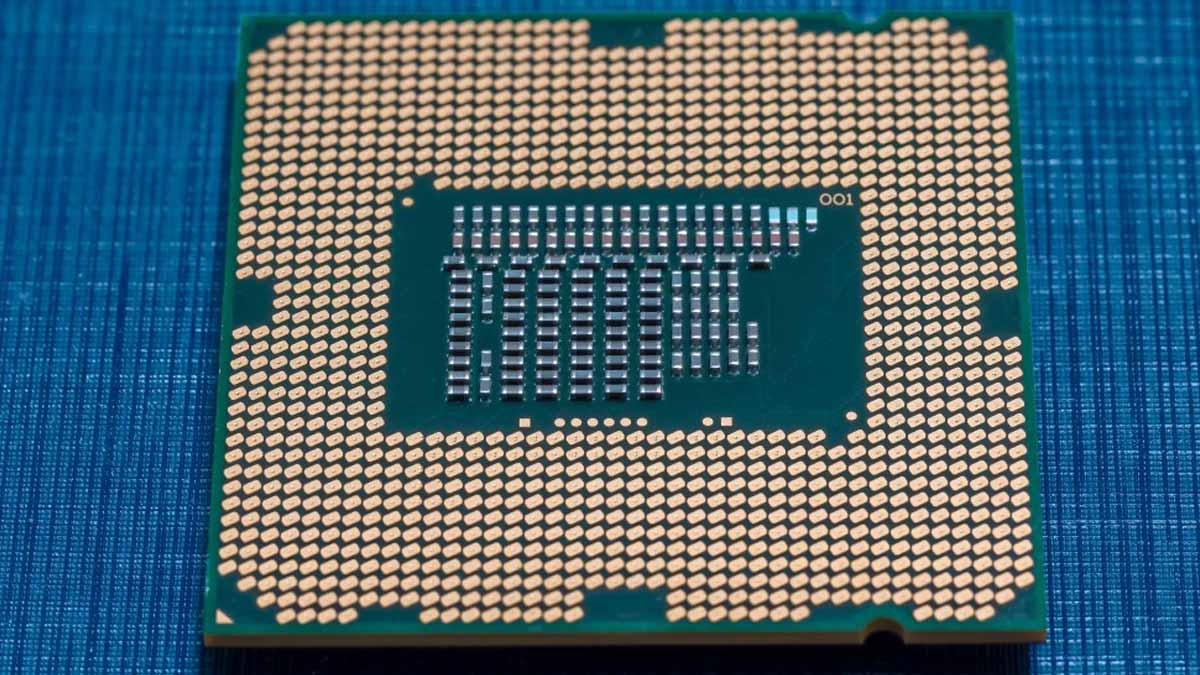

Amid a busy week of earnings reports from big tech names, semiconductor stocks remain relevant in the stock market today. For the most part, this would be because of the crucial role semiconductors play in most of the tech we use. From smartphones and computers to washing machines and televisions, most digital products we use every day rely on semiconductors. On top of that, industries all around are looking to digitize their operations, further fueling the demand for semiconductors. As such, investors could be looking for the best semiconductor stocks to buy right now.

A notable semiconductor stock would be Marvell Technology (NASDAQ: MRVL). Just yesterday, Raymond James (NYSE: RJF) upgraded the semiconductor company. Analyst Chris Caso upgraded Marvell to outperform from market perform and put an $80 price target on MRVL stock. In other news, Intel (NASDAQ: INTC) and Lockheed Martin (NYSE: LMT) announced a partnership last month. Notably, the two will be joining forces to bring together innovative 5G-capable solutions for the U.S. Allied Defense Systems. With all the developments going on in the industry, here are some of the top semiconductor stocks to watch in the stock market today.

Semiconductor Stocks To Buy [Or Sell] Right Now

- ASML Holding NV (NASDAQ: ASML)

- Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM)

- Advanced Micro Devices Inc. (NASDAQ: AMD)

- Qualcomm Inc. (NASDAQ: QCOM)

ASML Holding

ASML Holding is a company that manufactures complex lithography systems that are crucial to the production of microchips. For those unfamiliar, lithography systems are machines that are used to make the aforementioned chips. As a matter of fact, the company’s products are used by various major chipmakers. It is also the only company in the world capable of making extreme ultraviolet (EUV) lithography machines. This essentially makes them the sole enabler for big tech companies to manufacture their products. Hence, most of the electronics we use today may not exist without ASML machines.

Last week, ASML reported its first-quarter earnings of the year. For starters, it brought in sales of $3.8 billion which slightly exceeds estimates and leans towards the higher end of its guidance. As for profits, the company raked in a net income of $749 million, slightly ahead of expectations. Moving on, its net bookings sees strong numbers as well, coming in at $7.55 billion. Thanks to a global chip shortage, ASML sees customers racing to increase production capacity. For the full year, ASML expects revenue growth to be around 20%. With this solid quarter in mind, should you invest in ASML stock?

[Read More] 5 Top Automotive Stocks For Your Late April 2022 Watchlist

Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company (TSM) is one of the largest semiconductor companies in the world. Put simply, TSM manufactures and sells integrated circuits and semiconductors. On top of that, the company also offers customer service, account management, and engineering services. In addition, TSM also owns and operates the largest semiconductor design ecosystem globally, the Open Innovation Platform. Two weeks ago, the company reported first-quarter financials that smashed expectations.

Diving in, the company pulled in sales of $17.57 billion for the quarter, representing a stunning 36% increase compared to the same period last year. Moving on to profits, the company pulled in earnings of $1.40 per share, surpassing analyst estimates of $1.27. Besides that, gross profit margin for the quarter came in at 55.6%. This impressive first-quarter result is thanks to strong demand in its High-Performance Computing and Automotive-related segment. Wendell Huang, Vice President and CFO of TSM added, “Moving into second quarter 2022, we expect our business to continue to be supported by HPC and Automotive-related demand, partially offset by smartphone seasonality.” Given the positive outlook, should you buy TSM stock?

Advanced Micro Devices

Next up, we have Advanced Micro Devices, or AMD for short. The chip titan essentially produces high-performance computing, graphics, and visualization technologies. With over half a century of experience in the semiconductor industry, the company continues to be a pioneer of innovation with its highly advanced processors and technologies. As a matter of fact, the company’s products and services are used by hundreds of millions of consumers globally. Last Wednesday, the semiconductor company announced the expansion of its EPYC processor into the cloud ecosystem.

Namely, it will be powering the new Oracle (NYSE: ORCL) Cloud Infrastructure (OCI) E4 Dense instances. As part of its VMware Solution offerings, these new instances enable customers to build and run a hybrid-cloud environment for their VMware-based workloads. As such, customers can now take full advantage of industry-leading OCI compute shapes with the same VMware tooling on-premises. In other news, Raymond James gave AMD stock an upgrade, citing strong confidence in the company’s data center business. Analyst Chris Caso raised his rating to strong buy from outperform and maintained a price target of $160. All things considered, should you add AMD stock to your portfolio?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Qualcomm

Last but not least, we have Qualcomm, the world’s leading wireless technology innovator. It is also one of the key players in the development and expansion of 5G connectivity. As a matter of fact, the company owns several patents critical to the 5G and 4G mobile communications standards. In addition to wireless technology, Qualcomm over the years has expanded into selling semiconductor products using a predominantly fabless manufacturing model. The company also develops semiconductor components and software for vehicles, watches, laptops, wi-fi, smartphones, and other devices.

On April 14, the company entered into a multi-year collaboration with automotive company Stellantis (NYSE: STLA). Notably, the collaboration will focus on merging Stellantis’ software domains into High-Performance Computers. Hence, this leverages the high-performance, low-power Snapdragon Automotive Platforms across all of its significant vehicle domains. Besides that, the two are also looking to tap into Qualcomm’s Snapdragon Digital Chassis advancements. Specifically, by implementing it across Stellantis’ 14 automotive brands beginning in 2024. These brands would include the likes of Chrysler, Maserati, and Jeep among other notable brands. Besides that, Qualcomm will be reporting its quarterly earnings on Wednesday. As such, will you be keeping tabs on QCOM stock?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!