4 Artificial Intelligence Stocks To Consider Adding To Your Watchlist Right Now

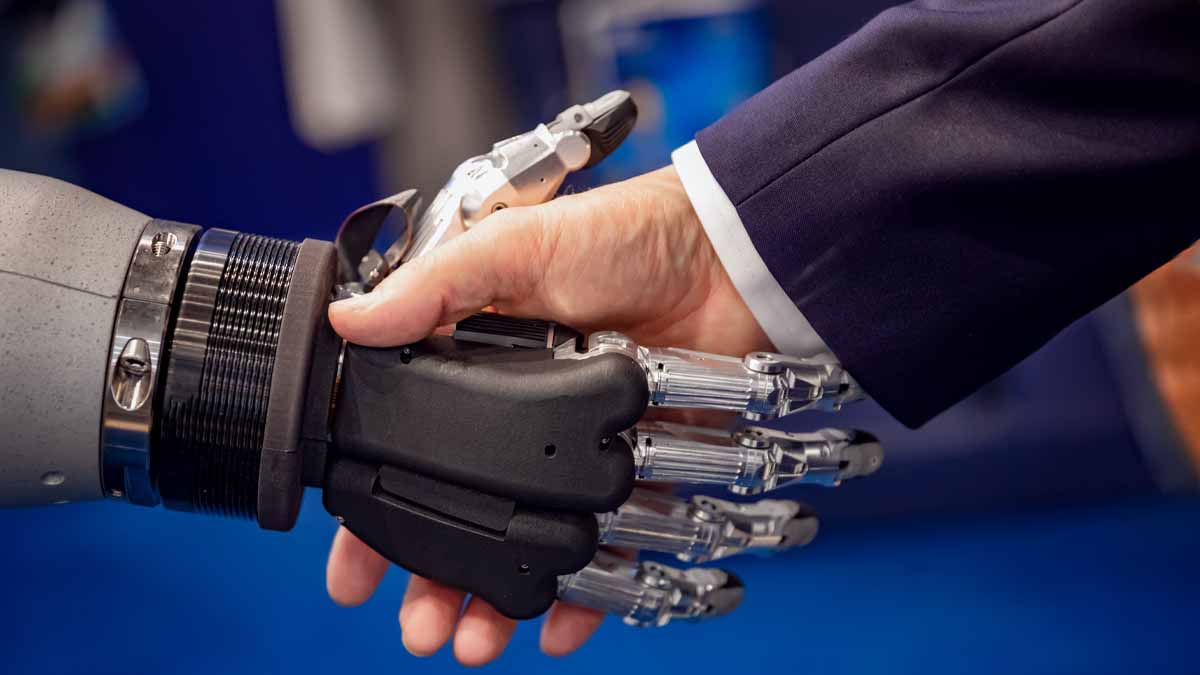

Artificial intelligence stocks appear to be gaining traction among tech investors in the stock market today. Whether you are familiar with the concept of AI or not, it remains an increasingly relevant area of research now. Simply put, artificial intelligence deals with machines that emulate human intelligence. Most of us would think of fancy gadgets and sentient robots when it comes to AI. However, a lot of it revolves around complex algorithms and software, which enable enterprises to make more effective decisions.

Today, we encounter AI in search engines, social media, and many enterprise software applications. With the tech industry rapidly growing in terms of scale, massive amounts of data across businesses and industries continue to pile up. This would be where AI-related services come into play. And in the future, don’t be surprised if we would need to work alongside autonomous robots.

You might remember that earlier this year, Tesla (NASDAQ: TSLA) held an AI focused event. And that’s when Musk introduced the Tesla Robot, designed to handle “tasks that are unsafe, repetitive or boring”. For investors, though, there are a few ways to play this trend. You could even invest in companies that will make the semiconductors required for AI. Or perhaps invest in companies that fall into the pure-play category. Given all this, investors who are looking for tech companies that are already succeeding in using AI to accelerate their businesses might want to consider the following artificial intelligence stocks.

Best Artificial Intelligence Stocks To Watch In The Stock Market Today

- Upstart Holdings Inc. (NASDAQ: UPST)

- Nvidia Corp. (NASDAQ: NVDA)

- CrowdStrike Holdings Inc. (NASDAQ: CRWD)

- Amazon.com Inc. (NASDAQ: AMZN)

Upstart

Upstart is a leading artificial intelligence lending platform that is designed to improve access to affordable credit while reducing the risk and costs of lending for its bank partners. Its platform uses sophisticated machine learning models to accurately identify risk. Therefore, it could approve more applicants than traditional credit-score based lending models. That appears to be an attractive business model, and the company has demonstrated enormous growth since it went public a year ago. Upstart stock has seen best-in-industry gains and has enjoyed gains of over 900% in the past year alone.

Earlier this month, the company announced its Upstart Auto Retail software, which includes AI-enabled financing. In essence, it is a cloud-based solution that enables a new car buying experience for both consumers and dealerships. Furthermore, it will provide access to Upstart-powered auto loans as well. This is another area where the company could post high growth for the foreseeable future. In fact, more than $1 billion worth of cars were purchased in the second quarter using the Upstart Auto Retail platform. With the company’s massive growth potential, it’s hard not to have UPST stock on your list of top artificial intelligence stocks to buy.

[Read More] Top Reddit Stocks To Buy Right Now? 5 For Your Late 2021 Watchlist

Nvidia

Next up, we have Nvidia, the world’s top producer of discrete graphics processing units (GPUs). The company designs GPUs that are used by the gaming and professional markets. Notably, the company has made huge strides in the field of AI. As more companies are increasingly data-driven, demand for AI technology will grow and Nvidia will be at the center of the action.

The company in a recent blog post announced that it continues to extend its AI inference performance leadership with either x86 or Arm-based CPUs in this latest benchmark released. This would be the third consecutive time that Nvidia has set records in performance and energy efficiency on inference tests from MLCommons, an industry benchmarking group. This would also be the first time that its data-center category tests have run on an Arm-based system. And that gives users more choice in how they deploy AI. With that in mind, will you consider watching NVDA stock?

[Read More] Top Stocks To Buy Now? 4 Consumer Stocks To Consider

CrowdStrike

CrowdStrike is a fast-growing cloud-based cybersecurity company which applies AI in its applications. For starters, its Falcon endpoint security platform is powered by AI that runs on the company’s proprietary Threat Graph database. The platform offers a set of cloud-delivered technologies that provides a wide range of products including antivirus, endpoint detection, and many more. More importantly, the company crowdsources data from millions of endpoints, then leans on AI to block even the most sophisticated attacks. For this reason, CrowdStrike has become the gold standard in many sub-sectors of the cybersecurity industry.

Last month, the company announced the availability and FedRAMP authorization of CrowdStrike Falcon Forensics. Hosted within GovCloud, Falcon Forensics speeds up response time and remediation of critical security incidents for agencies by providing increased visibility and automated analysis of attacker activity. This is something most companies and agencies appreciate in the modern world today. The speed of response is absolutely crucial to help agencies prevent security incidents from turning into breaches. Not only did the company was able to leverage its AI expertise, but its growth is also accelerating. With the revenue skyrocketing and a surge in customer subscriptions, would CRWD stock make your list of top artificial intelligence stocks to buy in the stock market today?

[Read More] Best EV Stocks To Buy Right Now? 4 In Focus

Amazon.com

Tech giant Amazon needs little introduction. The multinational tech company focuses on e-commerce and artificial intelligence. In brief, its Amazon Web Services (AWS) provides on-demand cloud computing platforms and APIs to individuals, companies, and governments. Furthermore, AWS’s virtual computers emulate most of the attributes of real computers. It also offers the most complete set of machine learning and artificial intelligence services to meet customer business needs.

Perhaps, no company is using AI more widely than Amazon. The company uses AI for everything from Alexa, to its Amazon Go cashierless groceries stores, to AWS Sagemaker. Even its logistics operations benefit from its AI prowess, which helps scheduling, rerouting and other ways to optimize the delivery accuracy and efficiency. With the company continuing to invest huge amounts into building its infrastructure, that will provide long-term growth and help with its AI efforts. Considering all these, would you keep AMZN stock on your watchlist?