Retail stocks have been in a tricky spot due to the economic climate. Most places were forced to close all locations when the coronavirus pandemic began. Now as things get closer to reopening we are seeing momentum pick back up in many retail stocks. Investors are looking for retail stocks to buy hoping that more stores will open and have good financials. However, it is still uncertain when things will fully be open.

In general people have been shopping at retail locations less. Even after they have opened once again, many retail companies are struggling. At the same time many retail stocks have gained momentum in the market once again. Stores like supermarkets and places that never closed their doors like Walmart saw great benefits from this.

Retail stocks will continue to be relevant as long as people continue shopping in person. In the last 10 years e-commerce has grown to be a massive industry. It has caused some shopping malls to see a decline in consumers. Retail will always exist in our society no matter what though. Let’s take a look at two retail stocks that are trending in the market.

Read More

- 3 Stay-at-Home Stocks To Watch In 2020

- 2 Consumer Staples Stocks To Watch Amid The COVID-19 Pandemic

- Shopify Stock Jumps On Walmart Deal; Time To Buy?

Retail Stocks To Buy [Or Avoid] In 2020: Kroger

The first retail stock to discuss on this list is The Kroger Co. (KR stock report). Kroger is the second-largest general retailer in the world, first being Walmart. It was founded in 1883 and has grown to be an incredibly relevant brand for United States shoppers. As of February 2020, Kroger operated over 2,757 supermarkets across the United States. Currently, Kroger is listed as number 20 on the Fortune 500 list of companies.

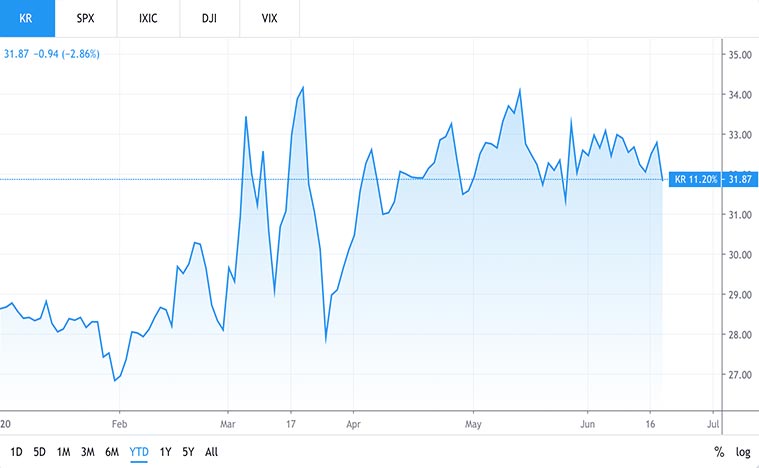

KR stock was not badly affected by the coronavirus pandemic. Shares of KR stock were at $29 a share when the pandemic began. Yet KR stock price never dropped below $27. This is due to the surge of customers that supermarkets and general stores saw. As of June 18th, KR stock is at $31.48 a share, up from before the pandemic began. There was a point where KR stock price reached $34.18 back in March, but this was due to the hype in the market.

KR stock price has the potential to rise as a long term investment making it a retail stock to watch. Investors who got in early on KR stock were able to make profit. If Kroger progresses more as a company KR stock will continue to see a rise because of it. Kroger reported a 19% increase in business in the last 15 months. It has also seen a 92% jump in digital sales since the pandemic began. The company is still adapting to the coronavirus outbreak. The CEO of Kroger Rodney McMullen said in a statement, “What we’ve said is there’s a lot of uncertainty. Obviously, we’re still in the middle of COVID. We’re investing a lot of money to make sure from a safety standpoint we are keeping our customers and our associates safe.”

[Read More] Do These 2 Food Stocks Have Investors Hungry For More?

Retail Stocks To Buy [Or Avoid] In 2020: Target

The next retail stock to talk about is Target Corporation (TGT stock report). Target was founded in 1902 and has grown to be the 9th largest retailer in the United States. As of 2019 Target has 1844 stores in the United States. Currently, Target is at number 37 on the Fortune 500 companies list by total revenue.

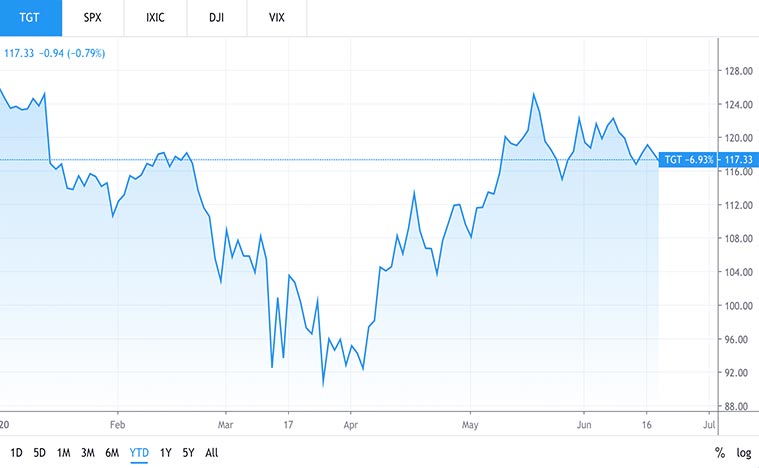

Before the stock market crash caused by the coronavirus TGT stock was at $118 a share on average. TGT stock price saw a decline as low as $92 a share in March. Since then, TGT stock has made a recovery. On May 18th TGT stock price reached $125.20, higher than its share price before the virus. As of June 18th, TGT stock is at $117 a share on average which essentially means it has recovered.

Bottom Line

TGT stock and KR stock are two examples of retail stocks that have been positively affected by the virus pandemic. Or at least have rebounded back to their average trading price. This effect is why these are two retail stocks to watch. Retail stocks are speculative as the world reopens more store locations. It will be fascinating to see how retail stocks continue to progress in the market.