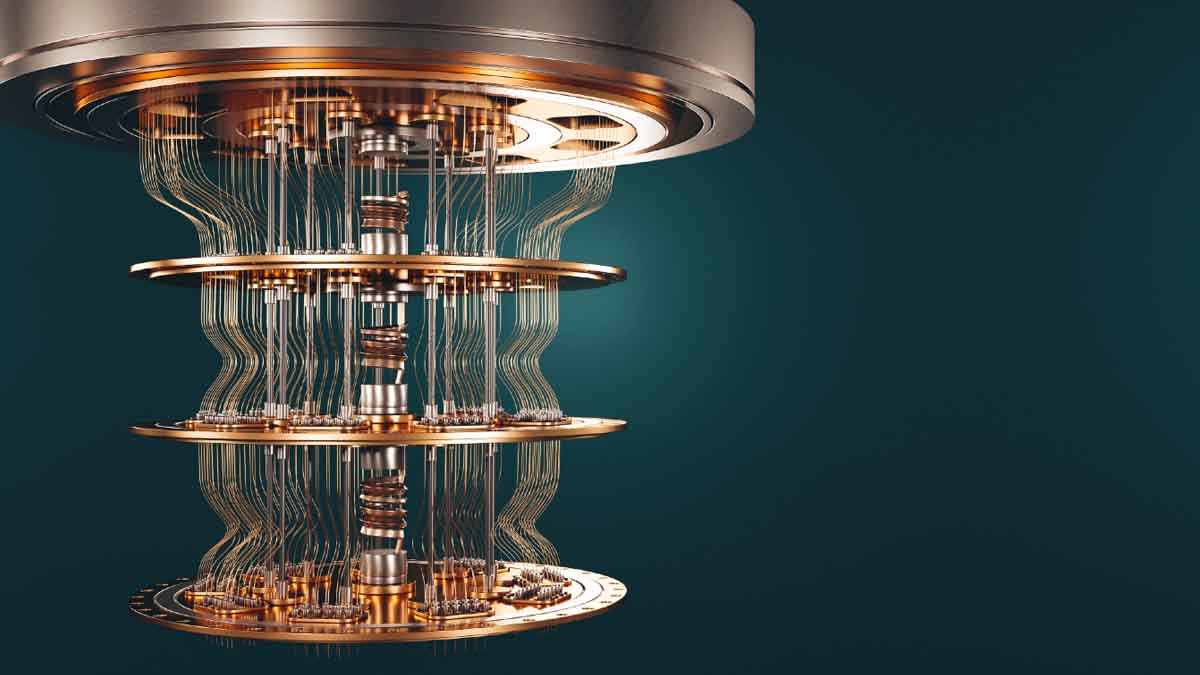

In the ever-evolving landscape of technology, one sector that is capturing the attention of investors and industry experts alike is quantum computing. This revolutionary approach to computing is pushing boundaries of what’s currently possible, transforming the way data is processed. Quantum computing leverages principles of quantum mechanics to process information at an exponentially faster rate compared to traditional computers. This breakthrough has the potential to disrupt industries, from cryptography and drug discovery to artificial intelligence and beyond.

As a budding field, quantum computing presents attractive investment opportunities. A handful of publicly traded companies are leading the charge in this sector, pioneering technologies that could redefine our digital age. Investing in quantum computing stocks gives investors the chance to be part of a transformative tech revolution. It is, however, still in its nascent stages with a high degree of risk and uncertainty, as well as tremendous potential for reward.

Investing in quantum computing stocks requires a thorough understanding of the technology and the companies spearheading its development. While the rewards could be substantial for early adopters of this technology, the risks are also significant. Quantum computing is a complex, rapidly evolving field, and its practical, large-scale implementation is still years away. Therefore, potential investors need to conduct careful research, consider expert insights, and closely monitor the developments in this groundbreaking field. That said, let’s look at two quantum computing stocks to watch in the stock market now.

Quantum Computing Stocks To Watch Now

- Honeywell International Inc. (NASDAQ: HON)

- IBM Corporation (NYSE: IBM)

Honeywell International (HON Stock)

First up, Honeywell International (HON) is a globally recognized conglomerate that operates across various sectors, including aerospace, building technologies, performance materials, and safety and productivity solutions. Recently, Honeywell has emerged as a front-runner in the quantum computing industry through its Honeywell Quantum Solutions division.

On Thursday, morning Honeywell reported its most recent second-quarter earnings report. In detail, the company posted Q2 2023 earnings of $2.23 per share, on revenue of $9.15 billion. This was versus consensus estimates for the quarter which were earnings per share of $2.20, along with revenue estimates of $9.18 billion. As a result, revenue increased by 2.16% versus the same period, the previous year.

Moreover, during Thursday’s afternoon trading session, shares of HON stock are trading down by 8.60% at $195.86 a share.

[Read More] What Stocks To Buy Today? 2 Dow Jones Industrial Average Stocks To Watch

IBM Corporation (IBM Stock)

Next, International Business Machines Corporation (IBM), is a multinational technology and consulting company. IBM is acknowledged for its continual innovation in technology, with significant contributions in fields like artificial intelligence through IBM Watson, cloud computing, and, notably, quantum computing.

Just last week, IBM also announced its most recent second quarter 2023 financial results. Diving in, the company reported Q2 2023 earnings per share of $2.18 and revenue of $15.48 billion. For context, analysts’ consensus estimates for the quarter were earnings of $2.00 per share, on revenue estimates of $15.56 billion.

Closing out Thursday’s trading session, shares of IBM stock closed the day up 1.34% at $142.95 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!