What Are Undervalued Stocks?

Undervalued stocks are those that trade for less than their intrinsic value. Intrinsic value is the fundamental value of a security, which includes both its underlying assets and earnings power. Undervalued stocks are often out of favor with the market and may be overlooked by investors.

However, they can provide an opportunity for long-term growth. Undervalued stocks may be underpriced due to a number of factors, including temporary financial difficulties, negative press, or investor pessimism. As a result, they may offer a good value for the price.

For example, a stock that is trading at $50 per share may have an intrinsic value of $100 per share. This creates a margin of safety that can protect against downside risk. Undervalued stocks can be difficult to find, but they may be worth the effort for investors who are looking for long-term growth potential.

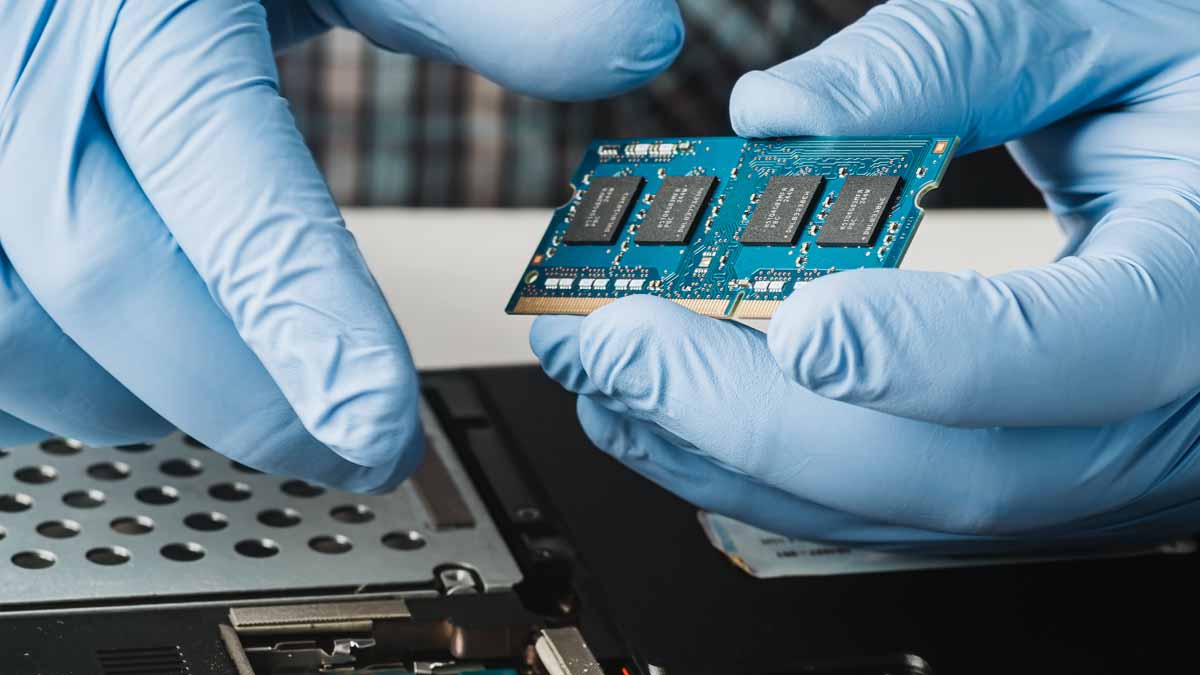

What Are Semiconductor Stocks?

Semiconductor stocks are a broad category of stocks that includes companies that manufacture, design, or sell semiconductor products. They’re essential for everything from computers to solar panels to TVs. And because they’re found in so many different devices, semiconductor stocks tend to be very sensitive to changes in the global economy. When demand is high, their stocks go up. But when demand slows down, their stocks can drop very quickly.

So if you’re thinking about investing in semiconductor stocks, it’s important to do your research and understand the risks. But if you’re willing to take on some risk, semiconductor stocks can offer the potential for sizable rewards. Considering this, let’s take a look at two top semiconductor stocks to watch in the stock market today.

Semiconductor Stocks To Buy [Or Sell] Right Now

- Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM)

- NVIDIA Corporation (NASDAQ: NVDA)

1. Taiwan Semiconductor Manufacturing Co. (TSM Stock)

Leading off, Taiwan Semiconductor Manufacturing Company Ltd (TSM), also known as TSMC, is the world’s largest semiconductor foundry. TSMC is the world’s largest provider of contract chip manufacturing services. It is also the largest provider of silicon wafers to the semiconductor industry.

TSM Recent Stock News

Last month, the company announced its third quarter of 2022 financial and operating results. In the quarter, TSMC reported earnings of $1.79 per share and revenue of $20.2 billion. For clarity, analysts’ consensus estimates for Q3 2022 which was an EPS of $1.69 and revenue of $19.9 billion. In addition, the chipmaker notched in a 35.9% increase in revenue compared to the same period, the previous year.

With that, Wendell Huang, VP and Chief Financial Officer of TSMC commented, “Our third quarter business was supported by strong demand for our industry-leading 5nm technologies Moving into fourth quarter 2022, we expect our business to be flattish, as the end market demand weakens, and customers’ ongoing inventory adjustment is balanced by continued ramp-up for our industry-leading 5nm technologies.”

TSM Stock Price

Aside from that, as of today, TSMC has a PE Ratio of 13.91. Meanwhile, in the last month of trading action, shares of TSM stock have recovered more than 28%. On Friday TSM stock opened green up 0.47%, currently trading at $81.92 a share.

[Read More] Good Stocks To Invest In Right Now? 4 Fertilizer Stocks In Focus

2. NVIDIA Corp. (NVDA Stock)

Next up, Nvidia Corporation (NVDA) is an American technology company. Nvidia is widely popular for its graphics processing units (GPUs). These GPUs are present in a variety of consumer and enterprise applications. The company also offers a range of other products, including cloud computing platforms, automotive solutions, and gaming products.

NVDA Recent Stock News

On Wednesday of this week, Nvidia released its third-quarter 2023 financial results. In detail, the company reported an EPS of $0.58 per share, along with revenue for the quarter of $5.9 billion. For context, Wall Street estimates for the quarter were an EPS of $0.67 and revenue estimates of $5.8 billion.

Additionally, the company reported a 16.5% drop in revenue on a year-over-year basis. Meanwhile, the company also announced it expects Q4 2023 revenue in the range of $5.88 billion to $6.12 billion.

Moreover, Jensen Huang, founder, and CEO of NVIDIA said, “NVIDIA’s pioneering work in accelerated computing is more vital than ever. Limited by physics, general purpose computing has slowed to a crawl, just as AI demands more computing. Accelerated computing lets companies achieve orders-of-magnitude increases in productivity while saving money and the environment.“

NVDA Stock Price

As it stands today, NVDA currently has a PE Ratio of 50.53. Aside from that, the company also has also seen its shares start to recover by more than 28% in the last month of trading action. During Friday’s mid-morning trading session, NVDA stock is trading lower by 2.07% at $153.52 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!