Are These The Best Biotech Stocks To Buy This Month?

A lot of attention is placed on biotech stocks right now. The reason is simply that they are at the forefront of medical discoveries. For the quality of life that we enjoy today, we can thank these biotech companies and their continuous innovation. As such, investors are looking for the best biotech stocks to buy in the stock market today. That is because biotech companies are making remarkable progress in many segments of the medical field. From the advancement of drug manufacturing to the development of new types of treatment, the potential is limitless.

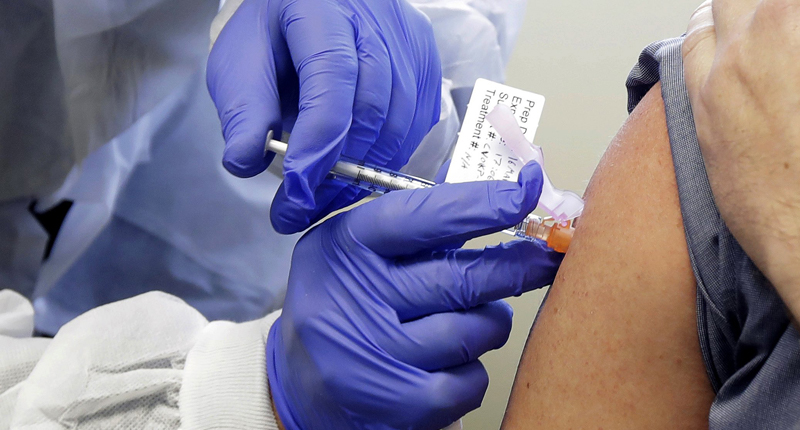

Today’s biotech news places the limelight on treatments and vaccine development for the COVID-19 pandemic. For pharmaceutical giants like Johnson & Johnson (JNJ Stock Report) and Pfizer (PFE Stock Report), the COVID-19 vaccine development is at the highest priority right now. As the pandemic has already infected 38 million worldwide, you can see what drives the biotech industry. As the industry pushes out new drugs and treatments, investors closely follow their clinical trials, development, and regulatory approval. For every positive development, it skyrockets the share price. But even if you are not keen on the vaccine stocks, don’t fret. After all, pandemics may come and go, but many other diseases stay around. There are many other top biotech stocks to watch out there that focus on other diseases. With so much going on in the biotech industry, do you have a list of top biotech stocks to buy in your portfolio?

Read More

- Looking For Top EV Stocks To Buy This Month? 3 Names To Know

- 3 Top Health Care Stocks To Watch With Potential Catalysts Approaching

Top Biotech Stocks To Watch In 2020: AstraZeneca plc.

Despite being in the news for its COVID-19 vaccine candidate AZD1222, AstraZeneca (AZN Stock Report) boasts an impressive array of drugs and treatments. From cancer treatment drugs to its cardiovascular, renal, and metabolism (CVRM) drugs, the company covers many fields of medicine. The Cambridge-based company has been up by 44.7% to $54.48 since the March market crash and has already recovered its share price.

To treat patients with chronic kidney disease (CKD), the company’s drug Farxiga has been receiving rave reviews recently. Farxiga has demonstrated an unprecedented reduction in the risk of kidney failure or cardiovascular death. AstraZeneca expects to utilize this drug among others by next year to protect the lives of 50 million people. Lynparza, a drug used to improve the overall survival of advanced prostate cancer patients is also making headlines. The drug has been recommended for marketing authorization in the European Union last month. This along with its pipeline of other new medicine and COVID-19 vaccine development places AstraZeneca in a position for strong growth.

In its half-year results for 2020, the company reported a revenue of $2 billion, up by 14% compared to a year earlier. A net gain of revenue was reported for all divisions which include new medicines (+45%), Oncology (+31%), and Respiratory & Immunology (+7%). The company also reported earnings per share (EPS) of $2.01, up by 26% year-over-year. For the company’s pipeline, it has an impressive lineup of drugs undergoing regulatory approval. The company seems to be laying the foundation for future growth. With so much going for AstraZeneca, it is no wonder why AZN stock remains a top biotech stock to watch in the long run.

Top Biotech Stocks To Watch In 2020: Alexion Pharmaceuticals.

Pharmaceutical giant Alexion Pharmaceuticals (ALXN Stock Report) is a leader in the treatment of rare diseases. The company specializes in blood, metabolic and autoimmune diseases. As being the sole manufacturer of drugs to treat these diseases, the company has projected strong growth for its revenue. Since March, the company’s share price is up by 62.1%, currently priced at $123.75 per share. In its second-quarter postings in July 2020, the company posted revenue of $1.44 billion, up by 20% year-over-year. This is because of continued demand for its anti-paroxysmal nocturnal hemoglobinuria (PNH) drug, Soliris.

Alexion is currently trading for 33x at price to earnings, which may seem low for a company with such potential. This is because its Soliris drug will lose its patent coverage next year, allowing generic competitors to enter the market. To combat this, the company has established Ultomiris as a new standard of care in PNH with more than 70% patient conversion from Soliris in the US. Ultomiris has brought in $251 million in revenue for its second quarter.

The company has also unveiled its roadmap for the future. It is currently undergoing 20 clinical programs across 7 rare diseases as part of its strategy for the future. To top things off, the company expects to launch at least 10 products by 2023. This could present an opportunity for investors to buy ALXN stock at a discount.

Top Biotech Stocks To Watch In 2020: TG Therapeutics

TG Therapeutics (TGTX Stock Report) has had a favorable run in the stock market so far. TG Therapeutics is a biopharmaceutical company, leverages the significant advances of B-cell tumor biology. The company is developing a combination of novel targeted and immune therapies. This would provide better outcomes for cancer patients without the need for toxic chemotherapy. The company also focuses on the acquisition and commercialization of novel treatments targeting hematological malignancies and autoimmune diseases. Treating cancer with a pill might sound impossible today, but with TG Therapeutics, this might someday be a reality.

In August, the Food and Drug Administration (FDA) has accepted the company’s application for Umbralisib. Its CEO, Michael Weiss stated that the oral drug Umbralisib, if approved, could be an important treatment option for patients previously treated for marginal zone lymphoma and follicular lymphoma. The drug is currently undergoing its phase 3 clinical trials after promising results from its phase 1 and 2 trials. The stock is up by 184.5% year-to-date, priced at $31.10 currently.

Despite not generating any revenue, TG Therapeutics has gone full swing in its R&D for this new form of treatment for cancer patients. With 5 medicines currently under development and 40 clinical trials ongoing, there is certainly a lot of excitement from this company. You could expect TG Therapeutics to be in the headlines in the years to come. With that said, should you have TGTX stocks in your portfolio to diversify your long-term gains?