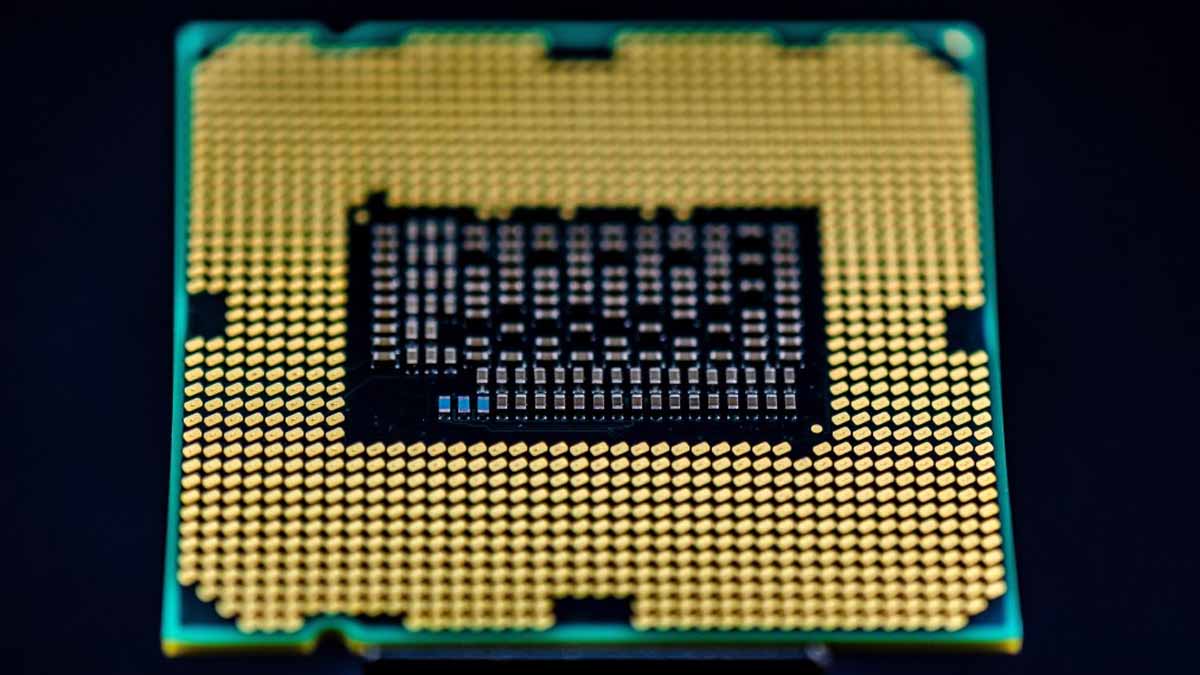

Are These The Best Semiconductor Stocks To Buy This Week?

The semiconductor industry has been growing at a stellar pace. As a result, investors are often on the lookout for semiconductor stocks in the stock market. While the semiconductor chips shortage remains a concern, companies are ramping up their production to meet the demand. In fact, the Semiconductor Industry Association (SIA) recently announced that the global semiconductor sales were $50.7 billion for January 2022. This represents a growth of 26.8% over the January of 2021 and is the second-highest-ever monthly total.

In addition, the sector is often filled with exciting new developments. For instance, Broadcom (NASDAQ: AVGO) recently announced the demonstration of its 100G/lane optical PAM-4 DSP PHY with an integrated transimpedance amplifier (TIA) and high-swing laser driver. This provides the highest level of CMOS integration and superior performance with lower power consumption.

Elsewhere, GlobalFoundries (NASDAQ: GFS) also announced a collaboration with industry leaders such as Broadcom, Cisco Systems (NASDAQ: CSCO), NVIDIA (NASDAQ: NVDA), and Marvell (NASDAQ: MRVL) to deliver innovative, feature-rich solutions to solve some of the biggest challenges in data centers today. All in all, the future of the semiconductor industry does seem to be quite promising. So, here are some of the top semiconductor stocks in the stock market today.

Semiconductor Stocks To Buy [Or Avoid] This Week

- Intel Corporation (NASDAQ: INTC)

- Applied Materials, Inc (NASDAQ: AMAT)

- Advanced Micro Devices, Inc (NASDAQ: AMD)

- CMC Materials Inc (NASDAQ: CCMP)

Intel

Let us start the list with one of the leading semiconductor companies in the world, Intel. Essentially, the company engages in the design and manufacturing of products and technologies. Intel is known for being a developer of the x86 series of microprocessors that are found in most personal computers (PCs). That said, it also operates in other segments such as Mobileye and Non-Volatile Memory Solutions Group. In fact, Intel intends to take Mobileye public in the U.S. this year and recently announced that it has confidentially submitted a draft registration statement on Form S-1 with the U.S. Securities and Exchange Commission (SEC). This is a necessary process by the SEC before proceeding with an initial public offering (IPO).

Furthermore, Intel announced yesterday the first phase of its plans to invest in the European Union over the next decade. The initial plan includes an investment of $18.7 billion into a leading-edge semiconductor fab mega-site in Germany. Besides that, the company also intends to create a new R&D and design hub in France and to invest in R&D, manufacturing, and foundry services in Ireland, Italy, Poland, and Spain. Evidently, Intel plans to bring its most sophisticated technology to Europe to create the next-generation European chip ecosystem. As such, it would hopefully address the need for a more balanced and resilient supply chain. Given these exciting developments, would you consider INTC stock a viable investment?

[Read More] Best Stocks To Invest In 2022? 4 Gaming Stocks For Your List

Applied Materials

Another top semiconductor stock that often goes unnoticed is Applied Materials. For those unaware, this is a company that provides manufacturing equipment, services, and software to the global semiconductor industry. Its Semiconductor Systems segment includes semiconductor capital equipment that is used for the chip-making process. Aside from that, Applied Materials also offer products for manufacturing liquid crystal and organic light-emitting diode (OLED) displays and several other display technologies. Impressively, AMAT stock has shown resilience throughout the stock market correction. While many of its peers have gone on a downward spiral, the stock has managed to hold up over the past year.

Well, this could be thanks to its healthy financials and an optimistic outlook for fiscal 2022. Last month, the company reported a record quarterly revenue of $6.27 billion for its fiscal first quarter of 2022, representing an increase of 21% year-over-year. Meanwhile, its GAAP earnings per share increased to $2.00, up 64% compared to the prior year’s quarter. Applied Materials achieved all these while the supply environment remains a challenge. What’s more, it expects long-term secular trends to drive its markets structurally higher. With that in mind, could AMAT stock be a top semiconductor stock to buy?

Advanced Micro Devices

Similar to Intel, Advanced Micro Devices (AMD) is a global semiconductor company that is primarily known for producing x86 microprocessors. However, it also specializes in products such as accelerated processing units (APUs), discrete graphics processing units (GPUs), semi-custom System-on-Chip (SOC) products, and chipsets. Investors should note that the company approved a new $8 billion share repurchase program last month. According to CEO Dr. Lisa Su, the program takes into consideration AMD’s balance sheet strength and expectations for future free cash flow generation. Well, this could be a positive sign for investors as the company is showing confidence in its own stock.

After all, it is difficult to argue against these sentiments as AMD has been constantly pushing out newer innovations on a consistent basis. Yesterday, the company announced the availability of the AMD Ryzen™ 7 5800X3D processor. It is the first Ryzen processor to feature AMD 3D V-Cache™ technology. With this in place, it will deliver 15% more gaming performance compared to processors without stacked cache technology. Now, this means that this is likely the world’s most advanced desktop gaming processor. Therefore, such a development would probably draw significant traction among gamers. All things considered, would you be jumping on the AMD stock bandwagon?

[Read More] Good Stocks To Buy Right Now? 5 Reopening Stocks In Focus

CMC Materials

To conclude the list, we will be looking at CMC Materials. In detail, the company is a global supplier of consumable materials to semiconductor manufacturers. This includes chemical mechanical planarization slurries and polishing pad products, high-purity process chemicals used to etch and clean silicon wafers, photovoltaics, and flat plane displays. Additionally, it also provides performance products and services to the pipeline operations industry. CCMP stock has risen more than 35% over the past six months.

Riding on a healthy momentum, CMC started the month of March with more positive news. The company announced that its stockholders had approved the previously announced merger agreement. Under which, Entegris (NASDAQ: ENTG) will acquire CMC Materials in a cash and stock transaction. Not to mention, CMC recently declared a quarterly cash dividend of $0.46 per share on the company’s common stock. Thus, would you be watching CCMP stock?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!