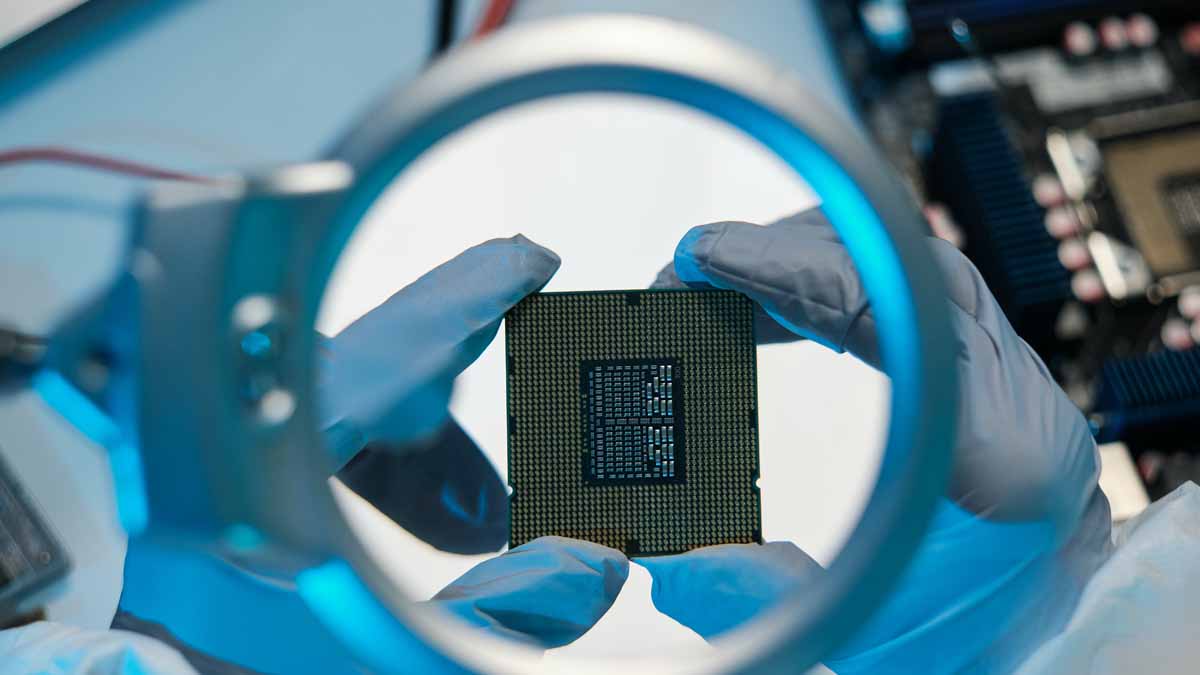

Semiconductors are tiny electronic components that are crucial to the functioning of modern electronic devices, such as smartphones, laptops, and televisions. These components have special materials that focus on controlling the flow of electricity in electronic devices. They are at the heart of the electronics industry and drive technological advancements in areas like communication, computing, and consumer electronics.

With that, semiconductor stocks refer to the stocks of companies that design, manufacture, and market semiconductors and related products. These companies typically engage in the research and development of cutting-edge technologies. As such, they are known for their high growth potential. Investments in semiconductor stocks can offer good returns, but they can also be volatile and subject to rapid changes in the industry. It’s important for investors to keep a close eye on market trends and technological advancements, as well as the financial health of the companies they are investing in.

Separate from that, investing in semiconductor stocks can be a good way to gain exposure to the technology sector and benefit from the growth of the electronics industry. However, it’s important to remember that these stocks can be volatile and subject to rapid changes in the market. So it’s crucial to conduct thorough research before making any investment decisions. If this has you keen on investing in the semiconductor sector, check out these two stocks in the stock market this week.

Semiconductor Stocks To Watch Today

- Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM)

- Advanced Micro Devices Inc. (NASDAQ: AMD)

Taiwan Semiconductor Manufacturing Co. (TSM Stock)

To start, Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) is the largest dedicated semiconductor foundry in the world. In brief, the company offers a comprehensive range of integrated circuit manufacturing services.

Last month, the company reported its 4th quarter 2022 financial and operating results. Specifically, the semiconductor giant announced Q4 2022 earnings of $1.82 per share, with revenue of $19.9 billion. This is versus analysts’ consensus estimates which were earnings of $1.80 per share, and revenue estimates of $20.3 billion. Also, TSMC said it estimates first quarter 2023 revenue in the range of $16.7 billion to $17.5 billion.

Since the start of 2023, shares of TSM stock have gained by 30.95%. While, during Thursday’s afternoon trading action, TSM stock is trading higher on the day by 2.79% at $96.97 a share.

[Read More] 3 Copper Mining Stocks To Watch In February 2023

Advanced Micro Devices (AMD Stock)

Next, Advanced Micro Devices Inc. (AMD) is a global semiconductor company that designs and produces microprocessors, graphics processors, and other computing and multimedia products.

At the end of last month, AMD reported better-than-expected 4th quarter 2022 financial results. In detail, the company notched in Q4 2022 earnings of $0.69 per share, with revenue of $5.6 billion. For context, analysts’ consensus estimates for the 4th quarter of 2022 were earnings of $0.67 per share, and revenue estimates of $5.5 billion. What’s more, Advanced Micro Devices also reported a 16% increase in revenue versus the same period, the previous year.

Moving along, year-to-date so far, AMD stock has rebounded by 32.06%. While, during Thursday’s afternoon trading session, shares of AMD stock are trading flat on the day at $84.64 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!