Semiconductor companies are in high demand as they play a crucial role in driving technological advancements. In fact, these firms that are responsible for creating and producing semiconductor chips, are at the forefront of innovation. They also contribute to the growth of various sectors like smartphones, laptops, and automobiles. Moreover, the semiconductor market looks set to grow as the global economy recovers from the pandemic. This could result in an increasing demand for chips. As a result, this makes semiconductor stocks a potentially attractive investment option for retail investors.

Next, a large contributing factor to the growth of semiconductor stocks is the growing need for high-performance computing and data storage. This comes as the advancements in AI, IoT, and 5G networks are causing a surge in demand for more advanced semiconductor chips.

Additionally, the widespread adoption of electric vehicles that require these chips for power management is contributing to the growth of the semiconductor industry. With the market’s upward trend expected to continue, now may be a good time for retail investors to consider investing in semiconductor stocks. Here are two semiconductor stocks to keep an eye on in the stock market this week.

Semiconductor Stocks To Watch Today

- Intel Corporation (NASDAQ: INTC)

- Advanced Micro Devices Inc. (NASDAQ: AMD)

Intel (INTC Stock)

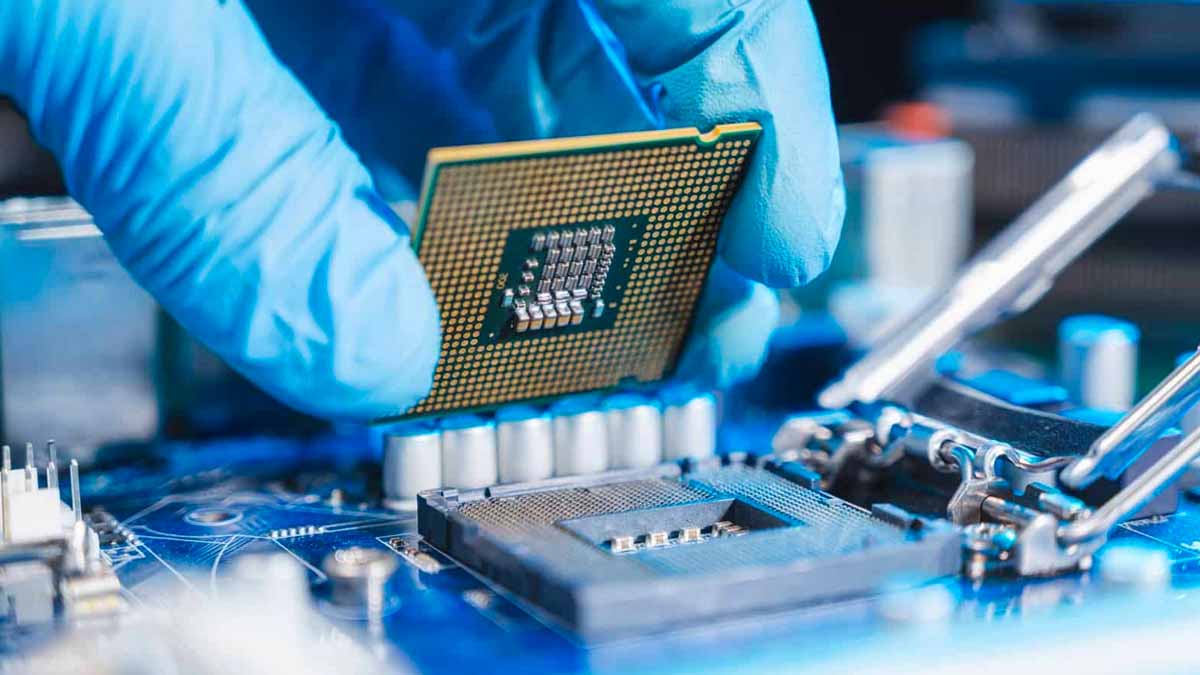

First up, Intel Corporation (INTC) is a technology company. In brief, the company designs develop, and manufactures a wide range of computer components, including microprocessors and memory chips. Intel is popular for its cutting-edge technology and innovative solutions. Which has made it a major player in the computer and data center industries.

Earlier this month, Intel announced the release of its 4th generation Intel Xeon Scalable processors, the Intel Xeon CPU Max Series, and the Intel Data Center GPU Max Series. This will enhance performance, efficiency, security, and artificial intelligence capabilities in data centers, the cloud, the network, and edge computing. The products are considered one of the major product launches in the company’s history. Meanwhile, they are focusing on providing the world’s most powerful supercomputing solutions.

Since the beginning of 2023, shares of INTC have started to recover by 5.35%. Meanwhile, during Monday’s pre-market trading session, Intel stock is trading lower by 1.92% at around $27.62 per share.

[Read More] 3 Natural Gas Stocks To Watch Today

Advanced Micro Devices (AMD Stock)

Next, Advanced Micro Devices Inc., or AMD, is another major player in the semiconductor industry. The company designs and manufactures computer processors and graphics cards. Today, AMD’s products are used in a variety of products. This includes everything from desktops and laptops to data centers and gaming systems.

Last week, Advanced Micro Devices (AMD) announced that its adaptive computing technology is being used by mobility provider DENSO Corporation for its new LiDAR platform. The technology will significantly improve the resolution and decrease the latency of the platform. As a result, this will provide better accuracy in detecting objects such as pedestrians, vehicles, and open space. The LiDAR platform is set to be available for shipping in 2025. Additionally, it will utilize AMD’s Xilinx Automotive system and functional safety tools to achieve ISO 26262 ASIL-B certification.

In 2023 thus far, shares of Advanced Micro Devices have jumped by 17.78%. While, during Monday morning’s pre-market trading session, AMD stock is trading modestly lower by 1.45% and is currently trading at $74.31 per share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!