Is DKNG Stock A Buy Right Now?

DraftKings Inc. (NASDAQ: DKNG) has been one of the best gaming stocks you can find in the stock market in 2020. When the company went public through the special purpose acquisition company (SPAC) route, it took the stock market by storm by flying to the clouds. However, DKNG stock fell more than 50% in less than a month after posting all-time highs of mid-$60s. Fortunately, the stock has been rebounding since then, recouping about two-thirds of those losses.

That could simply be because sports betting stocks are one of the hottest areas in the stock market today. What’s more, industry experts expect the industry would continue to grow massively in the years ahead.

For the uninitiated, DraftKings went public via a $3.3 billion merger with the SPAC Diamond Eagle Acquisition Corp. in April 2020. Since then, the stock has gained more than 150%. The potential of online gaming is certainly there. For instance, New Jersey is the biggest online sports betting and gaming market. In October alone, sports wagers exceeded $800 million in the state. Now that many states face revenue shortfalls due to the coronavirus pandemic and wider budget deficits, the need to fill that gap is increasingly pronounced. And who knows? Online betting could probably be one of those sources.

Read More

- Top Tech Stocks To Buy According To Analysts; Up To 45% Upside

- Are These The Best Streaming Stocks To Watch Ahead Of The Upcoming Stimulus Package?

Increasing Bullish Stance On Sports Betting Stocks

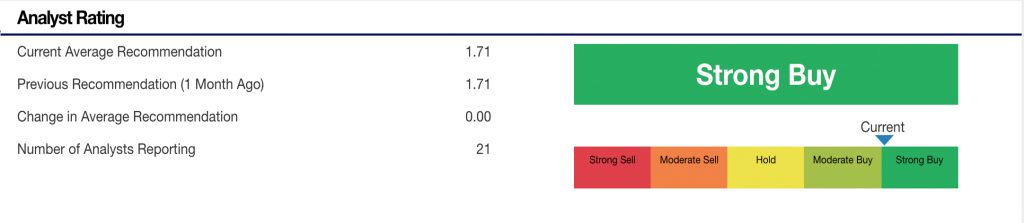

Analysts love the stock and the online gaming industry in which it competes. Nevertheless, there is a broad range of opinion on Wall Street regarding DraftKings stock. You can see that in the price targets which range from a low of $39 to a Street-high of $100. And that could be hard for investors to follow. Some believe that there aren’t any solid projections nor numbers that can justify DraftKings’ valuation today or even the growth potential of the company. Yet, one thing that we can say is that no analyst is recommending shareholders to exit their positions and move to the sidelines.

So why is Wall Street having mixed views on DKNG stock? A plausible reason could be because the industry has been valued differently by analysts. According to research firm Gambling Compliance, the U.S. betting market could range from $5.9 billion to $8.2 billion by 2024. Meanwhile, Morgan Stanley estimates the U.S. sports betting market to be worth $10 billion by 2025. That is just 10% of what is estimated for the global sports betting market. Separately, BofA Securities believes the U.S. market will hit $24 billion by 2030.

While all these could seem like a big number here, the market capitalization of DKNG stock of $21 billion might appear to be too far fetched. With online sports betting still pretty much at its nascency stage, it’s hard to gauge what the real value of the industry is. That’s not to mention the potential competition in the space. For instance, sports live TV streaming platform fuboTV Inc. (NYSE: FUBO) announced on January 12 the execution of a binding letter of intent to acquire sports betting and interactive gaming company Vigtory. Yet, on the flip side, it does validate the idea that sports betting is an attractive space to be in.

[Read More] Will Magnite (MGNI) Stock Be The Next Trade Desk In The Making?

The Largely Untapped Sports Betting Market Is Huge For DKNG Stock

From the company’s latest fiscal report, the company saw revenue rise 98% year over year to $132.8 million. The company also raised its full-year 2020 revenue range to $540 million-$560 million. That represents 25%-30% in annual revenue growth. If this isn’t impressive enough, the company provided 2021 revenue guidance of $750 million to $850 million, which equates to 45% year-over-year growth. This comes at a time when many companies refrain from giving such projections.

“The resumption of major sports such as the NBA, MLB, and the NHL in the third quarter, as well as the start of the NFL season, generated tremendous customer engagement,” said CEO Jason Robins in a news release. “In addition to our year-over-year pro forma revenue growth of 42%, DraftKings recorded an increase in monthly unique players of 64% to over 1 million, demonstrating the effectiveness of our data-driven sales and marketing approach.”

As you may or may not know, New York governor Andrew Cuomo has expressed support for sports betting in his state. Meanwhile, recent news of the Texas governor’s office reaching out to New Jersey for advice on the legalization issue could be another booster jab for the industry. Given the favorable news, who knows, DKNG stock could find its way to new highs in the first quarter of 2021.

[Read More] Best Biotech Stocks For 2021? 3 Names Trending This Week

Bottom Line For DraftKings Stock

There’s no question that DraftKings stock could be promising in this burgeoning industry. However, it would take some time before the online casino industry could truly prosper. As some may argue that DKNG stock is priced to perfection, there are still a number of people who believe that the stock could push higher amid waves of legalizations across the U.S. The company’s huge growth rate is one of the reasons why many could be still so optimistic with DKNG stock.

There is an opportunity for the company to operate in more states going forward. Thus, it is not surprising that some analysts are increasing their revenue estimates for the company. They expect sales to more than double by 2022 to reach $1.2 billion. If things go on track, DKNG stock could be your best bet on the increasing popularity of online gambling. But let’s be honest here. Looking at its current financials, the $21 billion market capitalization certainly doesn’t look cheap. The company would need to capitalize on the surging demand for online betting and favorable government policy. With a bit of good fortune, DraftKings might just be able to grow into its valuation.