5 Top Industrial Stocks To Watch In 2021

With the broader stock market moving sideways, industrial stocks could be worth looking at. For the most part, investors could be treading cautiously this week given the current market conditions. To begin with, concerns over a slowdown in the reopening trade were somewhat eased as the 10-year Treasury yield mostly held steady. Adding to that, consumer demand for goods continues to drive momentum in the manufacturing space now. Meanwhile, the spread of the delta coronavirus variant would be another key factor to consider now. Namely, the U.S. seven-day average of coronavirus cases hit 72,790 last week, topping peak figures seen last year.

Now, what does all this mean for industrial stocks? Well, some would argue that industrial stocks are in an interesting position now. On one hand, should economic growth persist with the help of anti-coronavirus measures, the bull theory for the sector would hold up. On the other hand, if the pandemic has a greater effect on the economy than anticipated, industrial stock would be trading at more attractive price points. This would especially be the case as investors consider the post-pandemic prospects for industrials.

Not to mention, President Joe Biden’s infrastructure bill is already boosting investor sentiment among the top industrial stocks now. We only need to look at the likes of Freeport-McMoRan (NYSE: FCX) and John Deere (NYSE: DE) to see this. Evidently, both FCX stock and DE stock have more than doubled in value over the past year. Given all of this, would you consider investing in one of these top industrial stocks in the stock market today?

Top Industrial Stocks To Buy [Or Avoid] This Week

- Nucor Corporation (NYSE: NUE)

- General Motors Company (NYSE: GM)

- Plug Power Inc. (NASDAQ: PLUG)

- Hollysys Automation Technologies Ltd. (NASDAQ: HOLI)

- Micron Technology Inc. (NASDAQ: MU)

Nucor Corporation

Nucor Corporation is a producer of steel and related products with headquarters in North Carolina. The company and its affiliates have operating facilities in the U.S., Canada, and Mexico. It produces carbon and alloy steels in the form of bars, beams, sheets, and plates. Also, Nucor serves a wide number of industries, which include automotive, construction, oil & gas, and transportation. NUE stock currently trades at $105.36 as of 1:09 p.m. ET.

On July 22, 2021, the company announced record quarterly earnings for its second quarter of 2021. Net sales for the quarter increased by 103% year-over-year to $8.79 billion. The company also reported second-quarter earnings of $5.04 per diluted share, marking the highest quarterly earnings in the company’s history. It also expects to set a new record for quarterly earnings in the third quarter of 2021 as demand remains robust and virtually all the steel end-use markets continue to grow. All things considered, will you buy NUE stock?

Read More

- 4 Artificial Intelligence Stocks To Watch Right Now

- Best Lithium Battery Stocks To Buy Now? 4 To Know

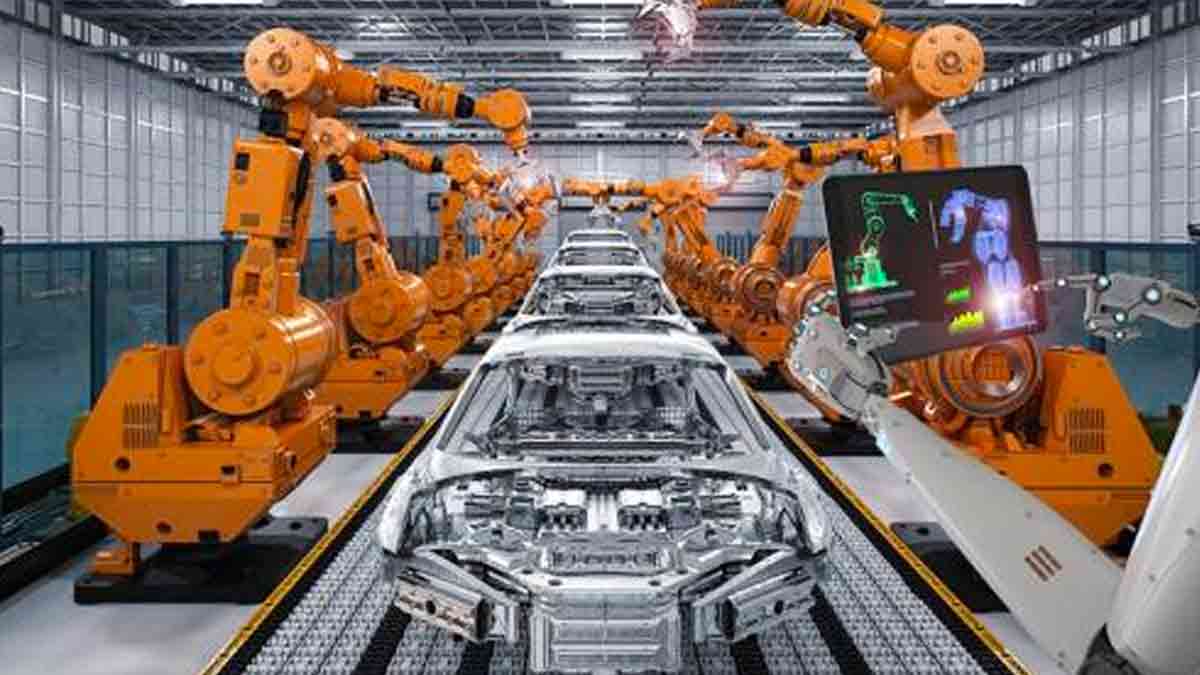

General Motors Company

General Motors is a multinational corporation that designs and distributes vehicles and vehicle parts. The company has made significant investments into moving to an all-electric vehicle for its range of automobiles. Notably, its Ultium battery platform, which will power everything from its mass-market to high-performance vehicles will play a crucial role in ensuring that the company transforms into an all-electric vehicle company. GM stock currently trades at $57.77 as of 1:10 p.m. ET.

Last month, the company reported that it continues to receive sustained robust momentum in China for its second quarter. Impressively, the company delivered more than 750,000 vehicles in the country, an increase of 5.2% from a year earlier. It also announced that it has formed a strategic investment and commercial collaboration with Controlled Thermal Resources to secure local and low-cost lithium. This lithium will be used for GM’s next-generation EV batteries and will be produced through a closed-loop process with low carbon emissions. For these reasons, will you consider buying GM stock?

[Read More] 4 Semiconductor Stocks To Watch Right Now

Plug Power Inc.

Plug Power is an industrial company that develops hydrogen fuel cell systems that replace conventional batteries in equipment and vehicles. Also, it has essentially revolutionized the material handling industry with its full-service GenKey solution. GenKey is designed to increase productivity, reduce carbon footprint, and lower operating costs in a reliable, cost-effective way. PLUG stock currently trades at $26.37 as of 1:11 p.m. ET.

In July, the company announced that it has hired David Mindnich, a 15-year leader in manufacturing who spearheaded operations for Tesla’s (NASDAQ: TSLA) Gigafactory. Moreover, Mindnich will join the company as executive vice president of global manufacturing and will lead the modernization of Plug Power’s manufacturing operations by creating process efficiencies and transforming its operations. He will be responsible for optimizing the performance of the company’s global manufacturing capabilities with his experience with high-volume global manufacturing. Given the excitement surrounding this piece of news, will you consider PLUG stock to your portfolio?

[Read More] 4 Robotics Stocks To Watch Amid Rising Shifts To Automation

Hollysys Automation Technologies Ltd.

Another industrial name making waves in the stock market today is Hollysys Automation Technologies. In short, Hollysys is a leading provider of automation control system solutions in China. Through a combination of tech and deep industry insight, Hollysys provides its manufacturing customers with a wide selection of services. Primarily, this revolves around its full spectrum of industrial automation hardware, software, and related services. The likes of which span field devices, control systems, enterprise manufacturing management, and cloud-based applications.

More importantly, HOLI stock currently trades at $19.49 a share as of 1:11 p.m. ET. Notably, this is thanks to gains of over 25% since today’s opening bell. This would likely be on account of Hollysys evaluating a non-binding offer to be acquired in an all-stock transaction. In detail, the current offer from Superior Emerald Limited would value HOLI stock at $23.00 per share. Given the relevance of Hollysys’ offerings in the current age of automation, Superior Emerald could see more value in the company. Likewise, investors seem to be keen on HOLI stock given its latest update. Would you consider yourself in the same boat?

[Read More] 5 Top Infrastructure Stocks To Watch In August 2021

Micron Technology Inc.

Following that, we have Micron Technology. In brief, the company primarily designs and manufactures computer memory and data storage hardware. This includes but is not limited to dynamic random-access memory (dRAM), flash memory, and USB flash drives. Given the recent uptick in digital acceleration trends across the board, Micron’s wares would be relevant in the current market. After all, organizations and consumers alike will likely be using more digital memory as a result of work-from-home initiatives.

Now, with MU stock trading at $80.40 a share as of 1:13 p.m. ET, would it be worth buying? If anything, Micron seems to be doing well across the board. This is evident as the company is initiating a quarterly dividend of $0.10 as of earlier today. CEO Sanjay Mehrotra cites the company’s “outstanding position” as a core reason for this move. With Micron looking to provide more shareholder value, would you consider MU stock a top buy now?