Stock Market Futures Mixed Following Federal Reserve Policy Update

Stock market futures are mixed during today’s early morning trading. This is likely as investors digest the latest statements from the Federal Open Market Committee (FOMC). Now, among the key takeaways from the FOMC meeting would be its decision to hold interest rates at near-zero for now. Even so, there remains a focus on withdrawing pandemic-era policies amidst rising inflation. This is evident from the following statement from the Fed. “With inflation well above 2% and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

Now, the current move by the Federal Reserve is not all that surprising. This is because policymakers have and continue to reiterate that ending the central banks’ asset purchase program is their first priority. On this front, the FOMC affirms that it will likely complete the process by early March. By extension, we could see the first interest rate hike within the next two months. For one thing, increasing interest rates would help to address the current issue with inflation. This would primarily raise borrowing costs and reduce demand for goods in general.

For today, investors could be closely watching how these updates weigh in on earnings in Big Tech in the stock market today. As of 7:24 a.m. ET, the Dow & S&P 500 are declining by 0.26%, and 0.09%, while Nasdaq futures are trading higher by 0.15%.

[Read More] Best Artificial Intelligence Stocks To Buy Right Now? 5 To Watch

Apple Earnings On Tap After Closing Bell Today; Reportedly Making Bold Push Into Fintech

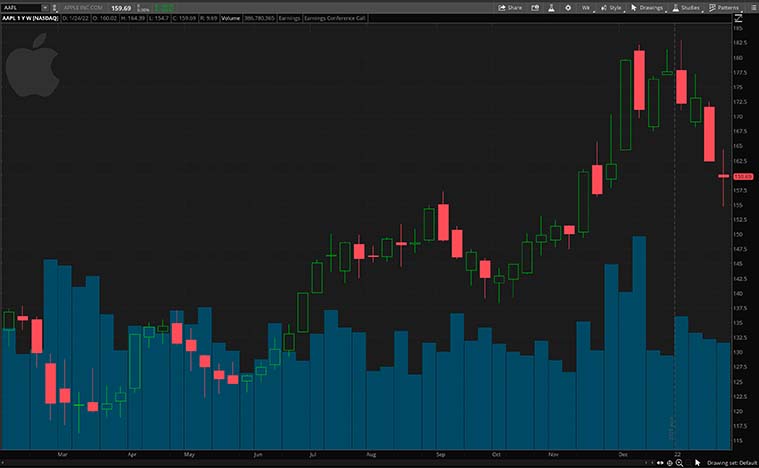

Apple (NASDAQ: AAPL) is the next FAANG member reporting quarterly earnings figures today. With the consumer tech titan coming under the microscope today, investors will likely be tuning in to AAPL stock today. Accordingly, Wall Street is currently expecting Apple to report an earnings per share of $1.88 on revenue of $118.7 billion. Now, to begin with, these figures are commendable even after accounting for the company’s massive operations. However, after a solid two years of strong iPhone sales amidst the pandemic, things appear to be normalizing for Apple. According to a statement to its component suppliers, the demand for iPhone 13’s is weakening. Because of this, the focus could be on Apple’s iPhone revenue this quarter.

Aside from its earnings, Apple does not seem to be slowing down in the least bit on the operational front. According to sources from Bloomberg, the company is planning to test out new fintech services. This would see small businesses being able to accept digital payments directly from iPhones. In other words, Apple could be looking to turn iPhones into payment terminals. More importantly, the report suggests that all this will be done without additional hardware through near-field communication (NFC) tech.

Should all this be the case, Apple would be stepping up to the plate against firms like Block (NYSE: SQ). Regardless of how you look at it, Apple seems to be having an exciting week. With that in mind, investors may want to consider taking a closer look at AAPL stock now.

Tesla Posts Strong Earnings And Reveals Plans To Rev Up Autonomous Vehicle Tech And Production Efforts

Elsewhere, Tesla (NASDAQ: TSLA) reported positive numbers in its fourth-quarter earnings yesterday. After the closing bell, the company reported earnings of $2.52 on record quarterly revenue of $17.72 billion. Notably, this would be well above estimates of $2.36 and $16.57 billion respectively. In detail, the electric vehicle (EV) goliath saw its total revenue soar by 65% year-over-year. Over the same period, its automotive revenue is currently looking at sizable gains of 71%. Also, Tesla’s net income is up by a whopping 760%, totaling $2.32 billion.

Despite all of this, TSLA stock ended the post-market trading hours in the red. For the most part, this would be due to CEO Elon Musk’s latest update on Tesla’s operation. According to Musk, the EV firm will likely remain “chip-limited” this year and lack any new models in 2022. Furthermore, he also notes that Tesla’s factories have been and still are running below capacity. The reason for this is supply chain issues becoming a “main limiting factor,” in Musk’s words.

While all this may appear to be negative, the company has also been holding its ground. Throughout 2021, Tesla hit record production figures and is looking to expand beyond its 600,000 units per year manufacturing capacity. After considering all of this data, investors looking for long-term buys could be eyeing TSLA stock.

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

Intel Reports Solid Earnings Beats And Provides Optimistic Guidance

Similar to Tesla, Intel (NASDAQ: INTC) also posted better-than-expected figures in its latest earnings report. Diving in, the semiconductor maker raked in a total revenue of $19.5 billion for the quarter. This would exceed consensus forecasts of $18.31 billion. Moreover, Intel recorded an earnings per share of $1.09, beating expectations of $0.91. If that wasn’t enough, the company’s Client Computing Group, its largest division, raked in a revenue of $10.1 billion. To put things into perspective, this is against estimates of $9.6 billion and marks a 7% year-over-year dip.

Commenting on the company’s overall performance is CEO Pat Gelsinger. He says, “Q4 represented a great finish to a great year. We exceeded top-line quarterly guidance by over $1 billion and delivered the best quarterly and full-year revenue in the company’s history.” Adding to that, Gelsinger highlights, “Our disciplined focus on execution across technology development, manufacturing, and our traditional and emerging businesses is reflected in our results. We remain committed to driving long-term, sustainable growth as we relentlessly execute our IDM 2.0 strategy.”

Additionally, Gelsinger also talked about the company’s next-generation server chip, Sapphire Rapids. According to the CEO, Sapphire Rapids is set to begin shipping this quarter with plans for production boosts in Q2. All in all, it seems like Intel is kicking into high gear across the board. Because of that, INTC stock could be in focus in the stock market now.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Notable Earnings To Know In The Stock Market Today

Not to mention, there are plenty of massive companies reporting their earnings today as well. This ranges from some of the biggest names in consumer tech to industrial giants, and consumer staples. In the pre-market hours, we have Mastercard (NYSE: MA), Nucor (NYSE: NUE), McDonald’s (NYSE: MCD), and Altria (NYSE: MO) on tap. Also, two key airline operators, JetBlue (NASDAQ: JBLU) and Southwest (NYSE: LUV) fall in this group as well.

Alternatively, for those looking towards earnings after the closing bell, there is a strong focus on tech. Aside from Apple, Robinhood (NASDAQ: HOOD), Visa (NYSE: V), Western Digital (NASDAQ: WDC), and Atlassian (NASDAQ: TEAM) are reporting earnings. Between major tech earnings and FOMC policy updates, investors have plenty to consider in the stock market now.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!