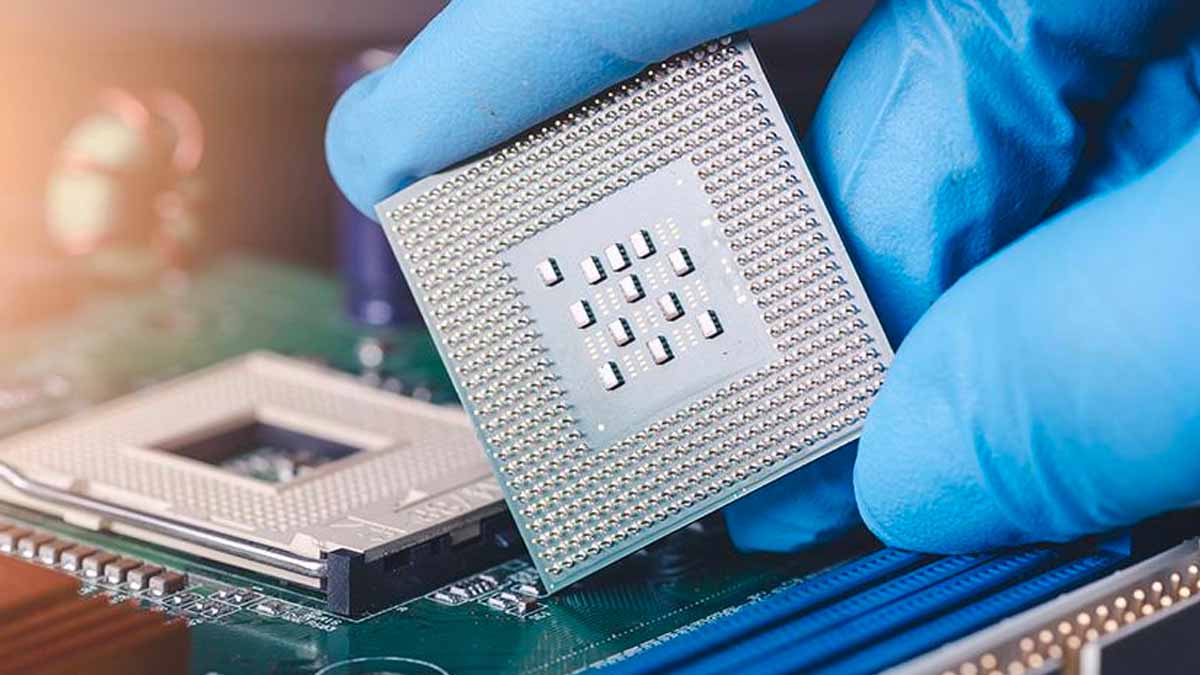

The semiconductor industry stands at the heart of modern technological advancements, fueling a digital revolution that spans from smartphones to autonomous vehicles, and even smart home devices. As the architects of the digital age, semiconductors play a pivotal role in driving innovations and improving efficiencies in various sectors. These tiny chips have become integral components in almost every electronic device, making the industry’s growth trajectory closely tied to the ever-increasing global demand for technology solutions.

For investors, semiconductor stocks offer a gateway into the tech world’s rapid evolution. While the sector can be cyclical, reflecting the broader tech industry’s ebb and flow, it’s underscored by strong long-term growth potential. Investing in semiconductor companies requires a keen understanding of market trends, technological advancements, and supply-demand dynamics. That said, let’s look at three semiconductor stocks to watch in the stock market right now.

Semiconductor Stocks To Buy [Or Avoid] Now

- Advanced Micro Devices Inc. (NASDAQ: AMD)

- Texas Instruments Incorporated (NASDAQ: TXN)

- NVIDIA Corporation (NASDAQ: NVDA)

Advanced Micro Devices (AMD Stock)

First up, Advanced Micro Devices Inc. (AMD) is a global semiconductor company recognized for its role in computer processing units (CPUs) and graphics processing units (GPUs). Additionally, AMD provides solutions for a wide range of applications, from personal computing to gaming and data centers.

Last month, AMD announced the release of their new AMD EPYC™ 8004 Series processors, marking the completion of the 4th Gen AMD EPYC CPU family. These latest processors integrate the “Zen 4c” core, catering specifically to hardware developers. The goal is to provide platforms with superior energy efficiency that can support various applications, from intelligent edge operations like retail and manufacturing to broader data center tasks such as cloud services and storage. Notably, major tech companies like Dell Technologies, Ericsson, Lenovo, and Supermicro have shown support for these processors.

Year-to-date, shares of AMD stock are up a whopping 61.02% so far. Meanwhile, during Monday morning’s trading session, Advanced Micro Devices stock is trading slightly higher off the open by 0.22% at $103.05 a share.

[Read More] AI Stocks To Buy In October 2023? 2 To Know

Texas Instruments Inc. (TXN Stock)

Next, Texas Instruments Incorporated (TXN) stands as one of the leading semiconductor manufacturers in the world. Also, TI specializes in developing analog chips and embedded processors. These key components power countless electronic devices, ranging from smartphones to advanced industrial equipment.

Just last month, Texas Instruments announced a 5% increase in its quarterly cash dividend, taking it from $1.24 per share to $1.30, which translates to an annualized amount of $5.20. This revised dividend is scheduled for payment on November 14, 2023, to shareholders recorded as of October 31, 2023, pending an official declaration by the board of directors during their October meeting.

In 2023 thus far, shares of TXN stock have pulled back modestly by 1.97%. However, during Monday morning’s trading session, TXN stock is trading higher by 0.62% at $159.99 per share.

[Read More] Good Stocks To Invest In Now? 3 Copper Stocks To Check Out

NVIDIA Corp. (NVDA Stock)

Finally, NVIDIA Corporation (NVDA) is known for its advancements in the graphics technology domain. Specifically with its Graphics Processing Units (GPUs) for gaming and professional markets. Over the years, NVIDIA has expanded its portfolio to cater to a broader audience. This includes areas like artificial intelligence and automotive technology.

In September, Nvidia revealed a collaboration with Tata Group to establish AI computing infrastructure and platforms for AI solution development. This partnership intends to offer AI capabilities to various businesses, organizations, AI researchers, and startups throughout India. As part of the collaboration, the companies aim to develop an AI supercomputer powered by Nvidia’s GH200 Grace Hopper Superchip.

Year-to-date, Nvidia stock is up by 213.70% so far. While, on Monday morning, shares of NVDA stock opened higher on the day so far by 3.24% at $449.07 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!